by Jeff Deiss

Harvesting losses on an annual basis is a prudent strategy that we employ and where we have more flexibility than other money managers because we focus on buying individual securities. In addition to harvesting losses, investors should recognize that managing your gains is also part of investing (rebalancing). The value of continuing to defer capital gains taxes is not as great as it seems (See Dealing with Unrealized Capital Gains). The liability is already there so make sure that you don’t fall into the trap of allowing unrealized capital gains to dictate your investment strategy or potentially prevent you from meeting your overall financial goals.

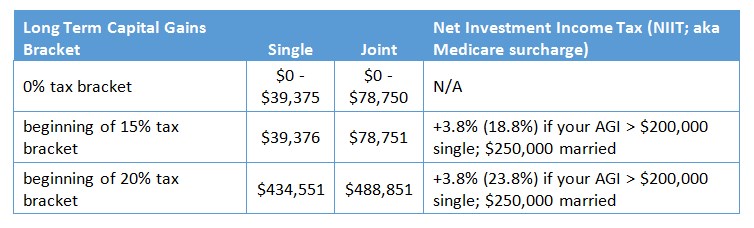

The goal of a capital gains harvesting strategy should be to take whatever gains can be absorbed within your current capital gains tax bracket.

For example, Leslie and Jeff are married and have a combined AGI of $170,000. They are looking to switch to a new advisor for their $1,000,000 portfolio, but are having trouble pulling the trigger due to the $200,000 of long term capital gains in their portfolio.

Given that they have another $80,000 before they hit the $250,000 AGI threshold where the 3.8% (NIIT) Medicare tax kicks in, they set a capital gains budget of $80,000. This will allow them (or their new advisor) to go through their portfolio and transition far more than $80,000 in total value. There may be some positions that their new advisor will want to keep, part of the portfolio that may not have any gains and there may be some other losses that can be realized as well. So it’s feasible that they could transition $500,000 or more of assets without triggering the 3.8% Medicare surcharge and then they could repeat the process in the following tax year until they get the new portfolio fully invested.

The strategy is obviously more effective for those in the 0% capital gains tax bracket (which could apply in a low-income year) where the gains are effectively tax-free – at the federal level. State income taxes may still apply. But even at higher levels, you may be able to work through your cumulative gains with a few years of gains budgeting.

For those with a concentrated position in a single stock, a variation on the tax bracket budgeting is staged selling. Rather than making your decision an ‘all or none’ proposition, you instead commit to selling in stages over time to diversify out of large single-stock positions. With a concentrated position, investors’ concerns are both losing out on additional upside by selling too soon and riding the position down in a bear market. Only one in a million ever gets it perfect and, by committing to a process, you take the emotion out of the decision and you can set up a predetermined plan within your capital gains tax bracket.

As always, the fourth quarter is a time when we review our clients’ taxable accounts and try to reduce any realized gains by selectively taking losses. Please let your ACM advisor know if you have gains or losses in your taxable non-ACM managed accounts. With only a few remaining trading days of 2020, we can still work with you to help mitigate taxes and keep more of your return.