by Paul Broughton

The current news is very concerning and, to many people, very disruptive. We have fires raging in California and social unrest in many cities. The presidential debates got off to an unruly and ugly start. Voting by mail looks to be a divisive issue, and, in turn, may lead to a contested election outcome. The Supreme Court nominee will likely lead to a heated approval process that potentially further exacerbates political and social tensions. And there have been some recently announced large job cuts: Disney is laying off 28,000, Allstate is reducing 3,800 positions – about 8% of its workforce, Marathon Petroleum is cutting 2,000 positions – about 12% of its workforce. American and United Airlines are furloughing 32,000 employees, but will recall these workers if an aid package is approved. The restaurant, hotel, travel and other services and hospitality industries still remain severely impacted. And the Covid virus is clearly still potent. And yet the S&P 500 is close to all-time highs. It’s probably safe to say that there seems to be a disconnect.

The markets are always forward-looking instruments. And despite the virus and all of the social and political vitriol, the markets have been pushing higher. The S&P 500 has recovered all of its very sharp first-quarter drop of -33.8% and then some. It made a new all-time high on Sept 2nd – a recovery of 61.4% from its March 23rd bear market low. And it remains close to that high level today. The primary driver of the recovery reflects the massive monetary and fiscal stimulus, the gradual re-opening of the economy, and improved Covid-related measures such as mask wearing, social distancing, increased testing, and improved methods of treatment. While near-term risks remain substantial, the longer-term outlook behind the market’s rise points to further economic recovery.

With the Fed adopting a new policy of letting inflation run above its target of about 2%, in order to make up for past extended periods of below 2%, the tech-heavy Nasdaq 100 Index has the led the way higher. It’s up 29.8% year-to-date compared to the S&P’s 5.1% gain and the DJIA’s 1.3% decline. This new policy by the Fed may mean that interest rates remain very low for years. This, in turn, puts a premium on growth assets in a low-growth economic environment. But, can growth stocks continue to outperform value at the same pace that they have over the last several years? Growth stocks have outperformed value by 41.6%, 70.3%, 100.3%, 228% over the last 1, 3, 5, and 10-year periods. This is largely due to near-zero interest rates and very modest economic growth over the last ten years. A premium has been paid for growth in a low-growth economy.

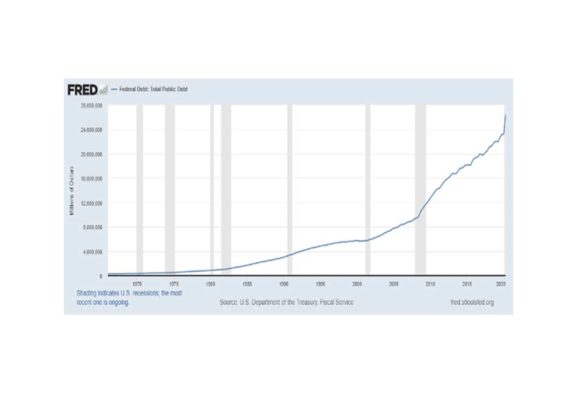

A vaccine would likely lead to economic growth above its recent long-term average of about 2%. And this would likely lead to value stocks to outperform growth. Value stocks tend to outperform growth in economic expansions following a recession. But the real test of vaccine-induced economic growth would be just how much above 2%? And for how long would that growth spurt last? Keep in mind that the federal debt level is at an all-time high and only going higher (chart below, we’re at $26.5 trillion but who’s counting?). And there’s the significant possibility of higher personal and corporate taxes in a Biden administration which could potentially temper growth.

So, what’s an investor supposed to do now in light of the current situation as described above? Near-term risks are high and the economic data suggests some bumps in the road before we return to a solid, sustained expansion, but we are finding attractive opportunities by focusing on and thinking about where each company will be in the next 3 to 5 years. This process brings about a fairly balanced portfolio of stocks that isn’t tilted overly heavily in one direction versus the other.