Politics. Blah

I detest writing about politics. We are all told how much the stock market is correlated to the presidency, especially in recent years when the level of the stock market has somehow become a feather in the cap of the president. This. Is. Not. True.

Coming to the rescue

Presidential policy has the ability to dampen the impact of a catastrophic event such as the 2008/2009 housing and credit market crash, as well as the Covid-19 correction we experiencer earlier this year. Flooding the market with capital can help dampen the short-term impact of these events.

Other than during a crisis, a president can’t do a ton to boost the economy in the short term…..but they certainly can hurt it in the short term. Think back to 1971 when President Nixon in response to inflation enacted price controls. There was a direct and immediate negative impact made to the real economy.

True presidential impact is often times invisible, and more about what didn’t happen, or what was prevented, rather than what did happen. The true results only become visible years, and perhaps decades later.

Party like its 1999

During the ending days of President Clintons time in office, he effectively repealed the Glass-Steagall act. Although not actually “repealed”, the restrictions it placed on banks and investment banks were lifted allowing for the two to merge. There is a direct line to be drawn from this one act in 1999 to the housing crisis in 2008/2009 a full decade later. We don’t know and won’t know the impact of 99% of presidential policy until that president is most likely not in office any longer. Some can argue that other factors had a bigger impact, and some argue that nothing else had any impact except for the repealing of Glass- Steagall, and both of those arguments are wrong also. It had some impact, and other factors had some impact, but it can’t be understated that a decision made by a president in 1999 impacted the economy, country, and presidency of not the person who followed Bill Clinton, but the president after that in Barack Obama.

So, I should sell? No, wait I should buy?

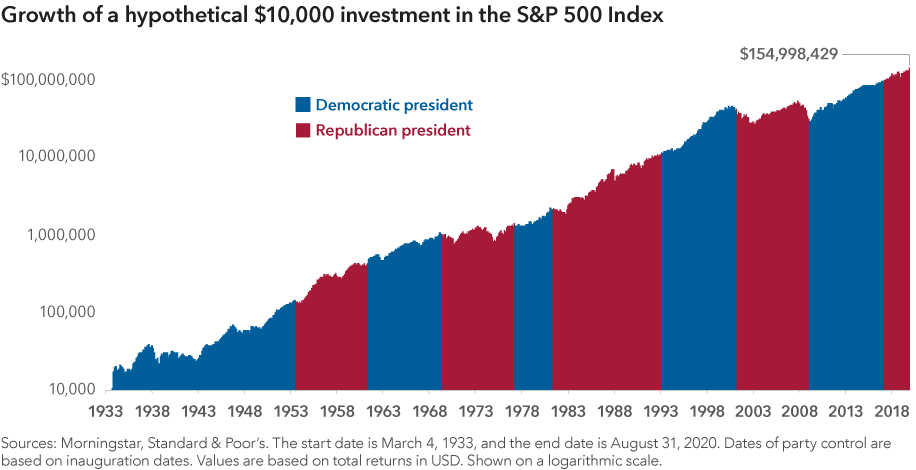

Take a look at the chart above. DON’T DO ANYTHING! It doesn’t matter if Democrats or Republicans win when it comes to the impact on the stock market. There will always be volatility, but as you can see, whether we are red or blue, the markets will rise steadily over time. The age-old argument for this is, “I don’t have that much time to wait!” I understand so let’s take a look at the chart below.

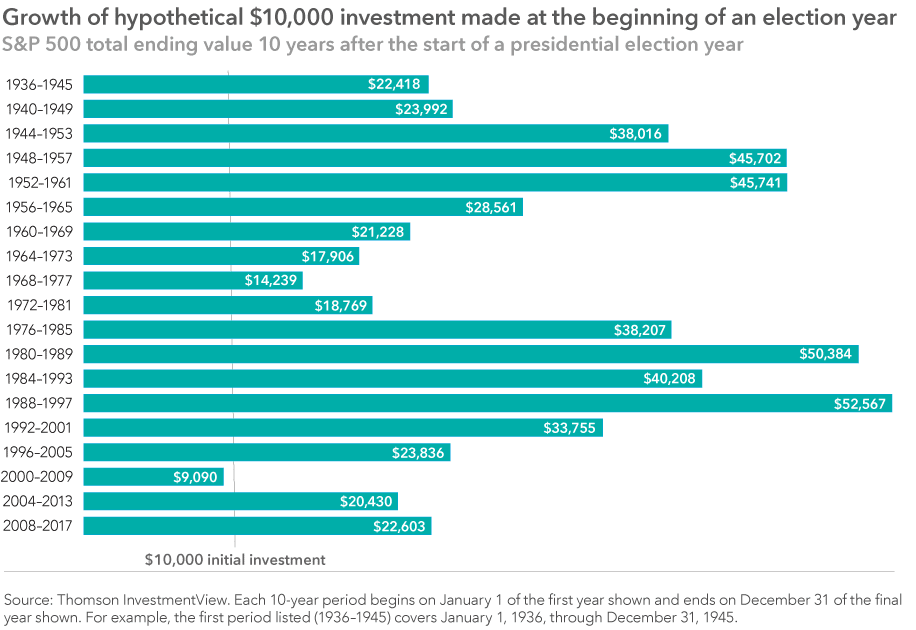

This is a hypothetical 10K invested at the beginning of each different presidential term. It shows very clearly, that even through corrections, depressions, volatility, and everything in between, following a disciplined plan and staying put will result in more money at the end of the time period than you began with.

Elections are emotional

I have always advocating fighting emotional responses to events that lead to financial mistakes because emotions have clouded your better judgement. Presidential elections are extremely emotional, especially this one. It’s okay, don’t fight against it, but recognize it. If you want to argue with friends, post on social media, or rant alone in your bathroom like I do, that’s all fine, but recognize that your emotions are at a heightened point and do not let it impact your financial plan and strategy. As I have shown in the above charts, regardless of how emotional elections are, or how much we like or dislike a candidate, over time our portfolios will all be fine.

Salesman hat

I love writing these weekly market updates, and what started as something for just my clients has blown up into a following, I never thought possible. I am deeply grateful, and work very hard to make sure these posts are informational, straight forward, and actually provide news without the noise.

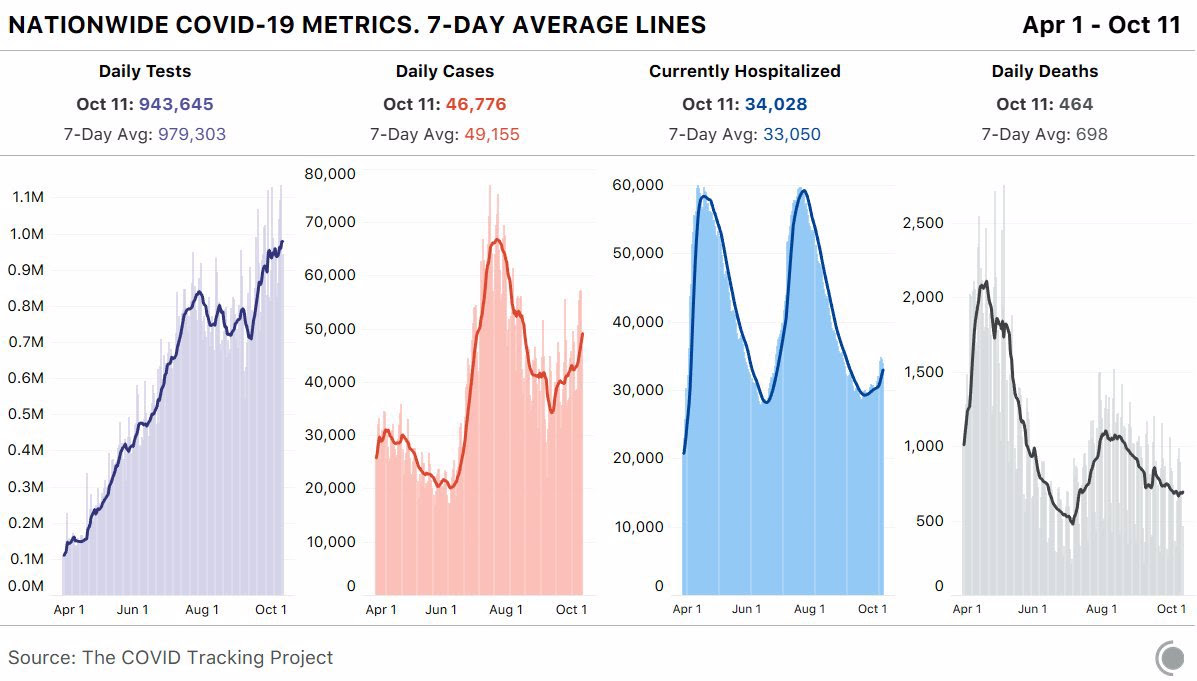

Today, I am going to put on my salesman hat for a moment. The next three weeks leading up to the presidential election are going to be emotional, anxiety riddled, and stressful. Please pass this market update along to anyone you can see getting very emotional about what is happening and have them drop me an email or give me a call. This isn’t meant for me to help them with finances, or find new clients, but rather a quick 10-minute conversation can help prevent a financial mistake driven by emotions. I can’t solve the anxiety and stress that presidential elections bring with it, especially ones held during a global pandemic, but I can help financial mistakes from being made.

So What?

So how does this impact all of you?

- The next three weeks are going to be emotional, don’t let it drive your decisions.

- Don’t hesitate to reach out when feeling financial pressure and anxiety.

- Don’t let politics cloud your vision for the markets. One person winning or losing isn’t going to derail anything.

- Stay safe and healthy

What to look forward to this week

Thursday October 15th, 2020

Initial and continuing jobless claims @ 8:30AM

Friday Octover 16th, 2020

Retail Sales @ 8:30AM

Most anticipated earnings for this week

Latest Covid-19 Data