May 30, 2023

Perception vs. Reality

As many of us did during this weekend of remembrance, I attended a BBQ with friends and family. A friend of a distant family member made a cake that looked and tasted delicious. Everyone at the gathering ate some of the cake, most of us getting a second piece and praising the chef. However, it wasn’t until later in the evening that she revealed that the cake was made using black beans. A few guests had Celiac disease, my wife being one of them, and making the cake using black beans and cocoa powder instead of flour made it gluten-free.

It didn’t matter much for all the adults, but as soon as the kids heard about the cake’s secret ingredient, they all did their best to win next year’s Oscar award for best dramatic acting. It got me thinking about perception vs. reality and how much it impacts adults, especially regarding money.

Stock Returns vs. Index Returns

I am no stranger to being asked my opinion on the markets, but this past weekend everyone who asked my opinion was far more optimistic than I was. So, finally, I asked someone why they felt we were out of the woods and on a path toward growth.

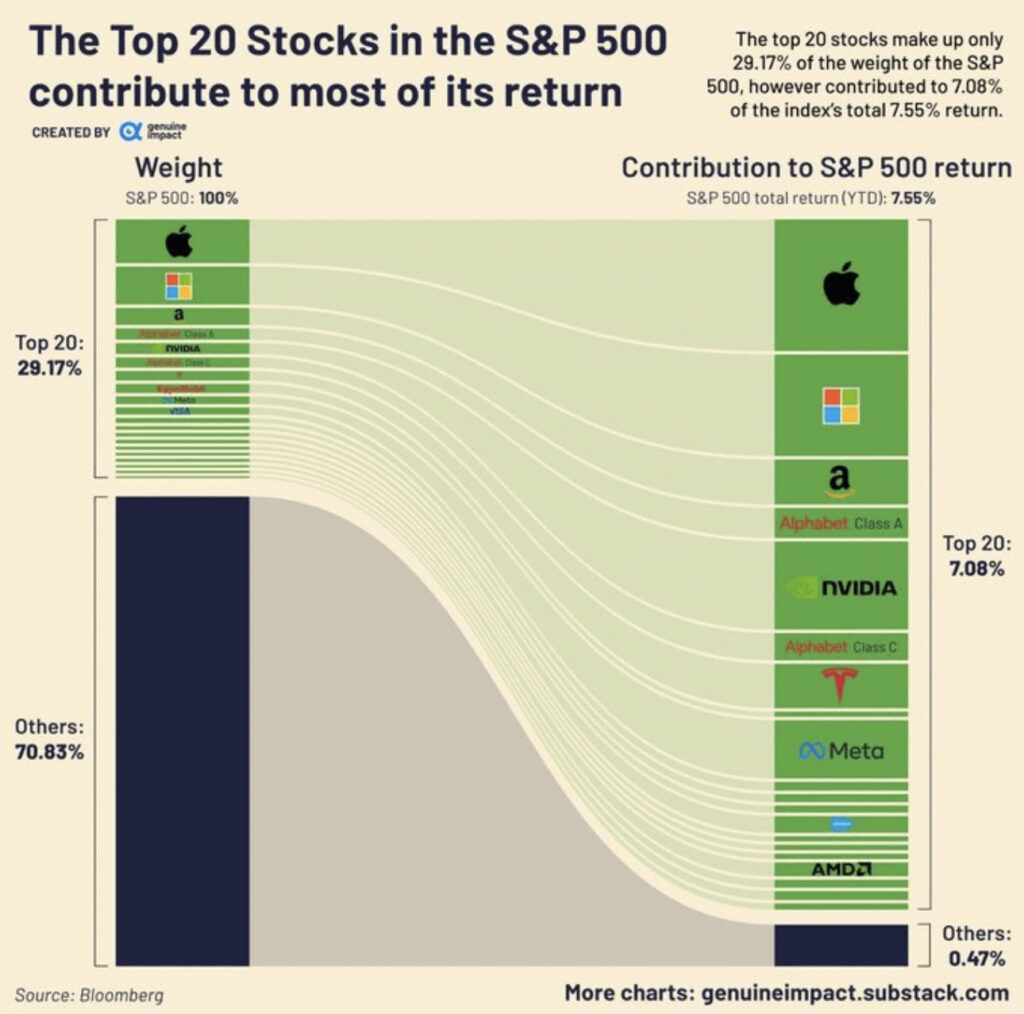

Most people cited the growth in the S&P500 for the year and the newly announced debt ceiling deal. It shocked most people when I pointed out that the top twenty stocks in the S&P500 were responsible for more than 94% of the gains. The other 480 stocks are responsible for just 6% of the overall growth in the S&P500, so unless you owned those twenty stocks, you have severely underperformed the broad markets.

The Plan vs. The Portfolio

For many investors, growth is not the ultimate goal; rather, income generation with some growth is the mandate for your plan. As a result, your plan will dictate your portfolio, and the mix of growth stocks, dividend-paying stocks, fixed income, ETFs, and cash is different for everyone depending on their plan.

The focus should shift from how are the markets doing today to how does my plan look? The S&P500 being up or down 2% today does not move the needle for anyone. Does my income satisfy my needs and desires? Is my automatic savings enough for me to reach my goals? How your plan is set up and performing should dictate your optimism or pessimism with the markets because perception is often not reality.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MAY 29 | |

| Memorial Day, all markets closed | |

| TUESDAY, MAY 30 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 1:00 PM | Richmond Fed President Barkin speaks |

| WEDNESDAY, MAY 31 | |

| 8:15 AM | ADP employment |

| 9:45 AM | Chicago Business Barometer |

| 10:00 AM | Job openings |

| 12:30 PM | Philadelphia Fed President Patrick Harker speaks |

| 2:00 PM | Federal Reserve Beige Book |

| THURSDAY, JUNE 1 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity |

| 9:45 AM | IS&P U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| 1:00 PM | Philadelphia Fed President Patrick Harker speaks |

| FRIDAY, JUNE 2 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

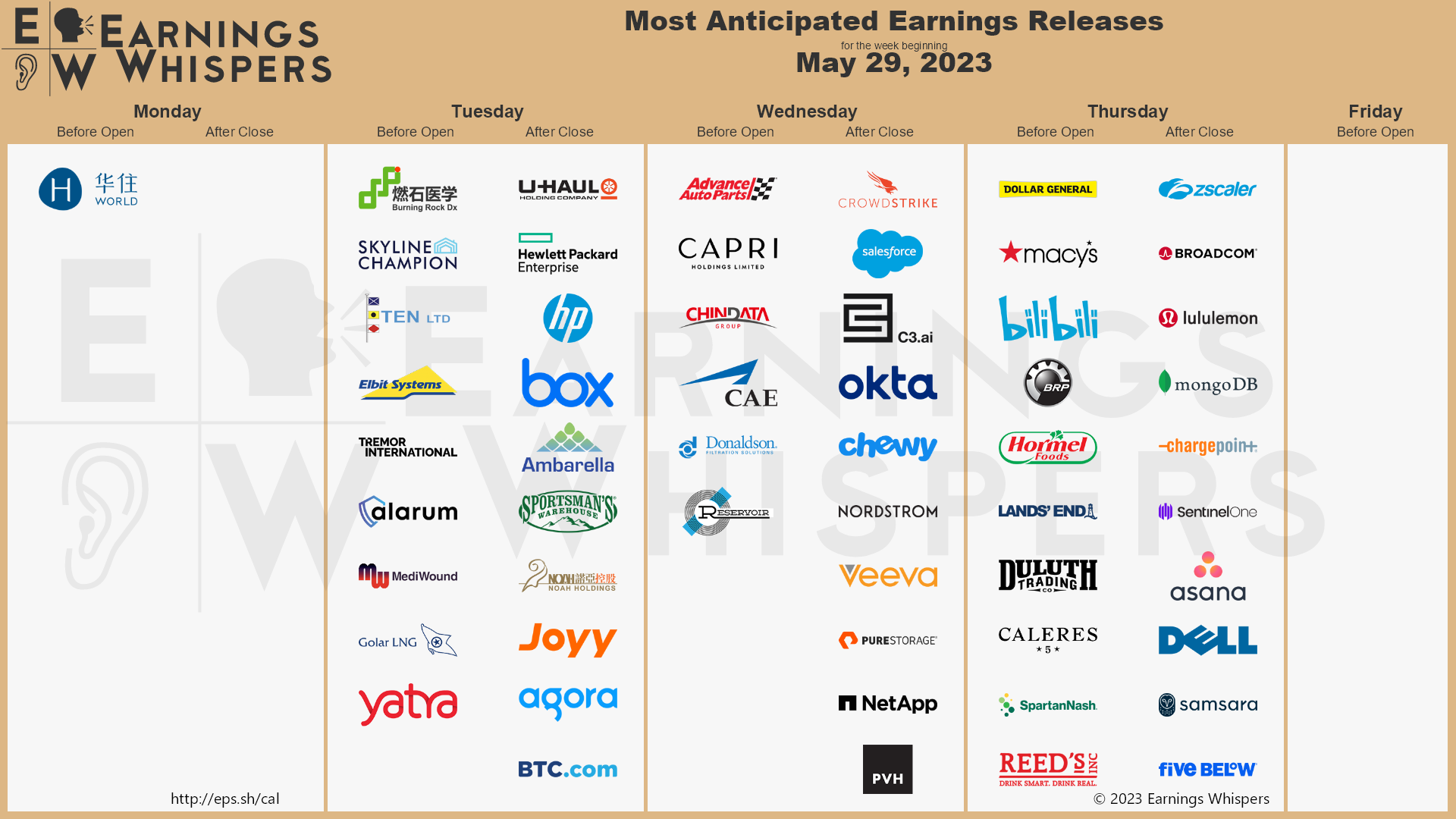

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.