May 22, 2023

Let’s Talk Politics

This will be one of my first and last blog posts about politics. It isn’t because I don’t enjoy a good debate, but that doesn’t occur in our country anymore. Politics used to be something people discussed; now, politics is something people live. As a result, political beliefs have become a significant part of people’s identities, impacting their decision-making capabilities.

The Jones Family (not their real name)

The “Jones Family” is a family of four, with Mr. and Mrs. Jones both highly educated and working. Mrs. Jones is a teacher, and Mr. Jones is in medical device sales. They are high earners and have two children above the age of 10. I have known Mr. Jones for nearly forty years, and he and I were good friends until high school. As it happens, people drift apart, but his parents are clients of mine and asked me to meet him and his family. They warned me, though, the couple had differing political beliefs, and it was a roadblock in their ability to save for the future.

Mr. Jones felt like any time there was a Democrat in office, he should have all their investments in cash. This includes 401Ks and 403Bs, and any other investment accounts they have built up over the years. As I always do, I asked him to explain his thesis, and as conversations like this tend to go, the thesis was made up of talking points that have no impact on the stock market or the economy. One of the major points was that he paid more in taxes last year, which only happened because Joe Biden, a Democrat, was in office. When I pointed out that the Tax Cuts and Jobs Act of 2017 had a provision where lower brackets increase every other year until 2025, when the provisions sunset, he waved it off.

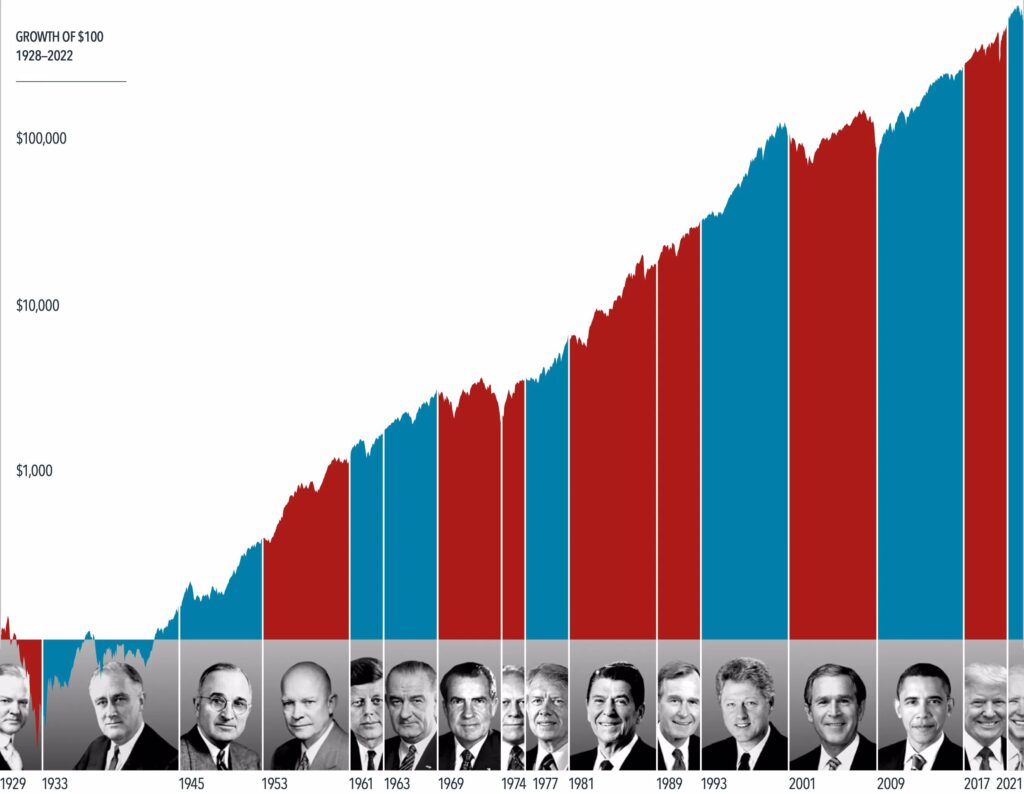

Disregarding facts because they don’t align with your political beliefs is a recipe for disaster. Also, the president has very little to do with the stock market performance while they are in office, illustrated by the chart below.

Investing and Politics

The Jones Family has tried to time the market on multiple occasions, each time prompted by the sensational headline of that week. Whether it is the debt ceiling, Covid, inflation, employment, or a recession, trying to get in and out of the market will never work.

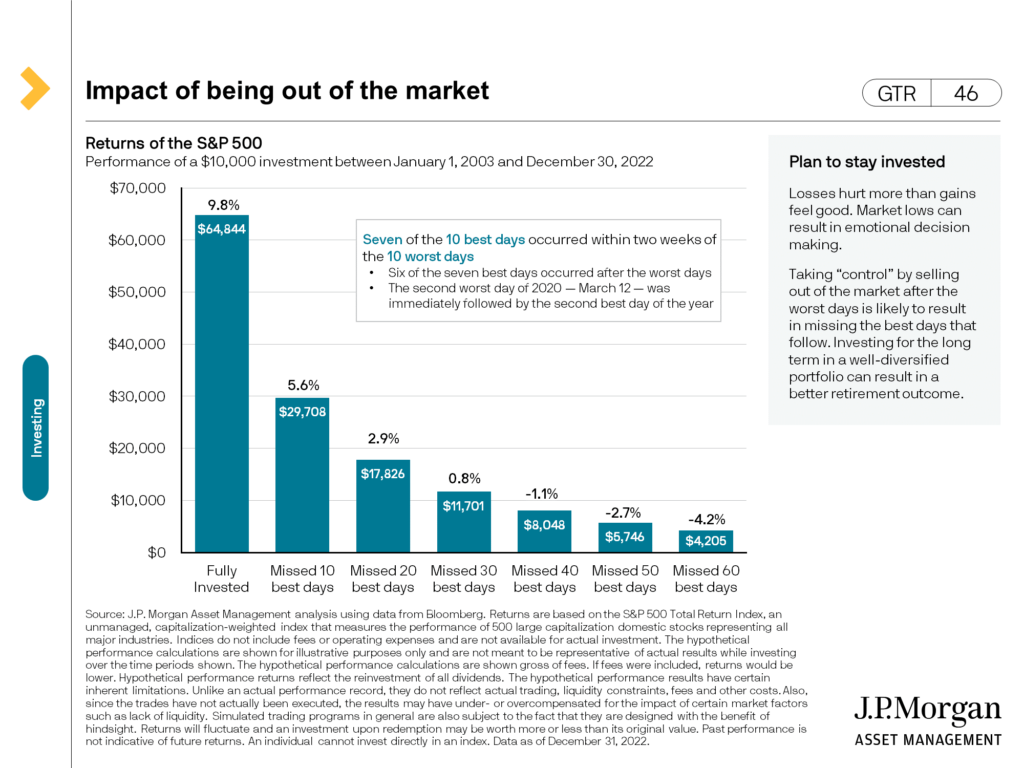

Since 2003, Seven of the ten best days in the stock market occurred within two weeks of the ten worst days in the stock market. The second-worst day of 2020, March 12th, was followed immediately by the second-best day of the year, which occurred on March 13th. Look at the chart below by J.P Morgan; it shows you the impact on your portfolio for missing a few of the best days in the stock market because you decided to try and time the markets.

Behavior Dictates Success, Not Intelligence

As is pointed out on the chart, losses have a much more significant psychological impact than gains. It hurts more to lose money. We often mistake hasty decision-making with taking control, but control in the form of selling when the market goes down is a decision rooted only in emotions, not data.

I did some quick math for the Jones Family, and I pointed out that even though Mr. Jones was earning nearly three times the salary of Mrs. Jones, she had more money in her retirement account. Mr. Jones contributes more to his account and gets a company match, so how is that possible? Mrs. Jones invested her money in a diversified portfolio and left it alone. Good, bad, or sideways markets didn’t matter to her. Mr. Jones routinely trades in and out of his retirement portfolio, currently sitting in cash since January of this year.

Finally, we had our eye-opening moment, and you saw that political identity began to take a back seat to data-driven financial planning. I don’t know what the outcome will be with the Jones family, and I hope they become another family added to the growing Forefront Family. Still, more importantly, I hope their decision-making process moving forward only considers politics when politics matter for the problem at hand.

So, What

We live in a time where it seems like we are more divided than ever, and television programming is more than happy for you to feel that way. My experience has been that this couldn’t be further from the truth, and every day I witness kindness on various levels that reminds me how much good is in the world. For some, they have their identity wrapped up in their politics, and to each their own, but things can begin to unravel quickly when that starts impacting your financial decision-making.

Stock market calendar this week:

| MONDAY, MAY 22 | |

| 8:30 AM | St. Louis Fed President James Bullard |

| 11:00 AM | San Francisco Fed President Mary Daly |

| 11:05 AM | Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin speak |

| TUESDAY, MAY 23 | |

| 9:00 AM | Dallas Fed President Lorie Logan speaks |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | New home sales |

| WEDNESDAY, MAY 24 | |

| 12:40 PM | Fed Gov. Christopher Waller speaks |

| 2:00 PM | Minutes of Fed’s May FOMC meeting |

| THURSDAY, MAY 25 | |

| 8:30 AM | GDP (second reading) |

| 8:30 AM | Initial jobless claims |

| 9:50 AM | Richmond Fed President Tom Barkin speaks |

| 10:00 AM | Pending home sales |

| FRIDAY, MAY 26 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 8:30 AM | Personal income (nominal) |

| 8:30 AM | Personal spending (nominal) |

| 8:30 AM | PCE index |

| 8:30 AM | Core PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE (year-over-year) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 10:00 AM | Consumer sentiment (final) |

Most anticipated earnings for this week:

Did you miss our blog last week?

Mother’s Day and Debt Ceilings

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.