Is distribution of wealth harder than accumulation?

Are you concerned about the FOMC announcement this coming Wednesday and whether or not the Federal Open Market Committee will raise interest rates at all, or at the very least curtail their monthly bond buying?

If you are in the accumulation stage of your life, this isn’t a concern of yours at all. See, the accumulation phase requires sacrifice, but has very few moving pieces. It gets boiled down pretty easily, budget my money so I spend less than I make and I can save the rest for the future. Done. The distribution phase is a puzzle full of moving pieces.

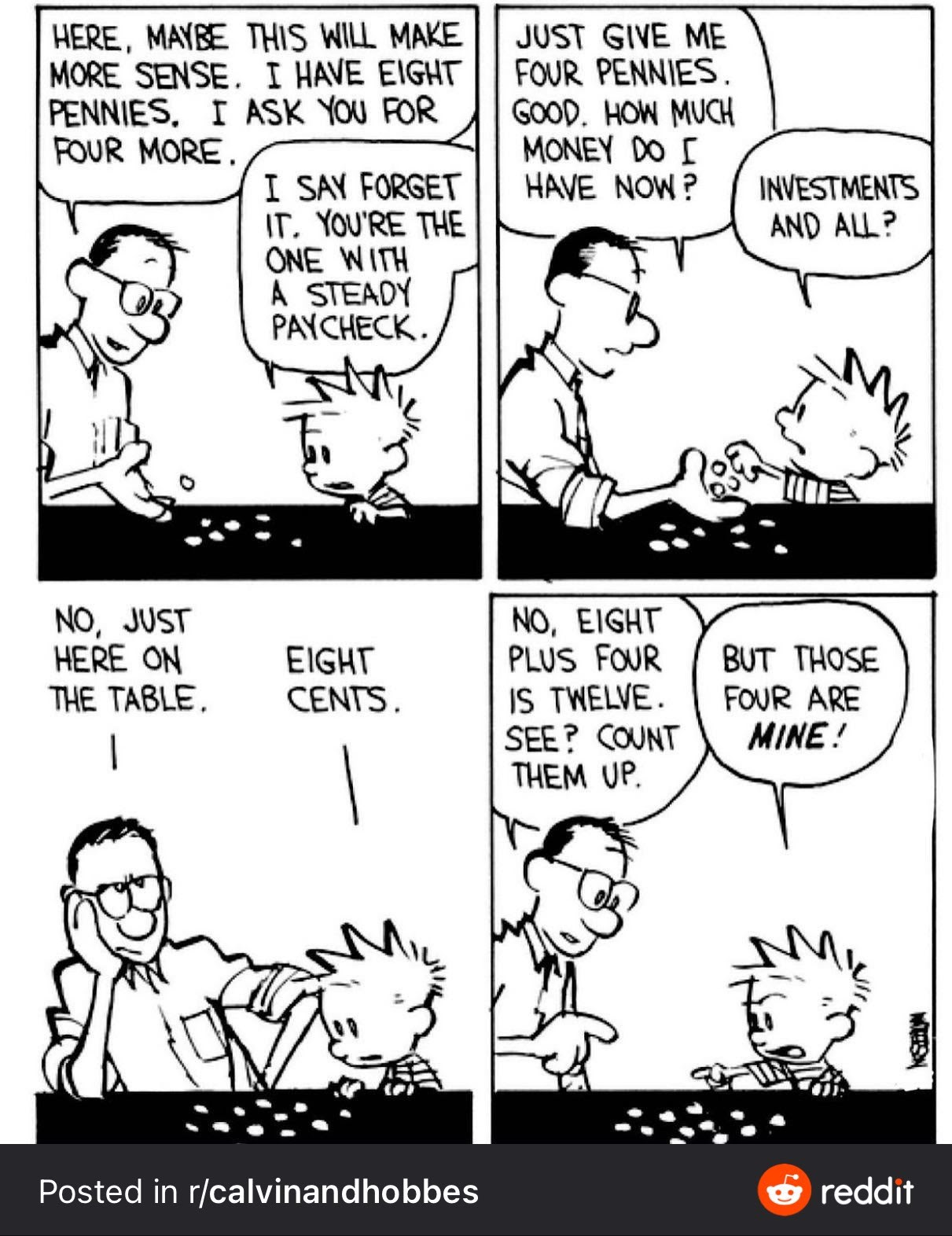

Teach them young

I am teaching my children a valuable lesson in taxes via all sweet treats they get. Everyone of us has been in the back seat with a bag of M&Ms and have seen our fathers hand reach around back and hold there cupped, awaiting what has now been dubbed “The Daddy Tax”. All of us do this with our children, and it actually does teach a pretty good lesson, but teaching them young is what counts.

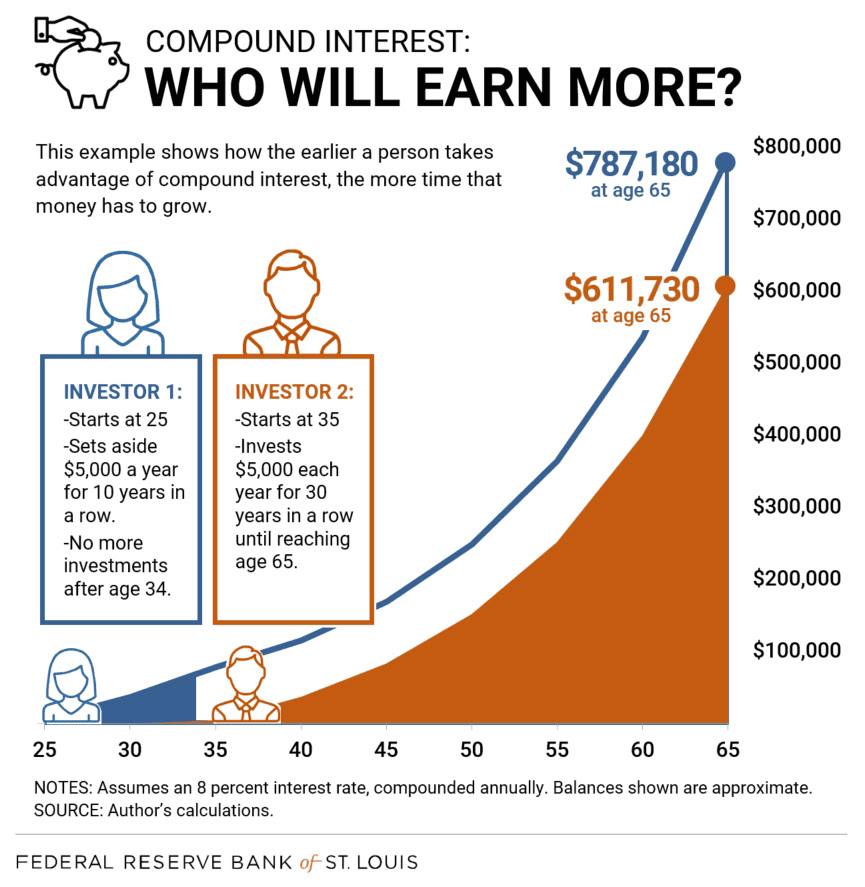

It also makes the accumulation phase of their life much easier because time is on your side if you start young. Take a look at the example below. Both investors save money in their lifetimes, but if you start earlier, your chances of success grow exponentially.

Accumulation vs Distribution

This isn’t to say accumulation isn’t hard, it certainly is, but the factors that determine success are completely in your control. Spend less than you make, and save the rest. With distribution there is a lot that is out of our control. Let’s start with sequence of returns risk.

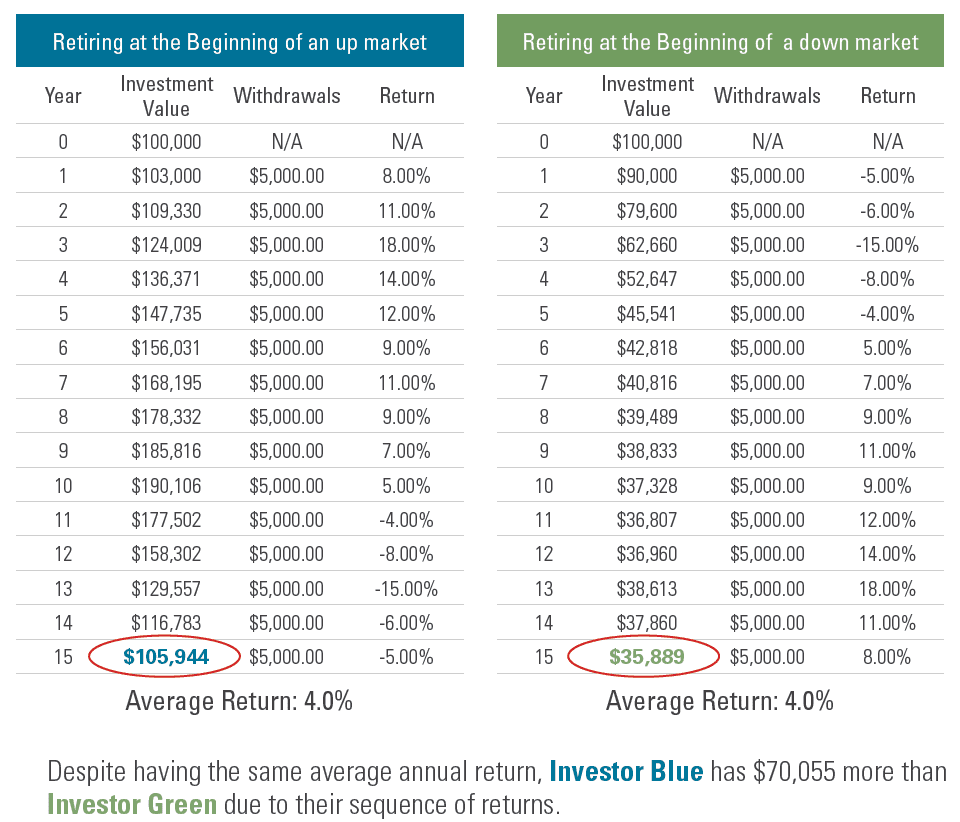

You can have the same average rate of return over a period of time, but if you start those distributions in a down market vs. an up market it changes the trajectory of your plan all together. Market returns are completely out of your control, and if someone has control over them, please call me. I want to be rich also.

Okay, let’s say we start our distribution phase in an up market, so that worked in our favor, what about keeping up with inflation while interest rates are virtually 0%? As healthcare costs, food, and energy prices continue to rise how do I make sure my money can keep up with that. What about the taxes when I do withdraw money from my retirement accounts? Does that impact my Medicare premiums or any other benefits I get currently? The questions don’t stop once you have entered the distribution stage of your financial plan, in fact new ones keep popping up.

What is the solution?

My kids went for ice cream with my wife, Christina, yesterday. They came home with small cups of mint chip ice cream for each of them, and a tiny child’s size cup of it. When I asked what the small cup was for, they told me it was for me and was “The Daddy Tax” so it didn’t take away from theirs. They had a plan!

The same solution holds true for everyone, and that is to have a plan. Sequence of returns risk is scary, but if you plan to build up cash before retirement so when your distributions need to start, they can start from the cash, you have helped to mitigate sequence of returns risk. Although no risk can be eliminated altogether, having a plan will let you mitigate risk to the point where you feel comfortable.

This plan starts during the accumulation stage of your life. By automating savings, and all of the other aspects of accumulation, you will have set yourself up with disciplined money habits. These habits become paramount to your success during the distribution stage. Just like we learned about taxes as children from our parents through “The Daddy Tax,” we can all learn from our younger selves to maintain our disciplined plans even when it switches to distribution, and the moving pieces start flying around.

So What?

So how does this impact all of you?

- Planning matters more than investment returns

- A disciplined accumulation plan that you start early, will set you up when your distribution plan has more moving pieces.

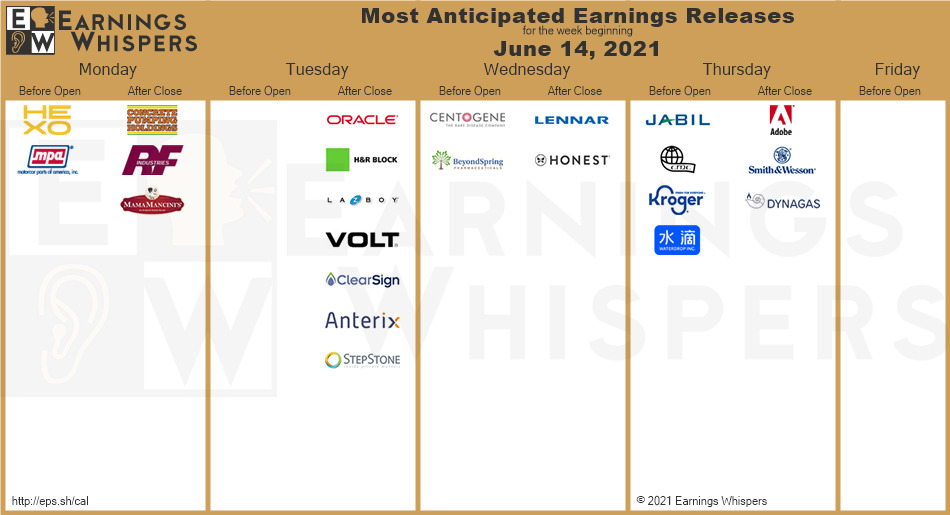

Stock market calendar this week:

Wednesday June 16th:

FOMC Announcement @ 2PM

Fed Chair Jerome Powell press conference @ 2:30PM

Thursday June 17th:

Initial and continuing Jobless Claims @ 8:30AM

Are we in a housing bubble? Is now the time to sell? Is now the time to buy? A lot goes into making a decision on housing, and understanding if we are in a housing bubble is paramount to making a good decision. Find out if we are in the latest episode of Understanding the Power of Money.