July 11, 2022

Forefront‘s Monday Market Update

Clichés

I remember growing up when my mother, exasperated, would tell me to “just wait; you will see when you have kids of your own.” Of course, I swore I would never become like my parents because all those old cliches are entirely wrong.

This weekend, as my son stood in front of the open fridge for the third time in twenty minutes, I uttered the words I had heard a thousand times before. “Shut the fridge; our names aren’t Rockefeller.” I had listened to these words yelled at me throughout my childhood, which was the final confirmation that I have indeed become my parents. All of those clichés about it are entirely true.

How People Feel

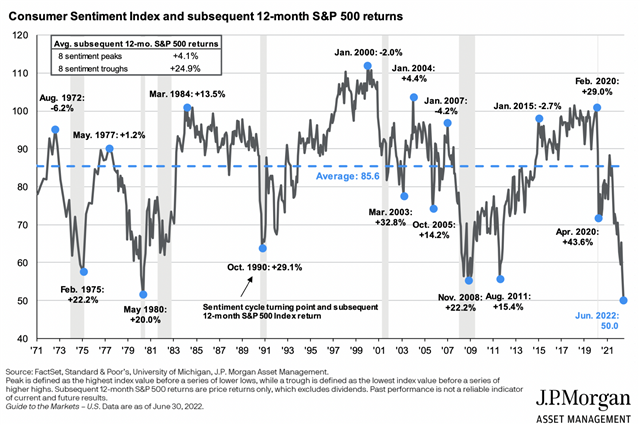

Consumer sentiment has plummeted over the past three months as the media has flip-flopped between inflation and a recession being the cause of human demise. Maybe they aren’t that bleak, but if they haven’t gotten enough clicks that week, they can get pretty morbid.

Please look at the above chart, and notice that as consumer sentiment is at its lowest, the market is getting ready to turn a corner. The upcoming election plays some role in consumer sentiment, but each month as the reading comes out, it is used as a data point to show how bleak things are. The opposite can be taken from this data point; as consumer sentiment hits rock bottom, it provides a good entry point into the market.

This is not to say that the market is poised for a rally in the short term. I know that during times of distress, we will see more scams, more people trying to sell you a newsletter, and more media using data points wrong to scare you more. We will see consumer sentiment driven lower because when you are inundated with negativity, it is bound to impact your opinion about the world. If I knew the market would do that, I promise I would shout it from the rooftops.

Investing Clichés

As I learned the hard way this weekend, all of those clichés about parenting are entirely true, and if you don’t believe me, wait till you’re parents (see what I did there). The same holds for all those investing cliches we have heard.

“Investors would be wise to be fearful when others are greedy, and greedy when others are fearful.” The consumer sentiment chart is screaming this at your right now.

“Don’t look for the needle in the haystack; just buy the haystack.” The plan is the product, not the portfolio! Stop trying to find the next hot stock; deploy your capital across the broad market as early and often as possible.

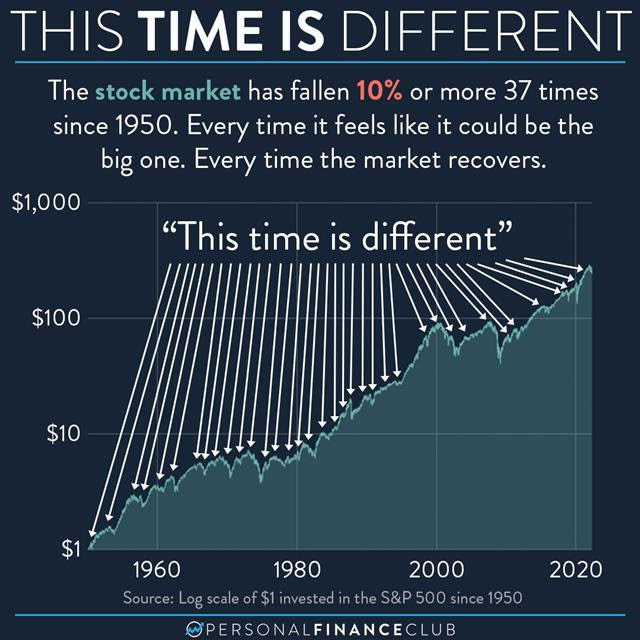

“The four most dangerous words in investing are it’s different this time.”

I will leave you with it to end this week’s market notes. This time isn’t different.

So What?

So how does this impact all of you?

- Make sure to understand the data points given to you. The media will misuse data to cause anxiety and fear

- This time isn’t different.

Stock market calendar this week:

| MONDAY, JULY 11 | |

| 11:00 AM | 3-year inflation expectations |

| 2:00 PM | New York Fed President John Williams discusses move away from LIBOR |

| TUESDAY, JULY 12 | |

| 6:00 AM | NFIB small-business index |

| 12:30 PM | Richmond Fed President Tom Barkin speaks |

| WEDNESDAY, JULY 13 | |

| 8:30 AM | Consumer price index (monthly) |

| 8:30 AM | Core CPI (monthly) |

| 8:30 AM | CPI (year-over-year) |

| 8:30 AM | Core CPI (year-over-year) |

| 2:00 PM | Beige book |

| 2:00 PM | Federal budget (comparison vs. year-ago) |

| THURSDAY, JULY 14 | |

| 8:30 AM | Producer price index final demand (monthly) |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 11:00 AM | Fed Gov. Chris Waller speaks |

| FRIDAY, JULY 15 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding vehicles |

| 8:30 AM | Import price index |

| 8:30 AM | Empire state manufacturing index |

| 8:45 AM | Atlanta Fed President Raphael Bostic speaks |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization |

| 10:00 AM | UMich consumer sentiment index (preliminary) |

| 10:00 AM | UMich 5-year inflation expectations (preliminary) |

| 10:00 AM | Business inventories |

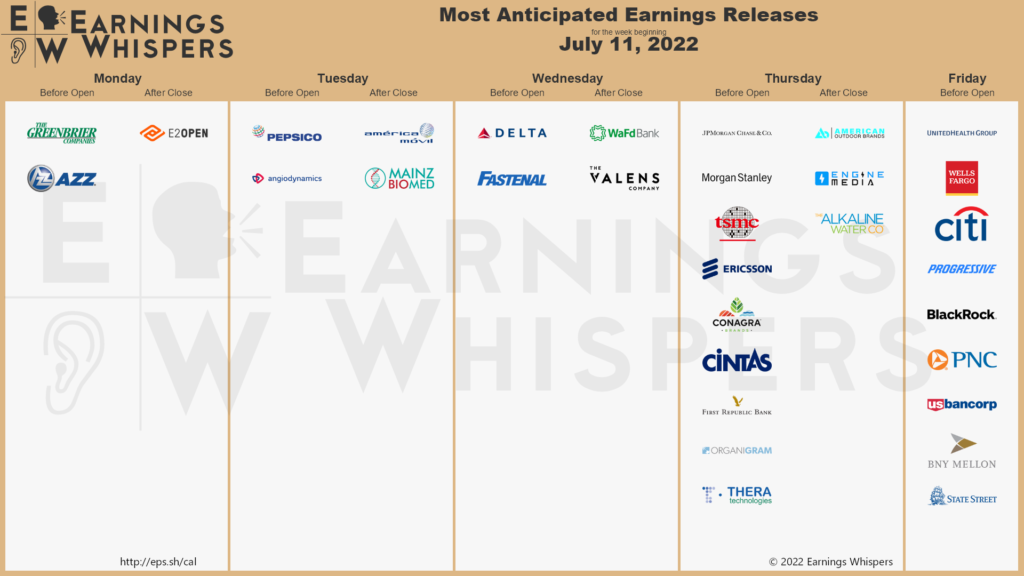

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.