July 18, 2022

Forefront’s Monday Market Update

What Type of Investor Are You?

One of the most complex parts of being a financial planner and portfolio manager is trying to understand what type of investor my client is. There is no one particular strategy or technique to invest your money. Whether you are dollar cost averaging into individual stocks or dumping cash in one lump sum into an index fund, all strategies and investment philosophies come with pros and cons. I would rather have a good plan that you can stick with rather than THE BEST plan that you can’t stick to. Alas, this comes down to asking yourself, “what type of investor am I?”

Experience

In 2021 when meme stocks and Reddit were controlling people’s investment philosophies, I heard from many of my older clients how the younger generation was crazy. I reminded them their parents thought they were crazy when they described the new and ground-breaking innovations coming out of a company called Google and Amazon.

No one is crazy; we are all just shaped by our own experiences. I remember the tech bubble bursting in the early part of this century. I don’t remember what happened to individual companies or how much the market was down, but I remember a discussion between my parents that I had overheard. They were discussing the possibility of having to sell our house and move. Luckily, that didn’t happen, but that one experience has shaped my investing strategy.

In 2008, I witnessed a foreclosure tidal wave sweep across our country, which shook me to my core. I was lucky enough to buy my home with an ultra-low interest rate, but I still make extra payments to my principal to pay the debt faster. This isn’t the correct mathematical decision, but it is a good plan I can stick to instead of the best one I can’t.

Who you are as an investor is shaped by your own experiences and the various market environments you have lived through.

Personality

Investing success is a soft skill, not a hard science. Your behavior will have a much more significant impact on your wealth than your intelligence.

Your personality plays a substantial role in what type of investor you are. Your temperament and overall emotional disposition draw you to particular investments and strategies. Often, I will joke with clients that I have a privacy policy for their vital financial information and that privacy policy extends to any discussions we have about themselves. I am always trying to peel back the layers on my clients so I can understand who they are and how they think because the type of investor you are will dictate the plan I build for you.

Mentors

This is a big one for me because I was lucky enough to have some incredible mentors. The Chief Investment Officer at my prior firm instilled in me the importance of risk management and that your planning and portfolio management were only as good as your process for creating the plans and portfolios. Process, process, process was his motto, and it is a motto I have adopted in my practice today.

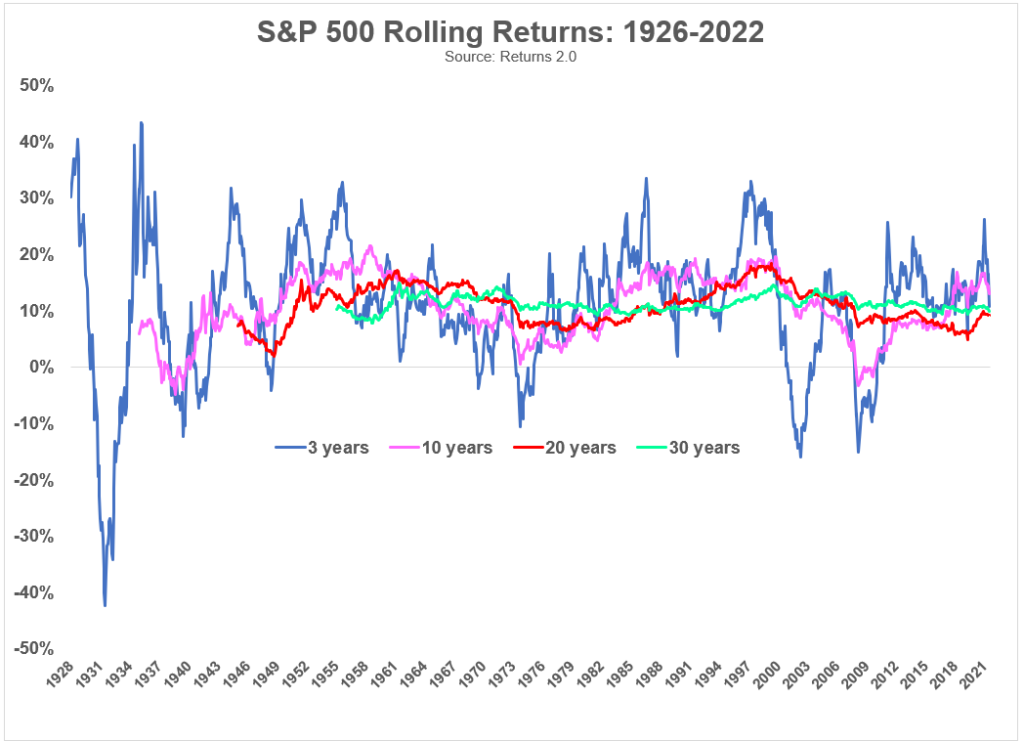

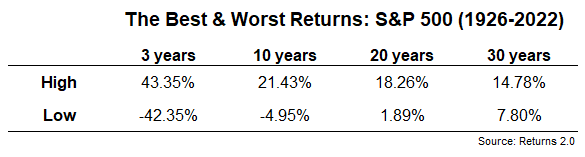

He also taught me that time horizon was the most overlooked metric when we, as individual investors, evaluate an investment plan and advisors when evaluating what goes into that plan. Time horizon and volatility are forever connected in the simplest of ways. The shorter the time frame you are looking at, the more volatile it is.

What’s The Point?

What is happening in the market right now is outside of our control. There is no zigging or zagging to be done, and those who think this is what a financial planner does have been sold a bill of goods that no one can deliver.

What can be controlled is your overall plan, and creating that plan is based on what type of investor you are and who you are as a person as a whole. If you are stuck in a panic, you MUST reevaluate your plan.

Whether the plan is designed to build wealth through savings or distribute your wealth in retirement, an essential feature of any strategy is to alleviate the emotional extremes. Keeping you even-keeled lets you stay invested, and history tells us staying invested is the best way to make money.

So What?

So how does this impact all of you?

- If corrections/recessions cause you to panic, reevaluate your plan.

- A good plan you can stick with is better than the best plan you can’t stick with.

Stock market calendar this week:

| MONDAY, JULY 18 | |

| 10:00 AM | NAHB home builders’ index |

| TUESDAY, JULY 19 | |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| WEDNESDAY, JULY 20 | |

| 10:00 AM | Existing home sales (SAAR) |

| THURSDAY, JULY 21 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 10:00 AM | Leading economic indicators |

| FRIDAY, JULY 22 | |

| 9:45 AM | S&P Global U.S. manufacturing PMI (flash) |

| 9:45 AM | S&P Global U.S. services PMI (flash) |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.