by Kevin Kelly, Portfolio Manager

If anything, the title is an understatement. Some investors own a large basket of high quality, investment grade bonds of well-known companies. The yields on such securities have declined dramatically and many are now 1% or even less. Many investors do not realize this, however, because they are looking at their coupons. The same logic applies to investors who own ETFs and focus on their dividends/distributions rather than the yield the underlying ETF assets are earning. Moreover, traditional fixed income investors will see little growth in their accounts as bond prices decline towards par ($100). Our goal is to make sure that you are not one of these investors. Whether you have ACM Wealth look at your fixed income account or not, you need to reassess your traditional fixed income bonds and ETFs.

Yield versus coupon – they are extremely different calculations!

Investors who fail to recognize that yield and coupon are different are dramatically overestimating their yield. Yield is the annual income a bondholder expects to earn between now and when the bond is sold, redeemed, or matures. This reflects the coupon and any expected change in the price of the bond. The coupon is the stated annual interest payment the company agrees to pay to bondholders until the bond matures. The coupon rate does not change as the value of the bond increases or decreases, since the coupon is set when the company issued the bond.. The yield is determined by the price other investors will pay the current bondholder to purchase that bond.

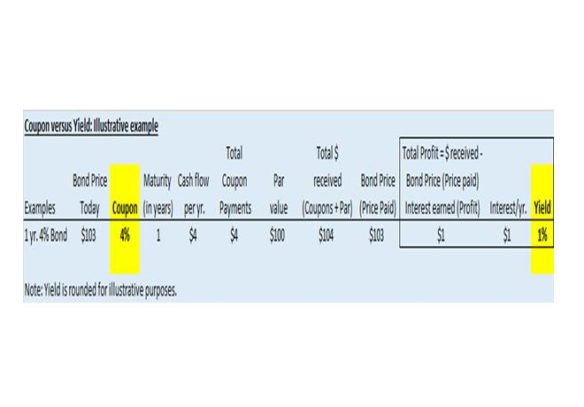

Example: Suppose a bond that matures in one year with a 4% coupon is currently trading at a price of $103 (par =$100). Every day you own the bond, you are earning the 4% coupon, but also suffering an erosion in value as the bond’s price declines towards par. A bond with a market price above par must suffer a price decline since the company has agreed to return exactly the principal, which is based on par value. So, if you choose not to sell it, you are accepting the return associated with buying it today at $103 and seeing its price drop to $100 when it matures.

Source: Bloomberg, LLC

By continuing to hold the bond for the year, you will receive $4 of interest (the coupon for one year) and $100 (par) at maturity for a total of $104 versus receiving $103 today by selling the bond. If you instead choose to sell the bond, you could then go reinvest the $103 of sale proceeds in another bond with a higher yield. By not selling, you are settling for a $1 profit for the next year ($104 of total proceeds in one year versus $103 today, $104-$103=$1 profit for one year). In this example, the coupon is 4%, but the yield is barely 1%. Your yield is NOT 4%! This misunderstanding has resulted in some investors failing to realize that they are now barely earning 1% on a traditional investment grade bond portfolio.

Seven potential warning signs that your fixed income portfolio may be yielding 1% or even less:

1. Most of your bonds show sizable gains

You’ve already won. You made most of your return. It is time to move on to new bonds with higher yields. Remember, when bond prices go up, yields go down. Unlike stocks, bond prices cannot keep going up indefinitely. Large gains indicate that the bond’s yield is now significantly lower than when it was purchased. Therefore, if most of the fixed income securities in your portfolio have sizable gains, then the yield on your portfolio has declined significantly. The larger the gain, the larger the decline in yield on a fixed income security. All bonds decline to par ($100) since the company only pays back the original amount borrowed.

2. You recognize the names of most of your bonds.

Some fixed income investors only buy bonds of large, well-known companies, a practice I refer to as “Brand-Name Bond Buying.” While this strategy performed extremely well in early 2020 and for the past few decades, it no longer has appeal unless you are satisfied with an approximately 1% yield or less on a 5-year bond. Frankly, 1% may be overstating your yield if you own only the highest quality investment grade bonds, or if you own bonds that are shorter than 5 years on average. This reflects the reality that high credit quality and general name recognition makes both professional and retail investors feel safer owning them. Less well-known companies attract less attention and may offer equally good credit quality, yet trade at higher yields. Finding these bonds, however, requires significantly more research.

3. You own Treasury ETFs or certain Investment Grade ETFs.

Treasury ETFs provide little yield prior to any fees. The 2-year and 5-year Treasuries yield a mere 0.15% and 0.34% respectively, before fees, inflation, and any taxes. Some investment grade ETFs offer little more and are akin to constructing a basketball team with a group of people randomly selected from the population. No manager would follow this path. He or she would, of course, primarily choose very tall people with athletic skills. Many investment grade ETFs give you such a wide array of corporate bonds that the higher yielding bonds and the lower yielding bonds all get mixed in together to create a low average yield for the portfolio. There is nothing wrong with earning average yields. But are you satisfied with average yields of less than 1%? Additionally, some investors quickly pick a few ETFs without properly comparing the 100+ fixed income ETFs currently available. How do I know this? The demand for many ETFs is driving prices so high that they are yielding 0.10% or less. If you own ETFs, you really need to pick your spots and do your research.

4. All your bonds mature in the next 5 years.

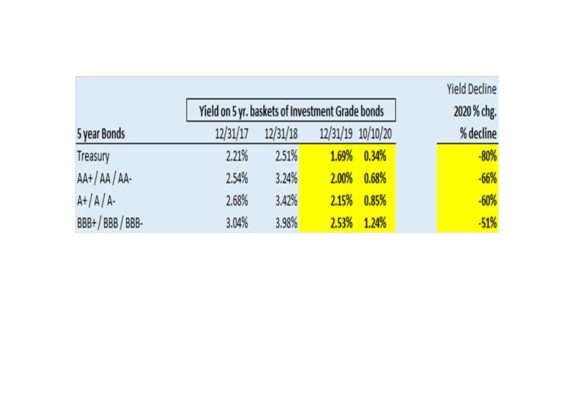

The Federal Reserve recently created facilities to buy investment grade bonds maturing in less than 5 years. This has pushed up prices and driven yields on such bonds to very low levels. The average yield on investment grade bonds maturing in 5 years is only 0.85% for those with A+/A/A- ratings and 1.24% with BBB+/BBB/BBB- ratings.

5. You have seen little activity in your portfolio in 2020.

If you have not taken some gains this year, you are likely sitting on some very low-yielding securities. Passive fixed income investing has never been so expensive as when investors fail to consider the opportunities they are missing. You likely have not taken advantage of selling bonds at low yields (and correspondingly high prices) to re-invest the proceeds in higher yielding bonds.

6. You do not know the yield on your ETFs.

Do not confuse dividends with yield. They are often extremely different. The same dynamics arise in evaluating fixed-income ETFs as arise when investors confuse coupons with yield on bonds. Often the dividend/distribution is substantially higher than the yield on the underlying securities owned. For example, there are multiple large ETFs with an SEC yield[1] of 0.15% or lower, yet the dividends they pay are 0.75% and higher (as of 9/30/20). The ETF’s value must drop to make up for the difference.

7. You own a closed end fund with an extremely high distribution.

Does the fund’s distribution rate make sense in a low yield fixed income market? You need to first ask yourself three key questions. First, is a portion of each distribution actually just a partial return of your initial investment? Do not assume all your distribution is interest/profit earned on your initial investment. Second, are you aware if your closed end fund employs leverage to enhance returns? This will increase the volatility of your investment. Third, are you comfortable with the riskiness of the assets purchased used to achieve such returns? One way to enhance returns in any environment is to just buy riskier assets. This only works if nothing goes wrong. Closed end funds may be potentially compelling to many investors, but we want to make sure clients understand their holdings.

So, what are investors supposed to do now?

Higher yielding, high quality fixed income alternatives do exist. Our fixed income approach carefully selects investment-grade securities yielding significantly more than the average 5-year investment grade bond with similar interest rate risk. Investors with a bit more risk tolerance could also choose to add some higher yielding and non-rated fixed income securities to boost yield. At ACM, we are doing our own credit analysis and managing to find bonds and preferreds that we believe are mispriced or at least cheap, so our yields are meaningfully higher than the yields available from owning Treasury bonds, and we are doing so by taking limited incremental credit risk. Such returns in a fixed income portfolio provide investors with both income and capital preservation over time.

Appendix

Investment Grade Yields have declined dramatically in 2020

Source: Bloomberg. LLC.

Note: We quote benchmark yields which are a based on a large basket of bonds and not generally indicative of the yield of our strategies.

[1] https://www.bogleheads.org/wiki/SEC_Yield