by Jeff Deiss

CFP, AEP, Wealth Advisor

With school out and summer jobs re-emerging after the shutdown, we thought we’d share some info on how you can provide some additional financial motivation and perhaps give your kids/grandkids a bit of an education at the same time.

You can open a Roth IRA in the name of a child to help him or her save for retirement, a first house, or, subject to some rules, educational expenses. You will not only be providing a head start on saving for the above, but also your child’s education in personal finance and, where parents or grandparents are contributing the funds, hopefully the opportunity to share your values about money and the beginning of a lifelong family conversation about important personal financial issues.

The child generally won’t owe taxes on the money when they withdraw it from a Roth IRA, no matter how much they have earned in the account over the years. This tax benefit is subject to one restriction: the money contributed must be held in the account for at least five years to get the full tax benefit.

The most important thing to know about this is that the child must have earned income in order to have a Roth IRA in their names. You (or the child) can contribute as much as they earned, up to the current $5,500 annual Roth IRA limit. You or another adult will be the custodian on the account, but the child will be the owner.

It’s up to you (or the child) to document that they had income earned from work. Earned income does not include an allowance or a gift or unearned interest/dividend income from other investments. It’s up to the custodian to be able to document the service rendered, when it was done, and the payment. It also has to be a reasonable rate. Listing $1,000 for a night of babysitting isn’t reasonable and will not work.

Assuming you are following the eligibility requirements for the child’s earned income, then the contribution you make to a child’s Roth IRA can be a gift from you or someone else and will count against the annual gift tax exclusion, currently $15,000, for 2020.

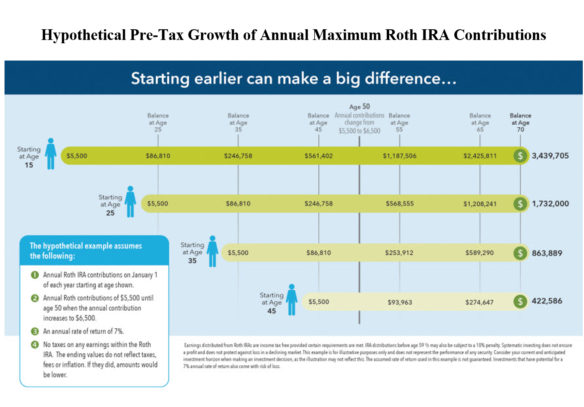

If you open a Roth IRA for a child, the money has a longer time to grow, or compound. That can make a big difference.

f you make a single, one-time contribution of $5,500 to a child’s Roth IRA when they are 15, that will turn into more than $160,000 tax free when they are 65 assuming a 7% annual return. If they waited until they were 35 to contribute to a Roth, they would need to contribute $22,000 initially to reach that same amount.

Adults, usually a parent or grandparent, control the Roth IRA account, but the account is opened in a child’s name. After the child who owns the account is 18 (or 21 in some states), you can shift the account into his or her control. As long as the account has been open for five years, he or she will have options for how to use the money.

• For retirement savings. The owner (the child who has grown up!) can withdraw the money after 59 1/2. No taxes will be owed on the earnings.

• To buy a house. The owner can withdraw funds to buy a house before reaching 59 1/2. The money must be used as a down payment for closing costs. The withdrawal is limited to $10,000. Early withdrawals for a home purchases are penalty and tax-free.

• For education expenses. The owner can withdraw money for college, but she will pay taxes on the earnings. However, there is no 10% early withdrawal penalty if the money is used for qualified education expenses (tuition, feeds, books, supplies equipment and most room and board charges).

• For emergencies. The owner of a Roth IRA can withdraw money in an emergency. But the withdrawal will be subject to taxes on the earnings, plus a 10% early withdrawal fee.

The adult controlling the account is the only person who can make investment decisions (until they are old enough to take control). If you have questions on how to open an account or how to invest the funds, then ask your ACM wealth advisor for a recommendation.

It’s hard for some kids to save even a small amount of what they have earned, even during an lockdown given that they do most things, like shopping, online anyway.

Instead of a full contribution (up to the amount of the child’s earned income for the year with a max of $5,500), another option for parents to consider is “matching” their child’s contributions as a reward for their hard work and commitment to saving. You can add $1 for every $1 they contribute or a multiple ($2, $3, $4, etc.) for every $1 they contribute. Beyond the financial head start you’ll be providing, opening and contributing to a Roth IRA for a child offers a chance to reinforce the value of earning money and shows them that you value saving for the future.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth