Forefront‘s Monday Market Update

Incentive matters

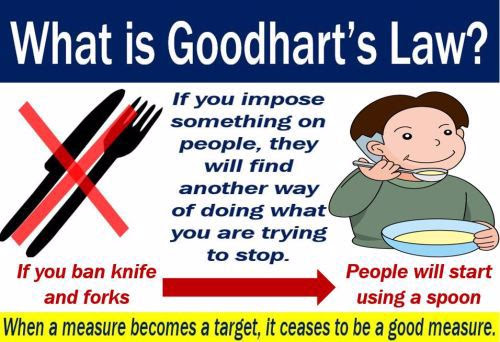

The simple model for incentives is a feeling all of us know well. Do something good, get something good. It seems straight forward, but often times, especially when it comes to financial planning and money management, the simple model of incentive that we all know so well leads to undesirable outcomes, and unintended consequences.

Snakes

There was a time during British rule of India, when the British decided there were too many Cobra snakes. They created an incentive system that they felt would help eliminate the Cobras from India, as well as benefit the local natives. The British colonists decided to pay a bounty for each Cobra head that was brought to them.

A cobra head was a simple way of measuring Cobra elimination. Bring me a Cobra head, and you must have eliminated one of the problem Cobras on the streets, right? Wrong! Locals began to breed Cobras, kill them, and turn in their heads for the bounties. Except, not all the snakes were killed, many were releases, subsequently increasing the Cobra population in India.

Wells Fargo

We all know this story well, as it was a major news story and resulted in Wells Fargo being fined billions of dollars. Wells used new accounts as a measure to help track business growth, the more new accounts are opened the more business must be growing, so they gave employees target numbers of new accounts to open as a gauge of the business, and the employee’s success.

The result was employees opening millions of fake accounts to make sure they hit their targets.

Robert McNamara

During the Vietnam war, the Secretary of Defense from 1961-1968 was Robert McNamara who had a very strong belief on quantitative metrics to make decisions. Simply put, he believed what can’t be measured isn’t important.

Anyone who has coached any type of sports can tell you how important leadership and locker room presence is for a team, both of which can not be formally measured, but are paramount for success.

The McNamara Fallacy causes you to focus on what is easy to measure and not what is actually important. Cobra heads, and new accounts are very easy to measure, but missed the point entirely.

Looking good more important than quality

When looking at incentive, a big factor you have to ask yourself is does this make me look good, or is this actually what is best for me? New account openings made Wells Fargo’s business look like it was growing, but the quality of those new customers was nonexistent because many of the accounts were fake. What does all this have to do with money, and building wealth?

Incentives matter when choosing an advisor

When evaluating a financial planner/advisor one of the major questions everyone should be asking themselves, is what is the advisors incentive? For all of us, we go to work and do our jobs so we can earn income, and the same goes for a financial planner. If the incentive is to simply earn income, we have to start looking at HOW an advisor earns his income. Is it through selling you a product, or do they actually have to deliver to be compensated?

The McNamara Fallacy is something that almost everyone falls victim to when trying to make a decision on hiring an advisor because the measure of success for everyone is performance. It is the only thing that can be measured and quantified, so that is what people look at to gauge success.

What is important to look at, is how is the advisor compensated? Do they have any conflicts of interest? Do your values align with their values, and are they focused on creating a repeatable process to help you build and manage your wealth? None of those can be measured with a number on the paper, but I would argue are far more important factors for success.

So What?

So how does this impact all of you?

- Ask your advisor what their incentive is to help you succeed?

- Focusing on only what can be measured, is leaving whats really important unexplored.

Stock market calendar this week:

Thursday September 9th:

Initial and continuing jobless claims @ 8:30AM

Most anticipated earnings for this week: