Forefront’s Monday Market Update

Your portfolio is missing something

Growing up, as I showed more interest in investing, I was always encouraged to research and learn about “companies that you know.” This is great advice and something I tell young people even today, but it does lead to some issues once you go from researching and learning, to actually investing your money in the company.

I sit down with hundreds of people each year, and for a vast majority of investors who manage their own portfolios, I can tell you what their top 5 or 10 holdings will be. We all took the lessons we learned and invest in the companies that we know.

Depending on your age your portfolio looks very concentrated in FAANG+ Microsoft and Tesla, or it looks like that with a sprinkling in of some Large Cap Value positions like Disney and Costco. Now, to be clear so I don’t have to put 3 pages of disclosure at the end of this: I am not recommending you go out and buy any of these stocks!

So, what’s missing then?

We can take this a step further and look at all of our 401Ks and the options available to us. Many people own some type of target date fund, which is simply a mix of the S&P500 (Large Cap) and Bonds (Fixed Income). What is missing?

Small Cap is what’s missing, and it’s a huge problem, especially amongst Gen X and Millennial investors. As you age owning larger companies and fixed income is just fine because you are exiting the accumulation stage of life, and entering the distribution stage. For the vast majority of us, in the accumulation stage we need to have our money exposed to multiple areas, to maximize our potential for growth.

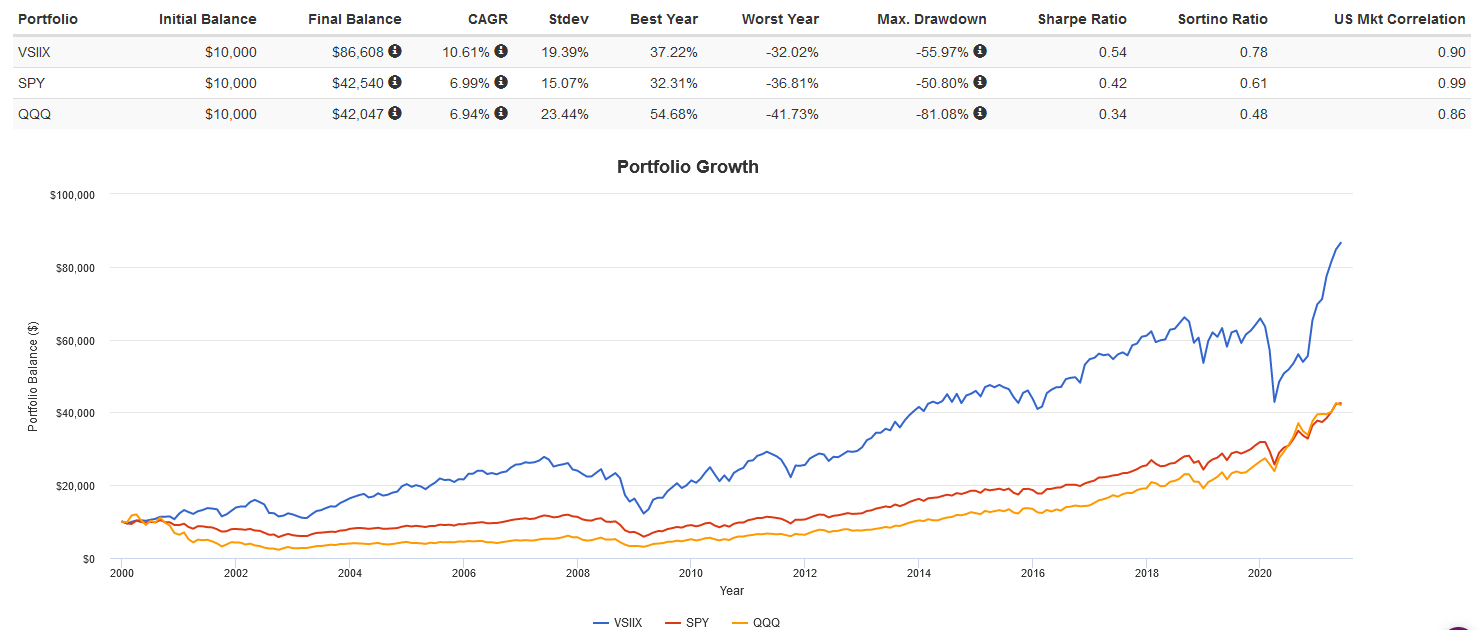

The chart above shows what putting 10K into the Vanguard Small Cap Index in 2000 would have resulted for you vs. the S&P500 and the QQQ. Again, this is not a recommendation to run out and buy the Vanguard Small Cap Value Fund!

How to fix what we’re missing?

As an advisor, I constantly go through my clients plans to make sure they are properly exposed to multiple areas of the market. Diversification expands over industries, sectors, size of the company, and a host of other factors. Making sure all of those things are being taken into consideration is paramount. Speak to your advisor, or click below to set up a time to chat.

So What?

So how does this impact all of you?

- Our portfolios aren’t perfect, what might be missing?

- Most people are overly concentrated in Large Cap, Small Cap is a missing area for most.

Stock market calendar this week:

Thursday June 10th:

Initial and continuing Jobless Claims @ 8:30AM

Federal Budget @ 2PM

Most anticipated earnings for this week