Are we in a housing bubble?

My parents recently sold their home, and although nostalgic, it was a few years later than my brother and I would have liked. They were able to take advantage of this post covid housing spike, but still sold their home for 25% less then they could have sold it for in 2008. 13 years later and they still couldn’t reach their peak value.

This has caused my own emotional response and me trying to convince my wife to sell our house because I am worried the home value will never be this high again. That is an irrational thought, and there are dozens of factors that contribute to my parent’s home value not recovering. It did start me to think if we were in a housing bubble though?

What is a bubble?

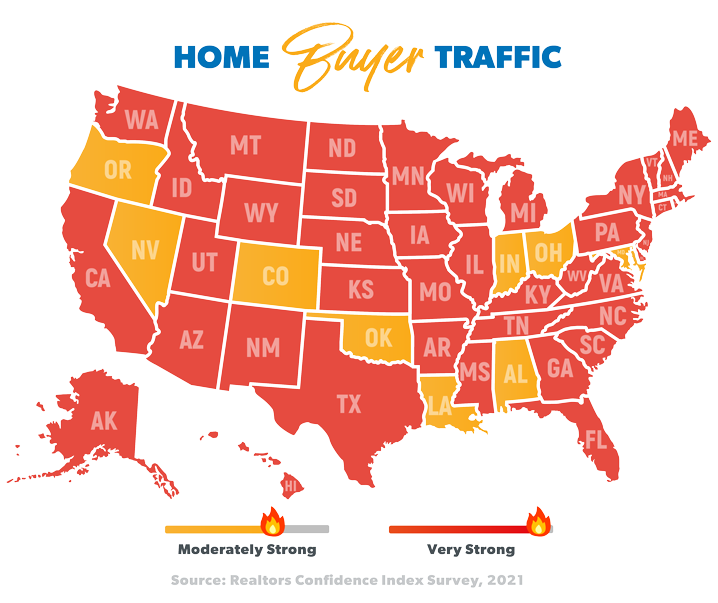

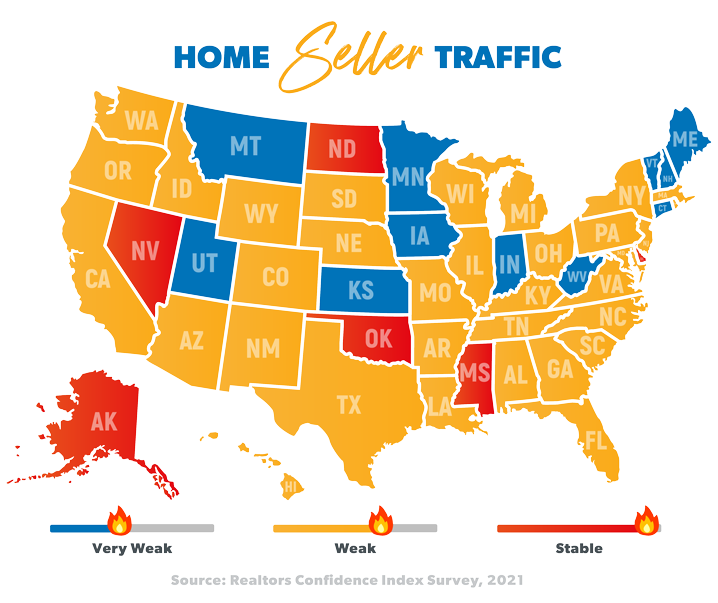

An asset bubble is when there is a run up in prices fueled by excess demand, and a lack of supply, but what truly makes it a bubble is if that demand is being caused by real factors or artificial factors. 2008 is a great example! There was certainly demand for homes, but a big factor in that demand was how easy it was to get a mortgage for people who traditionally would not have been able to get one. Predatory lending practices is not something that can sustain asset prices, so eventually that bubble burst. Anytime you have increased demand and lower supply you will see prices go up. Take a look at the charts below to see just how much demand there is, and the lack of supply we see on the market.

Where are we now?

2021 is very different than 2008. We are coming out of the Covid-19 pandemic lockdown year, and couple that with extremely low interest rates and a natural, albeit sped up move out of cities into starter, and forever homes.

The average age of a first-time homebuyer is 33 years old. So, in 2006 when the housing bubble began to pop you have to look back at 1973. From 1964 until nearly the end of the 70’s we saw birthrates stay pretty stagnant and even decline in some years. The Vietnam war has a lot to do with that. In 1973, 33 years before the housing crash we saw a decrease in birthrate from the year previous.

33 years ago today, is 1988 where we began a steady increase in birthrate right into the mid 90’s. There are more first-time home buyers right now, so demand is being created by something real, not artificial. There are more first-time home buyers behind these ones, as birth rates increased through the mid 90’s.

So, are we in a housing bubble?

I wish I had a definitive answer for you, but alas one of those might take a few years to figure out. Signals are pointing either way, but if I had to venture an opinion, I would say no. There are a number of more detailed reasons for my opinion, and listen to this week’s episode of Understanding the Power of Money where I break those reasons down further.

So What?

So how does this impact all of you?

- Lots of things go into causing a bubble, just because the housing market seems nutty, doesn’t mean were in a bubble.

- That doen’t mean we aren’t in one, you just have to look for ALL signs.

Stock market calendar this week:

Thursday June 2nd:

Initial and continuing Jobless Claims @ 8:30AM

Friday May 28th:

Nonfarm Payrolls and Unemployment Rate @ 8:30AM

Most anticipated earnings for this week