Fixed Income yields have declined rapidly in 2020 and many investors are not fully aware how little their ‘traditional’ Fixed Income portfolio likely yields. Two main forces account for this common misunderstanding. First, fixed income yields have moved dramatically and quickly in 2020 because of record low Treasury interest rates and relatively tight credit spreads. As a result, investment-grade bond yields hit all-time record lows this past week. Second, investors often confuse coupons (the interest payments received) with yield (the return actually earned on the fixed income securities). The drop in yields has dramatically undermined future fixed income returns, even though some coupons still look reasonable. (A full explanation of the difference between coupons and yields is provided at the end of this commentary.) Given the changes in market conditions, it may be timely for many investors to reevaluate their ‘traditional’ fixed income portfolios. While doing nothing is always an option, we suspect many investors are not satisfied owning a portfolio yielding approximately 1% (before any fees and expenses). We think our differentiated fixed income strategy can provide a better solution, or we can at least help you make a much more informed decision.

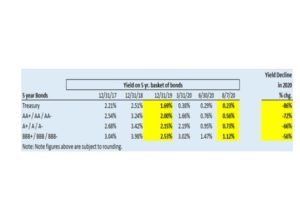

Yields on 5-year Investment Grade Bonds have declined more than 50% from 12/31/19 levels.

Source: Bloomberg. LLC. Note: Please note we quote benchmark yields which are a based on a large basket of bonds and not generally indicative of the yield of our strategies.

You are likely asking yourself, how did yields get so low? Since yield equals a Treasury’s “riskless” interest rate plus a credit spread, we analyze each component separately. The pandemic’s onset prompted investors to rush into the safety of Treasury bonds and this combined with the Federal Reserve’s actions to push down interest rates precipitously. On March 15th, the Fed cut the low end of the Federal Funds target from 1% to 0%. This was the start of a series of Fed actions to improve the functioning of markets and ensure the economy had sufficient liquidity. The Fed’s asset purchases during the Covid crisis was both more rapid and substantially larger than during the Global Financial Crisis, as is obvious from the sharp expansion of the Fed’s balance sheet from roughly $4 trillion to $7 trillion. In combination with the Covid-induced recession, the 2-year Treasury bond yield declined to approximately 0.13% versus approximately 1.57% at 12/31/19. Furthermore, the 10-year Treasury bond yield declined over 70% to 0.56% versus about 1.92% at 12/31/19. These are record low interest rates in the U.S.

Credit spreads, which reflect the difference in yield between a Treasury and corporate bond of the same maturity, have also tightened considerably after widening substantially in February and March. (As a reminder, investment-grade bond yields for the past 5 years have been driven approximately 60% by interest rates and 40% by credit spreads.) The three main drivers of credit spreads are liquidity, investor confidence, and the economic outlook. While the Fed could only do so much to impact the economic outlook, it was able to increase liquidity tremendously in the fixed income market and it was able to support investor confidence. In 2020, the Fed purchases also touched an unprecedented range of fixed income securities.

Many fixed income investors often buy bonds of very large, well-known companies, a practice I have referred to in the past as ‘Brand-name Bond Buying.” While this strategy performed well in 2020 and for the past several years, it no longer has appeal unless you are satisfied with an approximately 1% yield on a 5-year bond. Frankly, 1% may be overstating your yield if you own only the highest quality investment grade bonds, or if you own bonds that are shorter than 5 years on average.

So, what are your options besides accepting a 1% yielding fixed income portfolio? There are at least four alternative options to consider. First, investors can invest in a high yield savings account or Certificate of Deposit and earn a low, but at least, safe rate. This offers the ultimate in protection to the downside, but those rates are already quite low and they could potentially decline even further.

A second option is to take more credit risk by owning non-investment grade bonds and/or non-investment grade preferreds. This option may make sense for investors willing to stomach a bit more volatility. However, this option requires extensive credit research and a detailed understanding of the nuances of preferreds, so I would suggest hiring a professional unless you have fixed income experience.

A third option is to decrease your asset allocation to fixed income and increase your allocation to another asset class, perhaps equities. For example, AT&T stock yields far more than its bonds. This option involves more portfolio volatility, however, so it may not suit everyone. You may wish to have a thorough conversation with your financial advisor to discuss your risk tolerance, investment horizon, and return expectations.

The fourth option is to own a mix of carefully selected fixed income securities. This option is the most modest change, yet it could potentially more than double the yield as compared to a ‘traditional’ fixed income portfolio. At ACM, we construct such differentiated fixed income portfolios.

Under current market conditions, we find good value focusing on BBB- and select BBB fixed income securities. The lowest tier of investment grade, BBB-, is where we believe thorough credit research pays off the most, while allowing the investor to own investment-grade securities. We do not limit ourselves to just bonds. We also purchase select preferred stocks, which offer incremental return that we find very attractive on a risk adjusted basis. As discussed above, the bonds of the largest, most well-known companies typically provide little yield. This reflects the reality that high credit quality and general name recognition makes both professional and retail investors feel safer owning them. Less well-known companies attract less attention and may offer equally good credit metrics, yet trade at higher yields. This does not mean we have to own only small companies or very risky companies; it simply means we do the credit research to determine which companies have issued bonds we believe will provide attractive risk-adjusted returns. We also focus on a relatively small selection of positions—just 25 to 30—so that we can choose only under-appreciated fixed income securities rather than just settling for ‘average’ yields. We believe our diligent approach will allow our investors to earn yields well in excess of ‘traditional’ fixed income portfolios in a very attractive risk-adjusted manner. Regardless of your ultimate decision, reviewing your portfolio with ACM or an investment professional can enable you to evaluate alternatives to a very ‘traditional’ fixed income portfolio that is likely yielding approximately 1% or perhaps even less (before any fees and expenses).

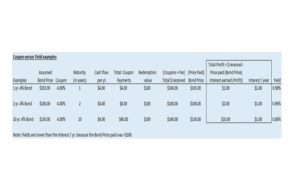

It is absolutely crucial for all fixed income investors to understand the fundamental difference between Coupon and Yield. Unless you pay par for a bond, (typically $1,000), the Coupon and Yield will be different, often several orders of magnitude different. Please see the examples in the following table to gain clarity on the difference.

Note that these calculations apply even if you bought a bond at par, but the price subsequently changed. If you bought a 4% bond at par, you were earning 4% when you bought it, regardless of its maturity date. But as time passes, the bond gets closer to maturity and its price changes, so the return you earn over its remaining lifetime also changes. You were earning 4%, but as the first example in the table shows, if there’s just one year left until maturity and the bond is currently worth $103, you are earning only 0.98% over that last year, even though the coupon still stands at 4%.

As always, please feel free to call ACM if you have any questions or require further clarification. We are always happy to help.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth