Like Sumo Wrestling, The Bigger You Are the More You Move the Needle

I write these Monday Market Updates to provide real news, without the noise, and more importantly, to educate. Each week we will look at different jargon or alphabet soup acronyms, and other subjects in finance that are confusing and overwhelming. Last week we touched on GDP, this week we are going to talk about market cap weighted and price cap weighted and that they mean.

Let’s Get Technical

Market capitalization (market cap) very simply, is the overall size of a company as determined by the stock market.

- Shares Outstanding x Stock Price = Market Cap

- This is size determined by the market alone, not a valuation of all individual assets

- In 2010 the largest S&P500 company was Exxon with a market cap of $310Billion.

- Apple moved up by $310Billion last week alone

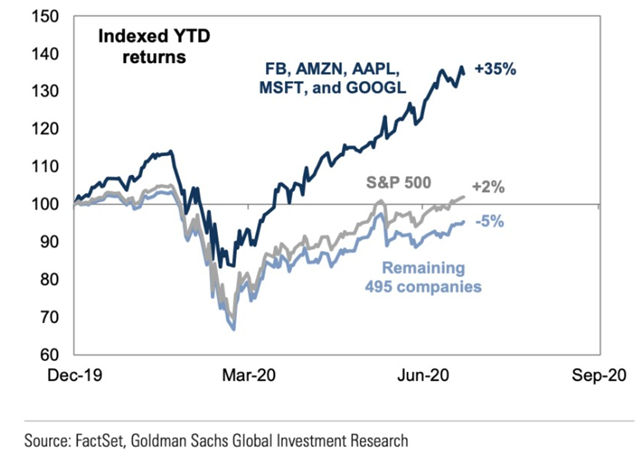

That is simple enough, but where it gets complicated is when you build an index such as the S&P500 and make the 500 constituents be represented based on their market cap.

Investors equate the performance of indexes with the performance of the overall stock market, and while that might have been true in the past, the divergence from the big and small has grown drastically.

Fine, that’s just one index, what about the Dow

This is when it gets even better! The Dow Jones Industrial Average weights its 30 constituents based on their share prices

- The higher the share price the more you move the index.

- There are days where 28 stocks can be down, but if Microsoft or Apple is up big, the entire index will be up for the day.

- 2/3rd of the Dow index is negative for the year

At the moment if we turn the television on, we are hearing about how great things are. If that’s the flavor of the week that’s selling, that’s what the news is pushing.

So……is this all going to end badly?

Don’t worry, wait for a few down days and the media will change its tune to how the market being this concentrated is going to cause a crash. On that day, doom and gloom is selling.

The market has seen this before, and although it has been quite some time since the concentration has been so high the market will chug along through this.

So What?

So how does this impact all of you?

- Education = comfort in times of market volatility

- Stop comparing your accounts to the indexes

- If I told you to put all of your money in just 5 companies you would run for the hills

What to look forward to this week

PPI Data being released Tuesday August 11th

CPI Data being released Wednesday August 12th

Initial and continued Jobless Claims released on Thursday August 13th

Retail sales for July released on Friday August 14th

Most anticipated earnings for this week

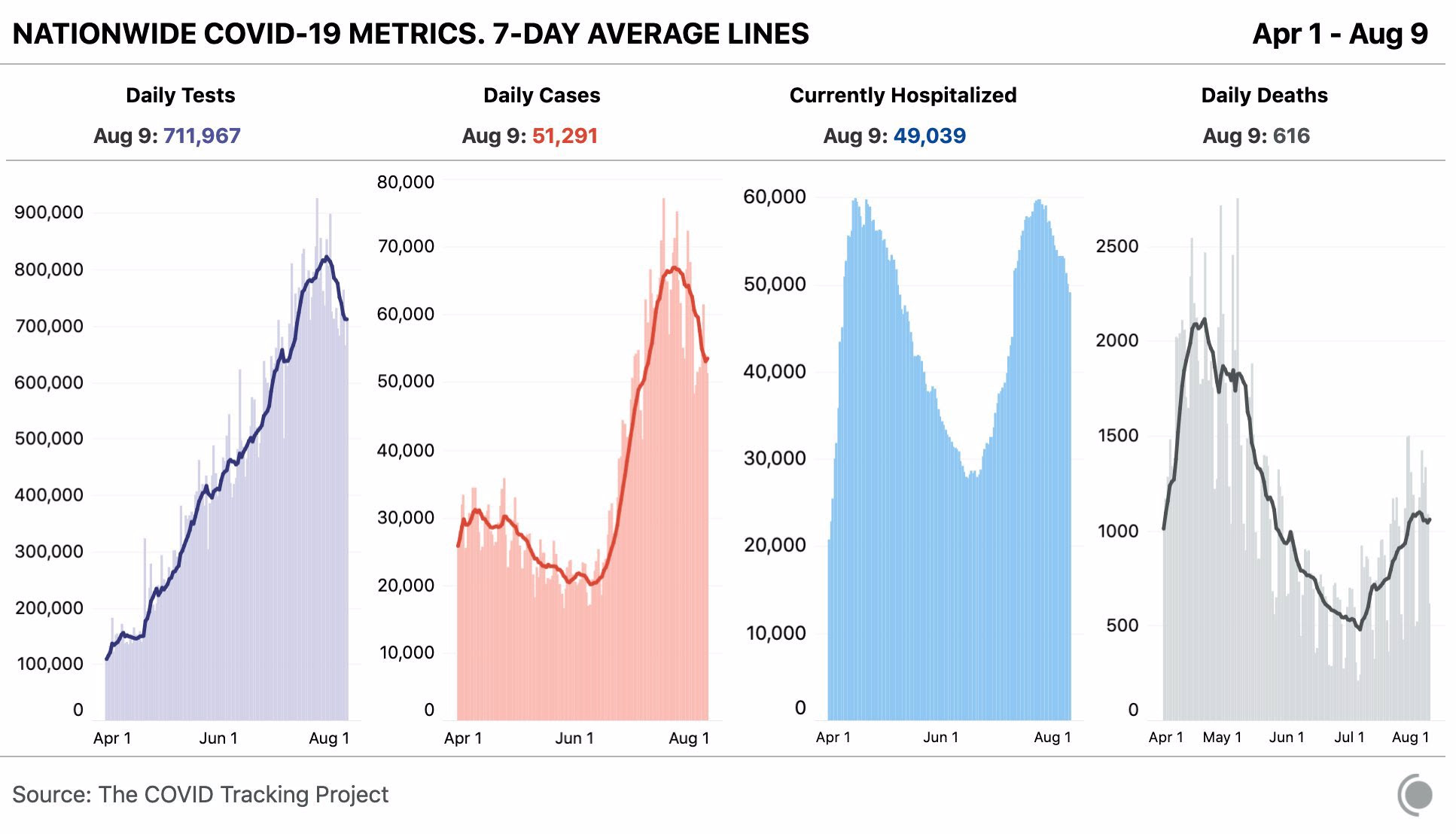

Latest Covid-19 Data