Do Fundamentals Even Matter?

Last week the Q2 GDP reading was released and showed a contraction of 32.9% in US GDP. The headline continues, but most people stop right there, and fail to see the words on an annualized basis at the end of the headline. Saying GDP contracted in Q2 by 9.5% just doesn’t sound as good, or bad if you are the news stations.

Let’s get basic for a second

Finance is a world of acronyms and lingo; meant to confuse and frustrate. Gross Domestic Product (GDP) is the total value of goods and services produced in a country over a period of time

- Looking at GDP on an annualized basis works, during normal economic times.

- Q2 of 2020 was not normal economic times (or normal in any way)

- For GDP to drop the 32.9% that the headlines mentioned, it would need to fall the same as in Q2 for both Q3 and Q4.

- We have already seen a large economic pick up in auto and home sales which makes that unlikely.

Seems like a lot gets left out when so much noise is coming in

Let’s not forget these are the preliminary Q2 GDP numbers, with a second and even a third reading coming in August and September. You want news, not noise, and that doesn’t attract viewers so a minor detail like that tends to be left out.

The Rich Get Richer

We also got earnings from three of the largest names in the S&P500 and the world. Apple, Amazon, and Facebook absolutely destroyed earnings, all beating on the top and bottom line. This is just continuing the divergence in performance between the mega cap tech names and the rest of the index.

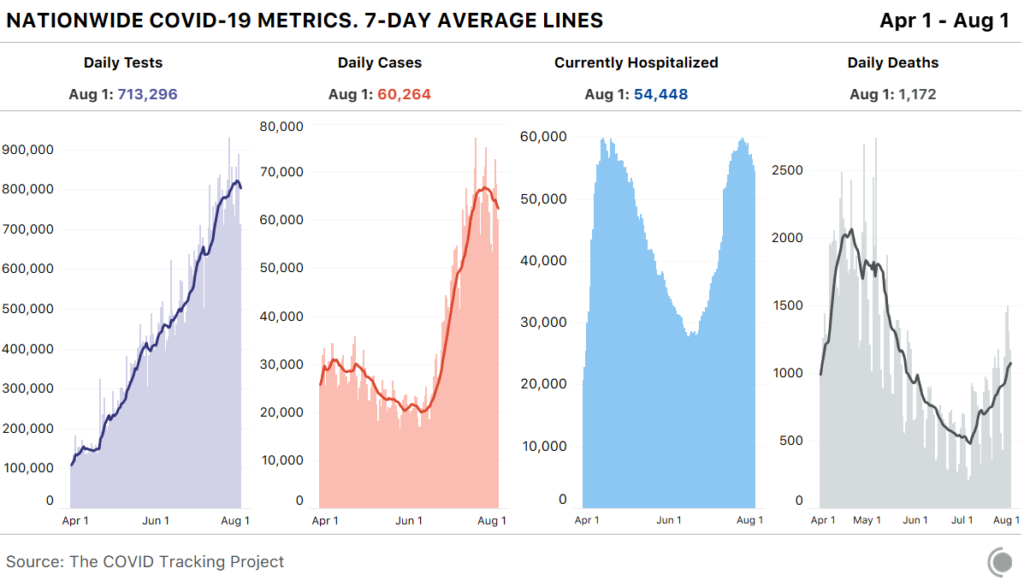

National Covid-19 Data ending August 1st, 2020

Most anticipated earnings for this week