Taxes, Taxes, Taxes

Do you remember your first job? Mine was at CVS, stocking shelves at first and eventually as a cashier. I remember coming home with my first pay check, absolutely beaming. I opened it with my father, and promptly asked “what the heck is FICA and why is it taking all of my money?” On that pay check I probably paid 10% in taxes total, but somehow ingrained in me was the feeling that I was paying too much.

How quickly we forget

Do you think taxes are going up or down in the future?

I know it’s easy to say how much we hate paying taxes and how we are all overtaxed, but many of us forget the times when the top marginal tax rate was 70% or more. By the way, this wasn’t that long ago, most of you reading today were alive for those rates.

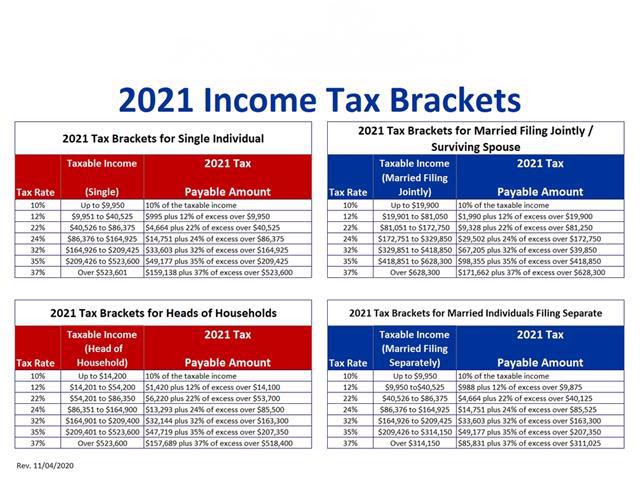

The only way the government gets money is through taxes so when you spend money you don’t have you are indirectly telling me that at some point you are going to come asking for more. Take a look at the 2021 IRS Income Tax Brackets and Phaseouts below.

Time for tax planning

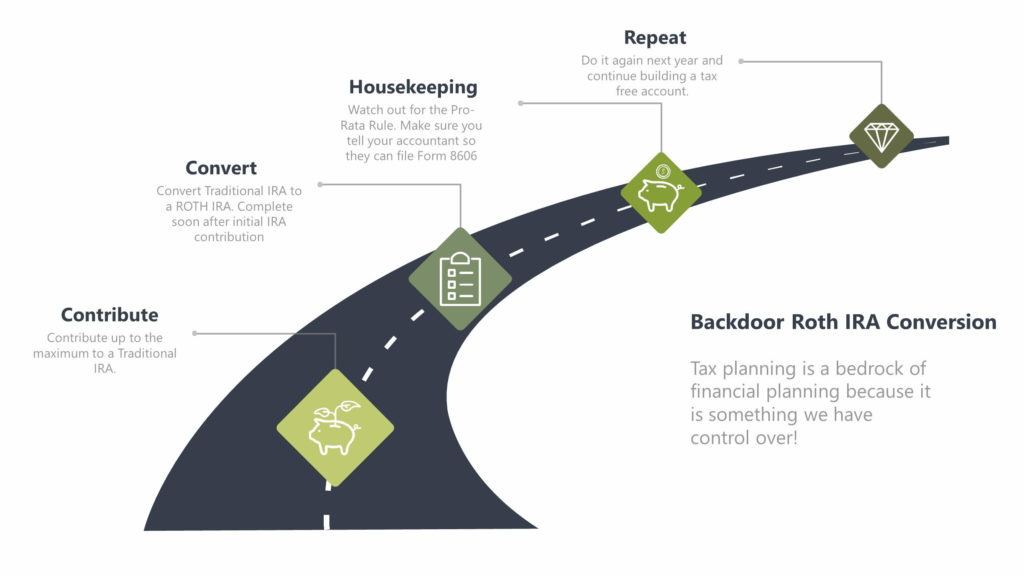

There are 4 pieces that contribute to the success of your financial plan. Taxes, costs, emotions, and market returns. We only have control over the first three. Tax planning is one of the bedrocks of financial planning but most people want to be tax efficient in December and don’t give it a second thought in June. I want you to always be tax efficient.

The myth of tax efficiency

When people discuss tax planning, or tax efficiency it is normally within the context of saving on their taxes in that specific year. Yes, this is certainly important and we address it by making sure we are maxing out our employer sponsored 401K plans etc. but what about trying to think about your taxes over the next 5 years, or even tax planning for the next phase of your life?

Remember when I mentioned how taxes are historically low, but our government keeps spending money it doesn’t have? That is a recipe for higher taxes, and it might not be today or tomorrow, but it’s coming. With that in mind a strategy that is severely under-utilized, especially for younger investors, is the backdoor Roth IRA conversion.

The backdoor Roth IRA conversion can be broken down into 5 steps.

- Step 1. Know the rules

- Step 2. Open a traditional IRA and a ROTH IRA

- Step 3. Fund the Traditional IRA up to the limit, in 2021 it is 6K or 7K if you are over the age of 50

- This will be a non-deductible contribution, meaning this 6K will not cause a reduction in your taxable income for the year

- Step 4. Once you have funded the traditional IRA, convert the full 6K to a Roth IRA quickly after.

- Step 5. Make sure you tell your accountant that you have done this and remind them that they will need to file Form 8606.

So What?

So how does this impact all of you?

- Start being tax efficient now, not just at the end of the year.

- Tax efficiency is both saving money now, and preparing for the future.

Stock market calendar this week:

Wednesday February 24th:

Fed Chair Jerome Powell Testifies @ 10:00AM

Thursday February 25th

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

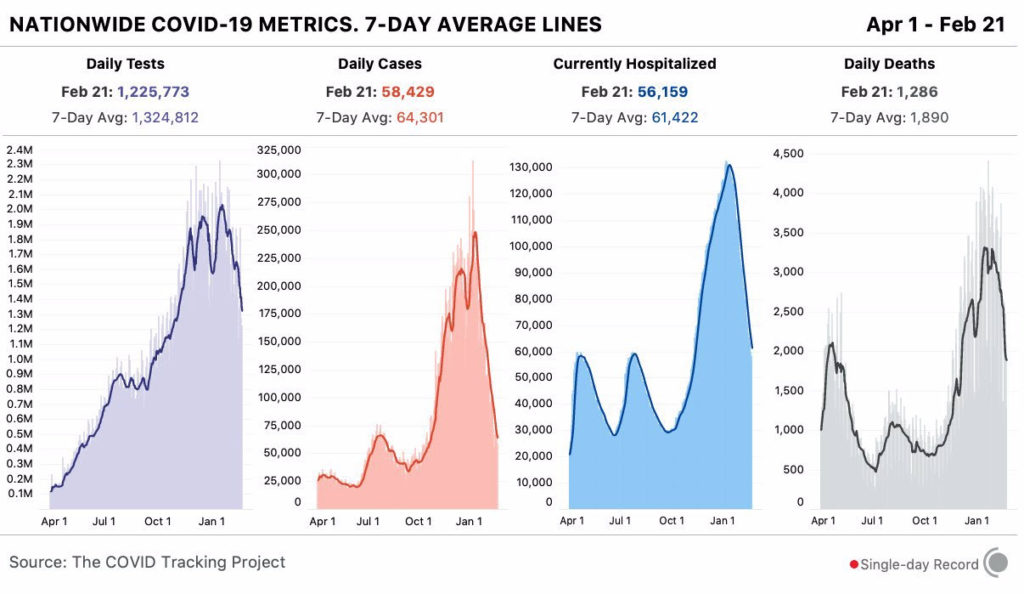

Latest Covid-19 Data