Vaccine + Stimulus + Pent up demand = Demand exceeding Supply

This morning we awoke to welcome news from Moderna that their Covid-19 vaccine is 94% effective which is great news for the entire world. Within a matter of weeks, we may have 2 viable vaccinations entering the market, ready for our frontline workers, and most vulnerable of the population. The reports are that by next Summer we should see a mass rollout of the vaccine across the general population. This is wonderful news, but lets see what that could mean for us in the short term, and how it creates the single greatest risk we all face going forward.

The biggest risk we all face

Vaccine + Stimulus + Pent up demand = Demand exceeding supply. This doesn’t seem like the worst thing to happen, but when demand exceeds supply it causes inflation, and not just some inflation but hyperinflation. If you were born pre 1970 you remember what hyperinflation was like. My parents used to tell me a story about how their first mortgage interest rate was 13%, their CDs were paying 13% and inflation was 13%. I discuss it in Episode 1 of my podcast Understanding the Power of Money.

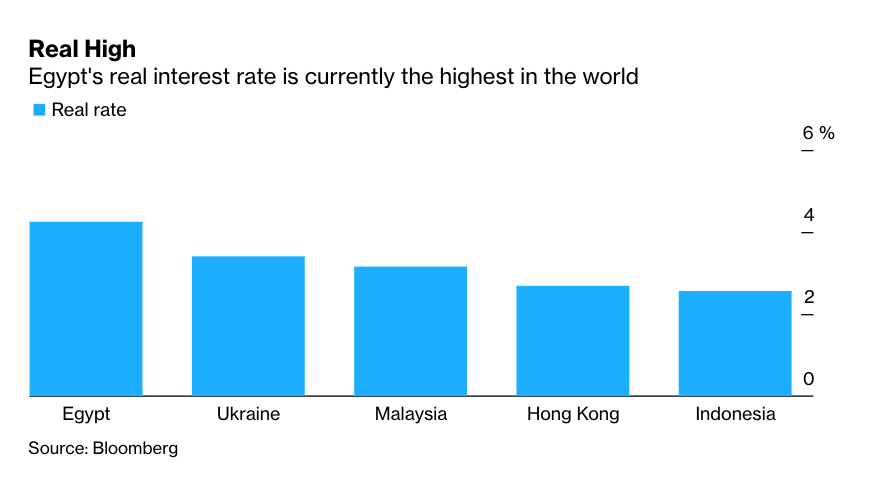

Inflation isn’t the worst thing, but couple that with historically low interest rates, that all indications have been given will stay low for the foreseeable future and we start to have an issue. Check out the chart below to see the country with the highest REAL interest rate.

You read that chart correctly, right now in the entire world Egypt has the highest interest rate at about 4%. Do any of you want to go put your cash in an Egyptian bank to earn more interest? I am going to go out on a limb and say most of you probably would prefer to not do that.

So where do we put our money?

Since the housing/bank/jobs crisis of 2008/2009 interest rates have been kept low so that Americans had no place to put their money other than the stock market. Now, if you are my client you know that regardless of interest rate, I am always advocating for a 6+month emergency fund in cash. Not earning anything on that money doesn’t matter, because knowing you have a safety net lets you not act as emotionally with the money you have exposed to the stock market.

Vaccine + Stimulus + Pent up Demand = Booming stock market

This could lend itself to be true, but is too simplistic of a viewpoint to base a financial plan, or an investment thesis on. The stage is set for good economic news, but what happens when demand for a good outpaces supply. The price of that good is going to increase, and if it increases and you are on a fixed income budget how do you prepare for that increase? Earning more interest is certainly not the solution as we discussed above, so what do we do?

Age matters

I know this isn’t politically correct to say, but when it comes to financial planning and portfolio management, age matters! If you are getting close to retirement, or are in retirement, building up a cash bucket in anticipation of future inflation is the best direction to go in. Is it mathematically the best solution? No, but sometimes the numbers and your emotions don’t line up. When on a fixed income budget, sleeping at night is far more valuable than the extra 1% you might earn by looking for bonds or some other cash alternative.

If you are younger, now is the time to make sure you build your emergency fund up to between 9-12 months of living expenses. If it seems high, it’s because traditional financial pundits, books, and advisors all want you to be investing as much cash as possible. Mathematically, that is sound advice, but what happens when your 9-year-old needs braces and you have the bare minimum in the bank?

Cash is always king

Cash is king is a saying we all hear, but only during market corrections and economic recessions. During times of low interest rates and a rising stock market the idea that cash is kind is normally met with some disdain, but what cash does is allow you to maintain discipline within your financial plan. Your emotions won’t be driven from fear to panic, and discipline = freedom.

Discipline = Freedom

I talk about this concept all the time, check out episode 2 of Understanding the Power of Money where I break down exactly what Discipline = Freedom means for you in your financial life, and how I use that mantra in my own life, and how I’ve used it for the past 15 years guiding my clients to success.

So What?

So how does this impact all of you?

- Cash is always king, because it gives us comfort

- Global demand rising faster than global supply is going to lead to inflation

- Financial plans are designed to manage emotions first and foremost

Stock market calendar this week:

Thursday November 19th, 2020

Initial and Continuing Jobless Claims @ 8:30AM

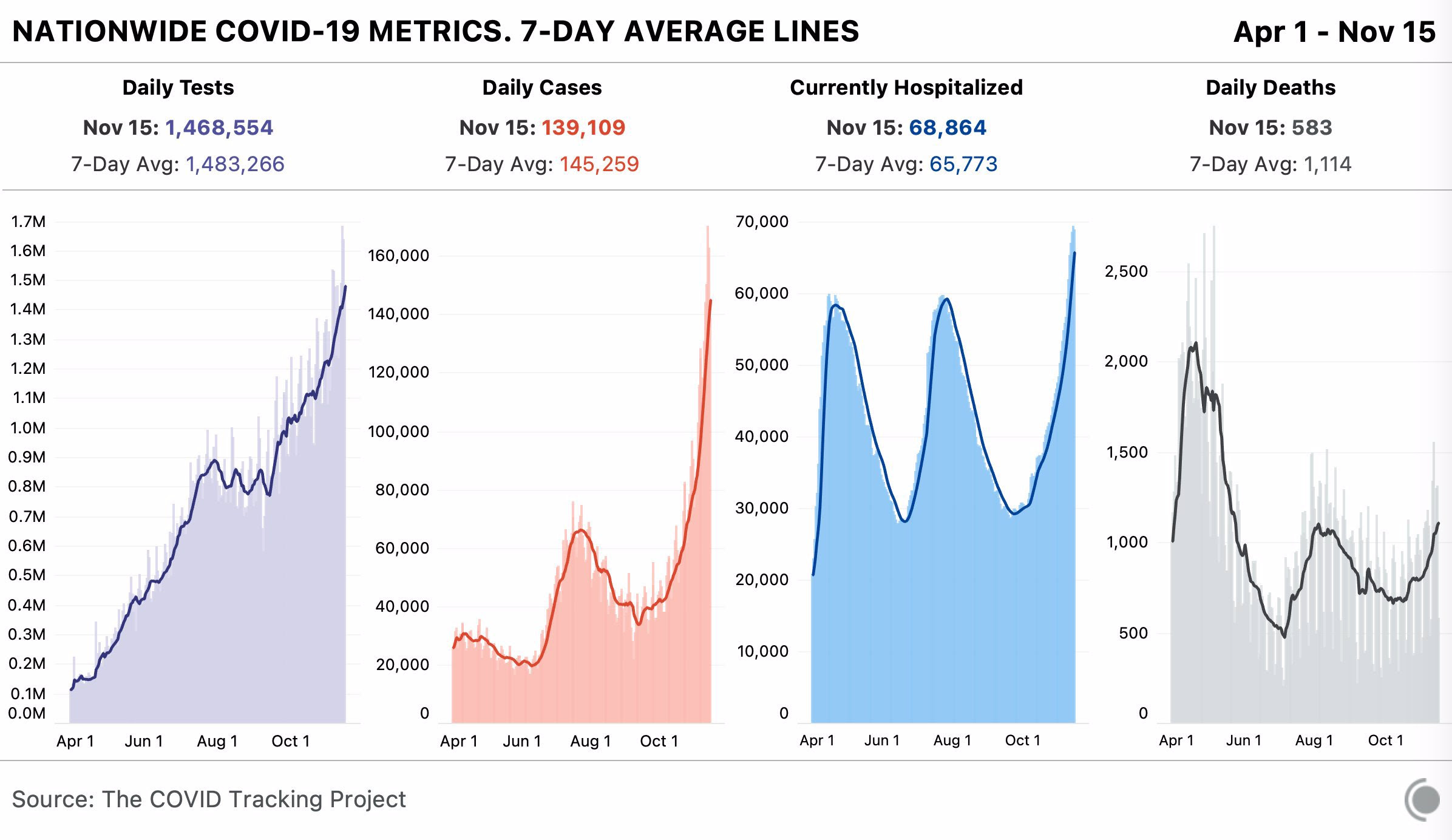

Latest Covid-19 Data