Reasonable…..or Rational?

First, let me start with a warm Happy Thanksgiving! This is one of my favorite holidays, and it has everything to do with pie!

My wife and I took our kids, AJ and Priya, to a skate park this weekend as both have taken up skateboarding and wanted to try it. AJ was fearless, dropping in off of ramps that looked too big, and although he wiped out a few times, AJ picked himself back up and kept trying.

On the car ride home, I asked him why he wasn’t afraid of falling while Skateboarding but was afraid of taking hits on the football field. He is fully padded up for both activities so I couldn’t fully understand. His answer was perfect!

“The ground can’t hit back daddy!”

I wanted to explain to him how that wasn’t rational because he is wearing pads for both activities and concrete is a lot harder than a 7 yr. old trying to tackle you. It might not have been rational thinking, but it sure was reasonable, and it got me thinking about how difficult it is to make rational investing decisions because most just don’t seem reasonable.

Stay the course, no matter what!

In 2008 research came out of Yale University making the argument that young savers should use leverage, 2 to 1 to be exact, to supercharge their retirement savings. So, for every dollar you invest, you should borrow 2 more dollars to invest. As time goes on you slowly reduce the leverage as your risk tolerance and ability to take on more risk decreases. Perfectly rational, and frankly in a spreadsheet is a genius idea. Except one thing.

A 50% drop in the market will completely wipe you out in this scenario, and that’s okay as long as the very next day, you pick yourself up and continue on with your plan, investing for retirement at 2 to 1 leverage. It works on paper and is a completely rational strategy to employ. Rational, yes. Reasonable? Not a chance.

Reasonable over rational

No reasonable person can watch their entire retirement savings get wiped out, and get back up the next day and keep moving forward with the plan. It just isn’t how humans are built, and although I can show you the math as to why this plan will work, sometimes just because something is rational does not make it reasonable.

We live in a world where from the first second you turn on the television, we are being inundated with programming designed to push our buttons and elicit the greatest emotional response possible. Making rational decisions becomes nearly impossible at this point, and that’s okay. We should be aiming for reasonable over rational pretty much every single time.

Who wants to day trade?

I am one of the few CFP®s that is an advocate for people having their own trading account if they like to day trade or like looking for the next hot stock. Rationally, its easy to make the case that day trading is just an excuse to lose your money. Like playing blackjack in Vegas, you might win a few times, but the odds always favor the house.

Reasonably though, if having a “fun” account that you get to “play” with scratches enough of an itch that it allows you to leave the rest of your assets alone to follow the carefully laid out plan you have created then it serves a great purpose and has much more long term impact than we initially see on the surface.

Rational or reasonable in the current world

I want to share a statistical breakdown of your odds of making money in the US Stock market over various periods of time.

1 day = 50/50 chance of making money

1 year = 68% chance of making money

10 Years = 88% chance of making money

20 years = 100% chance of making money (so far)

Thinking reasonably over rationally to keep yourself in the game has a clear advantage for your life and financial plan. The job of any good CFP® is to layout both the reasonable and rational choices in front of you, and help you walk the line between which choice makes the most sense for you, not just in real outcome, but in emotional outcome. It is why I advocate for everyone to have 9-12 months of cash in the bank even though interest rates are virtually 0. As many have heard me say before, what good is an extra percent or two if you can’t sleep at night?

So What?

So how does this impact all of you?

- Strive for reasonable not always rational

- Taking steps that let you leave your plan alone will make long term success more likely

- Financial plans are designed to manage emotions first and foremost

Stock market calendar this week:

Wednesday November 25th, 2020

Initial and Continuing Jobless Claims @ 8:30AM

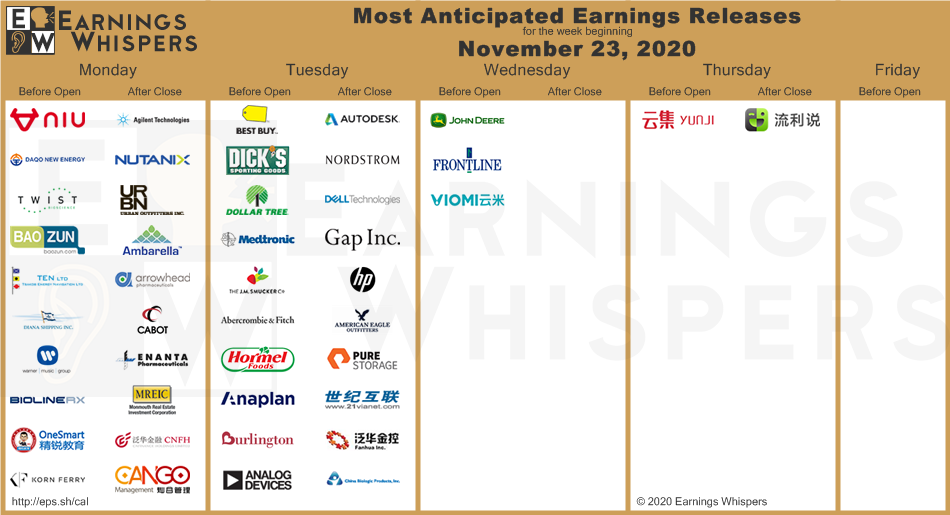

Most anticipated earnings for this week

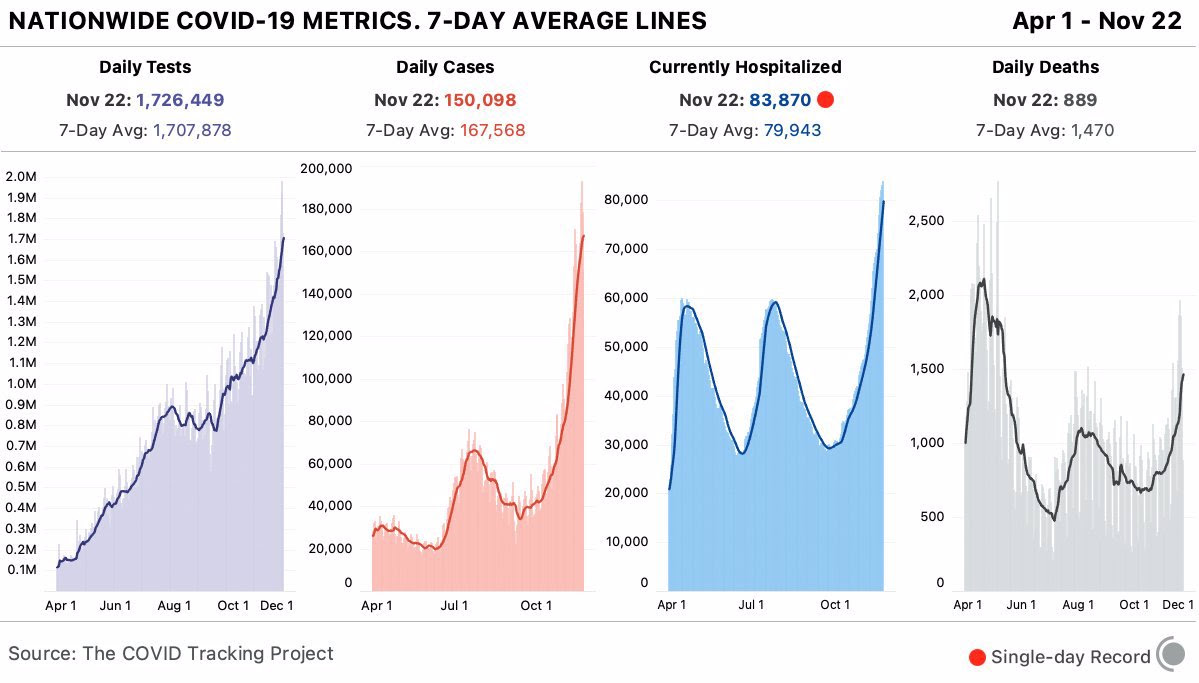

Latest Covid-19 Data