by Jeff Deiss

CFP, AEP, Wealth Advisor

Absent any last-minute changes from Congress, below are a few year-end tax reminders. This list is not exhaustive and a conversation with your tax advisor is always recommended.

- Harvest gains and losses before year-end, which is a classic year-end planning technique and one that we employ regularly at year-end for our clients with taxable investment accounts. If you have questions on your account or have considerations outside of your ACM accounts, then please contact your ACM Wealth Advisor.

- Take Required Minimum Distributions (RMDs) from your qualified retirement accounts. This applies to those over age 70.5 or if younger and or has an Inherited IRA. The RMD amount may be calculated on your monthly statement depending on the custodian; however, these calculations do not take into consideration any retirement accounts (IRAs) held elsewhere. RMDs for 2018 are based on the total value of all of your qualified accounts as of 12/31/18, regardless of how many you have or where they are held.

If you have to take an RMD, but you don’t actually need the proceeds (or the taxable income an RMD generates), then consider using some portion or all of your RMD to make a qualified charitable deduction (QCD). For taxpayers 70.5 years old or older, funds transferred directly from your IRA, Inherited IRA, or even an inactive SEP or Simple IRA plan to a qualified charity will not count as taxable income and will count toward satisfying your required minimum distribution. Ideally, the check should be deposited by the charity by December 31st. Click here for more info or reach out to us if you have questions.

- Contribute to tax-qualified accounts, such as your 401(k). Pre-tax contributions to your company-sponsored retirement plan reduce your current taxable income. Contributions limits for 2019 are capped at $19,000 if you are less than 50 years old and $25,000 if you are 50 or older. We will follow up with more information on this topic next week.

- Use your Flexible Spending Account (FSA) balance before you lose it. Not to be confused with Healthcare Spending Accounts (HSAs), FSAs can help you spend less money on health care while you are working, but only if you use all of the money you’ve contributed by year-end. In other words, FSA funds are “use it or lose it” and any unused portion after the end of the year is no longer yours. If you have any FSA funds remaining, then check the IRS list of approved medical expenses and check with your employer to see if your employer offers either a rollover option (which allows you to move up to $500 to next year’s balance) or a grace period (which provides up to 2 ½ months past the end of the year to use your funds). Your FSA likely has one of these options, but cannot have both under IRS rules.

For those contributing to an HSA, you still have until April 15, 2019 to make contributions for 2018. There is no extension beyond April 15.

- Use your annual gift tax exclusion, which is one of the easiest ways to maximize tax-efficient wealth transfer to the next generation and others. The annual exclusion for 2018 allows individuals to gift up to $15,000 and married couples to gift up to $30,000 to as many individuals as they wish without triggering any gift or generation-skipping transfer tax. Any amounts exceeding the annual exclusion amount are taxable gifts, however, these amounts can be applied against your individual lifetime gift tax exclusion, which is $11,400,000 per individual for $22,360,000 per married couple for 2019. The exemption amount increases next year, to $11,580,000 per individual or $23,160,000 per couple, however, the above annual exclusion amounts ($15,000/$30,000) remain the same.

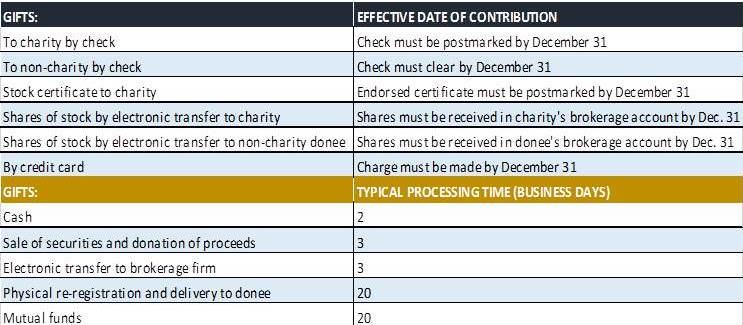

- Charitable deductions remain valuable in the current income tax rate environment, depending on your overall level of itemized deductions. You can donate by check, or by transferring securities (particularly those that have appreciated) or other assets or by using your RMDs (qualified charitable deduction) or by using a Donor-Advised-Fund. If you are unsure of the differences between these options, then click here for a review. It is advisable to review how much and to whom you are planning to give and to time your gifts properly.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth