by Joseph Pecoraro

When is the deadline?

The deadline for a contribution to a 2019 traditional or Roth IRA is the same as the tax-filing deadline—April 15. If you wait until April 15 to make the contribution, you can also make a contribution for 2020 at the same time or wait until this time next year.

How much can I contribute?

For 2019, eligible taxpayers age 49 or younger can contribute up to $6,000 to either a traditional or Roth IRA. If you are over the age of 50, you are given the opportunity to contribute an additional $1,000 for a total of $7,000. That may seem like a substantial sum of money, but don’t forget that you may also get a tax deduction for contributing to a traditional IRA, if you’re eligible, and keep in mind how much your contribution could grow over time. One $6,000 contribution could grow to almost $64,000 in 35 years, assuming a 7% annual return.

For 2020, the contribution limits have not increased.

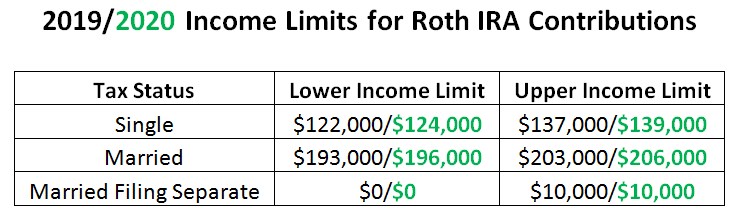

Roth IRA Contribution Limits

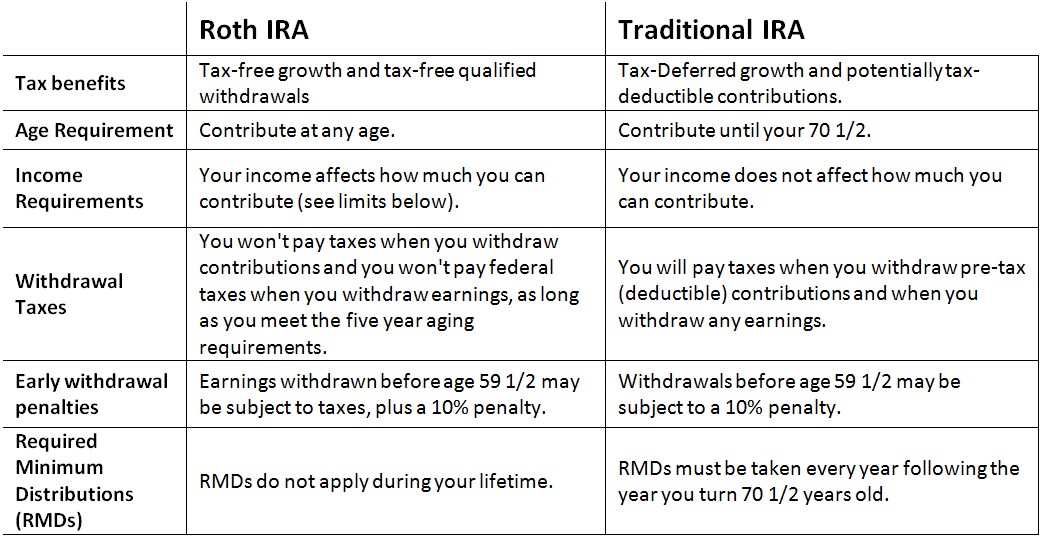

With a Roth IRA, your contribution isn’t tax-deductible the year you make it, but your money can grow tax free and your withdrawals are tax free in retirement, provided that you are 59 ½ and have held it for at least five years (or you are disabled or using up to $10,000 for a first-time home purchase). Contributions to a Roth IRA are allowed if you meet the following income limits, meaning that you can contribute the full amount if you are below these income limits, your contribution gets reduced if your income is between the lower and upper limits and you can’t contribute if your income exceeds the upper limit.

If your income exceeds the above limits for 2019 or 2020 and you cannot contribute to a Roth IRA, then you can still contribute to a traditional IRA.

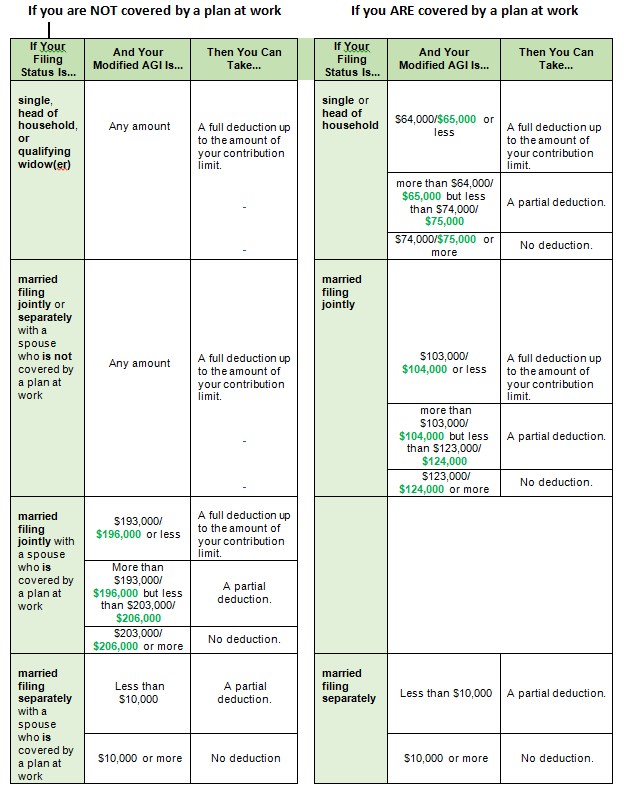

Traditional IRA Limits

With a traditional IRA, your contribution may reduce your taxable income and, in turn, your 2019 or 2020 taxes. Eligibility for a tax deduction depends on your tax status and income as follows:

Remember, even if you cannot deduct your contribution, you can still contribute to a traditional IRA. You can have both an IRA (traditional or Roth) and a workplace retirement savings plan like a 401(k) or 403(b). Traditional IRA contributions may not be fully tax-deductible if you are covered by a workplace plan (as per the income eligibility limits in the preceding chart). Or you can contribute to a Roth IRA, even if you have contributed to your workplace plan, as long as you meet the income eligibility requirements listed above.

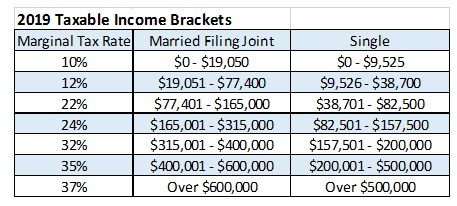

To estimate your tax savings on a traditional IRA contribution, multiply the amount you contribute by your marginal tax rate (below). That’s generally how much a traditional IRA contribution may reduce your federal income tax for the current year.

For instance, a person with a 22% marginal tax rate in 2019 he/she would save $1,320 in taxes on a contribution of $6,000. Keep in mind that this is an estimate.

Spousal IRA

A great benefit many people over look is a spousal IRA. If your spouse doesn’t work, he or she can have a spousal IRA. This allows non-wage-earning spouses to contribute to their own traditional or Roth IRA, provided the other spouse is working and the couple files a joint federal income tax return. This means eligible married spouses can each contribute up to $6,000 for the 2019 and 2020 tax year to their respective IRAs (traditional and Roth combined) or $7,000 if you are over 50.

Making a decision

Should you contribute to a traditional or Roth IRA, or both? For many people, the answer comes down to a simple question: Do you think you’ll be better off paying taxes now or later?

Contributions to a traditional IRA may help lower your taxable income today, if you are eligible, giving you more money in your pocket.

With Roth IRA contributions, you pay taxes upfront, but if you expect your tax rate in retirement to be higher than your current rate, a Roth IRA’s tax-free withdrawals might make it the better choice. That’s because withdrawals from a traditional IRA are taxable, and if your tax rates are higher in retirement than when you made the contribution, you will pay higher taxes on the money.

Roth IRAs also have additional advantages that go beyond taxes. Since you don’t need to take RMDs with a Roth and it can be bequeathed to your heirs’ income tax-free, it can be a useful estate planning tool.

If you are not eligible to contribute to a Roth IRA because your income is too high, then you can convert a traditional IRA or 401(k) to a Roth IRA. A Roth conversion is not subject to any income limits. You will need to pay income taxes on the conversion in the year you convert for any pre-tax contributions and/or earnings. Your after-tax (nonqualified) contributions will not be taxed.

Having it both ways

It may be appropriate to contribute to both a traditional and a Roth IRA— if you can. Doing so will give you taxable and tax-free withdrawal options in retirement. We like to call this tax diversification, and it’s generally a smart strategy when you’re unsure what your tax picture will look like in retirement. Just remember that you can contribute only $6,000 (or $7,000 if you are age 50 or older) in total for 2018 to any traditional and Roth IRAs you have.

Upon retirement, with a combination of traditional and Roth IRA savings, you could take distributions from your traditional IRA until you reach the top of your income tax bracket, and then withdraw whatever you need beyond that amount from a Roth IRA, which is tax-free.

On the other hand, taxes in retirement may not be the whole story. Reducing your current taxable income through traditional IRA contributions may also be advantageous for other reasons, such as qualifying for student financial aid.

Investing an IRA contribution

Many people make a last-minute IRA contribution just before the April tax deadline and put it into a money market fund. Then they never go back and choose a growth-oriented investment. This is generally not ideal. If you are not eligible for a current income tax deduction, then the primary benefit of any IRA is the ability to defer income taxes on its growth over time. One of the best ways to give the money a chance to grow over the long term is by investing in equity-oriented investments. Of course, that means getting used to riding the ups and downs of the market.

We hope that this information may be helpful to you, or to a family member or a friend. If you have any questions, please don’t hesitate to reach out to your ACM Wealth Advisor.

IMPORTANT NOTICE AND DISCLOSURE

The information and material contained in this communication is confidential and intended for the recipient addressee named. If you are not the intended recipient please delete the message and notify the sender immediately.

Advisors Capital Management, LLC is an Investment Adviser registered with the Securities and Exchange Commission. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developmentsmentioned. As a precautionary measure, we cannot rely on e-mail requests to authorize, direct or effect the purchase or sale of any security, wire transfer, or to affect any other transactions. Such requests, orders, or other instructions sent by email should be confirmed verbally, or by written instructions faxed to 201-857-4099 prior to their anticipated execution. We are unable to ensure email sent to you from us, or sent from you to us will be received. Please contact us at 845-652-3449 if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend you compare any account reports from Advisors Capital Management, LLC with the account statements from your Custodian. Please notify us if you do not receive statements from your Custodian on at least a quarterly basis. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.