by Jeff Deiss, CFP

CFP, AEP, Wealth Advisor

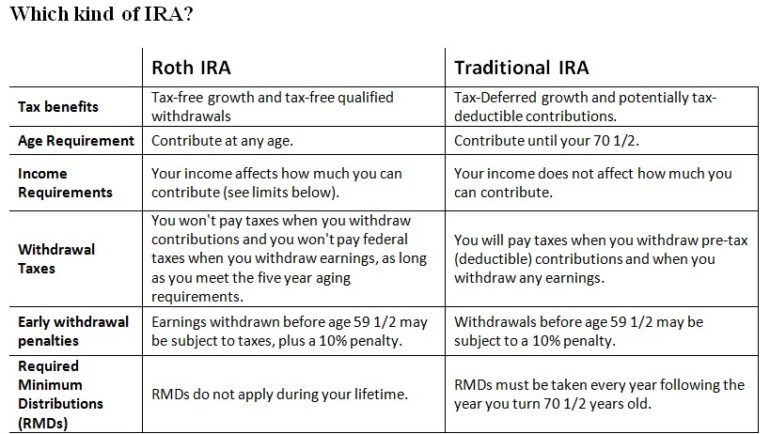

The topic of IRAs can be confusing and we typically get questions this time of year on IRA contributions amounts and limits and deadlines. The deadline for contributions to a 2020 traditional or Roth IRA contribution is the same as the tax-filing deadline—April 15.

Eligible taxpayers can contribute up to $6,000 to either a traditional or Roth IRA, or $7,000 if they have reached age 50, for 2020 and 2021.That may seem like a substantial sum of money, but don’t forget that you may also get a tax deduction for contributing to a traditional IRA, if you’re eligible, and keep in mind how much your contribution could grow over time. One $6,000 contribution could grow to almost $64,000 in 35 years, assuming a 7% annual return.

With a Roth IRA, your contribution isn’t tax deductible the year you make it, but your money can grow tax free and your withdrawals are tax free in retirement, provided that you are 59 ½ and have held it for at least five years (or you are disabled or using up to $10,000 for a first-time home purchase). Contributions to a Roth IRA are allowed if you meet the following income limits, meaning that you can contribute the full amount if you are below these income limits, your contribution gets reduced if your income is between the lower and upper limits and you can’t contribute if your income exceeds the upper limit.

| 2020/2021 Income Limits for Roth IRA Contributions |

| Tax Status | Lower Income Limit | Upper Income Limit |

| Single | $124,000/$125,000 | $139,000/$140,000 |

| Married | $196,000/$198,000 | $206,000/$208,000 |

| Married Filing Separate | $0/$0 | $10,000 /$10,000 |

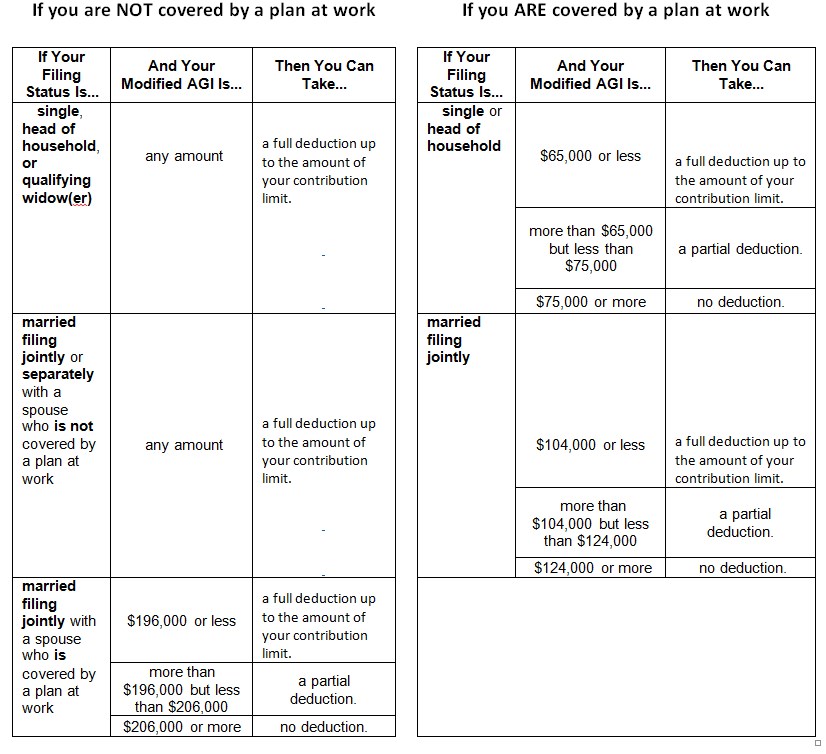

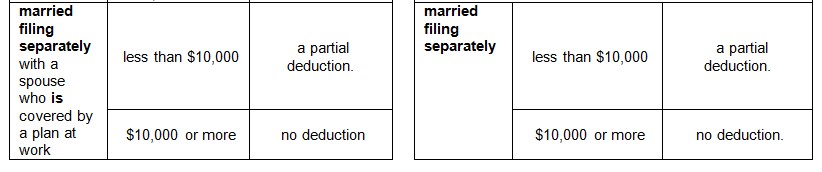

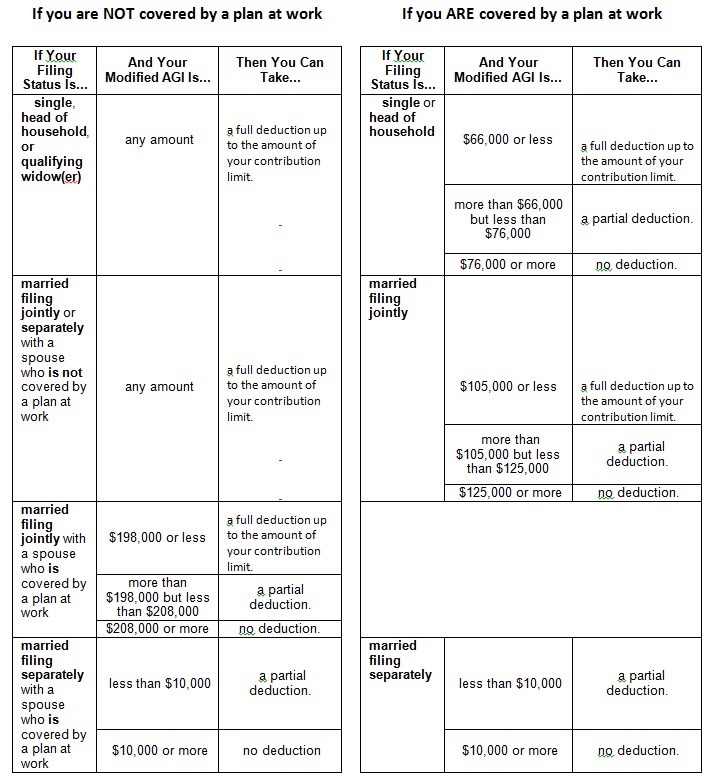

If your income exceeds the above limits for 2020 or 2021 and you cannot contribute to a Roth IRA, then you can still contribute to a traditional IRA. With a traditional IRA, your contribution may reduce your taxable income and, in turn, your taxes. Eligibility for a tax deduction for the 2020 tax year depends on your tax status and income as follows:

Eligibility for a tax deduction for the 2021 tax year depends on your tax status and income as follows:

Remember, even if you cannot deduct your contribution, you can still contribute to a traditional IRA. You can have both an IRA (traditional or Roth) and a workplace retirement savings plan like a 401(k) or 403(b). Traditional IRA contributions may not be fully tax-deductible if you are covered by a workplace plan(as per the income eligibility limits in the preceding charts).Or you can contribute to a Roth IRA, even if you have contributed to your workplace plan, as long as you meet the income eligibility requirements on Page 1.

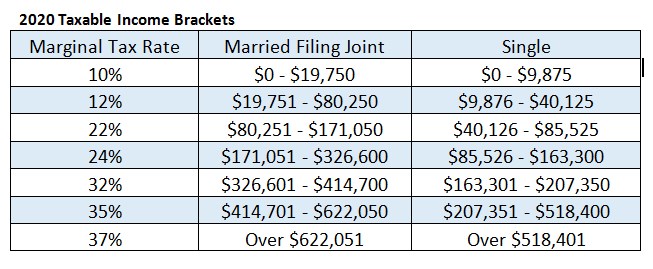

To estimate your tax savings on a traditional IRA contribution, multiply the amount you contribute by your marginal tax rate (below). That’s generally how much a traditional IRA contribution may reduce your federal income tax for the current year.

For instance, a person with a 22% marginal tax rate would save $1,320 in taxes on a contribution of $6,000. Keep in mind that this an estimate.

Also, if your spouse doesn’t work, he or she can have a spousal IRA. This allows non-wage-earning spouses to contribute to their own traditional or Roth IRA, provided the other spouse is working and the couple files a joint federal income tax return. This means eligible married spouses can each contribute up to $6,000 for the 2019 tax year to their respective IRAs (traditional and Roth combined) or $7,000 if you are over 50.

Making a decision

Should you contribute to a traditional or Roth IRA, or both? For many people, the answer comes down to a simple question: Do you think you’ll be better off paying taxes now or later?

Contributions to a traditional IRA may help lower your taxable income today, if you are eligible, giving you more money in your pocket.

With Roth IRA contributions, you pay taxes up front, but if you expect your tax rate in retirement to be higher than your current rate, a Roth IRA’s tax-free withdrawals might make it the better choice. That’s because withdrawals from a traditional IRA are taxable, and if your tax rates are higher in retirement than when you made the contribution, you will pay higher taxes on the money.

Roth IRAs also have additional advantages that go beyond taxes. Because you don’t need to take RMDs

And if you are not eligible to contribute to a Roth IRA because your income is too high, then you can convert a traditional IRA or 401(k) to a Roth IRA. A Roth conversion is not subject to any income limits. You will need to pay income taxes on the conversion in the year you convert for any pre-tax contributions and/or earnings. Your after-tax (nonqualified) contributions will not be taxed.

Having it both ways

It may be appropriate to contribute to both a traditional and a Roth IRA— if you can. Doing so will give you taxable and tax-free withdrawal options in retirement. We like to call this tax diversification, and it’s generally a smart strategy when you’re unsure what your tax picture will look like in retirement. Just remember that you can contribute only $6,000 (or $7,000 if you are age 50 or older) in total for 2020 or 2021to any traditional and Roth IRAs you have.

Upon retirement, with a combination of traditional and Roth IRA savings, you could take distributions from your traditional IRA until you reach the top of your income tax bracket, and then withdraw whatever you need beyond that amount from a Roth IRA, which is tax free.

On the other hand, taxes in retirement may not be the whole story. Reducing your current taxable income through traditional IRA contributions may also be advantageous for other reasons, such as qualifying for student financial aid.

Investing an IRA contribution

Many people make a last minute IRA contribution just before the April tax deadline, and put it into a money market fund. Then they never go back and choose a growth-oriented investment. This is generally not ideal. If you are not eligible for a current income tax deduction, then the primary benefit of any IRA is the ability to defer income taxes on its growth over time. One of the best ways to give the money a chance to grow over the long term is by investing in equity oriented investments. Of course, that means getting used to riding the ups and downs of the market.

We hope that this information may be helpful to you, or to a family member or a friend. If you have any questions, please don’t hesitate to reach out to your ACM Wealth Advisor.