by Jeff Deiss, CFP

CFP, AEP, Wealth Advisor

Absent any last minute changes from Congress, below are a few year-end tax reminders. This list is not exhaustive and a conversation with your tax advisor is always recommended.

- Harvest gains and losses before year-end, which is a classic year-end planning technique and one what we employ regularly at year-end for our client’s with taxable investment accounts. This year’s advice could go either way depending on your particular situation.

If you’ve already realized significant gains this year, then harvesting unrealized losses can lower your modified adjusted gross income (MAGI), which is the basis for how much of your social security is taxed, what your Medicare Part B & Part D premiums will be in 2022, and whether or not your gains will be subject to the additional 3.8% Net Investment Income Tax (NIIT) along with other deductions and credits. The NIIT is applied to the portion of your income from investments (capital gains, interest, dividends, rental income, etc.) when your MAGI exceeds $200,000 (filing individually) and $250,000 (filing jointly).

Remember, you normally use capital losses to offset capital gains, not to offset ordinary income (wages, interest, etc.), but you can apply up to $3,000 of excess losses against your ordinary income and carryover additional losses to apply against realized gains in future years.

If you’re holding significant unrealized gains in any investments, then you may want to consider realizing some gains for reasons we’ve described in the past.

Another consideration for certain taxpayers is future capital gains tax rates. One of former Vice President Biden tax policy proposals is to eliminate the preferential rate for long-term capital gains and qualified dividends on income over $1,000,000. Currently, capital gains and qualified dividends are currently subject to tax rates of either 0%, 15% or 20%, depending on your income. Biden’s proposals for incomes over $1,000,000 would basically increase the capital gains rate from 20% to 39.6%, which is a significant change.

The outcome of the Senate race in Georgia remains undecided and will determine whether or not Congress remains divided in 2021 and beyond. So it remains unclear whether such a proposal may be enacted. Regardless of the outcome on tax rates, if you’ve let “your winners run”, then it’s still a good time to consider whether or not to realize gains simply for rebalancing purposes or in the event you’d like to be able to consume some or all of the growth you’ve accumulated during your lifetime.

- Roth IRA Conversions – While there is no need to take Required Minimum Distributions (RMDs) from your qualified retirement accounts in 2020 as a result of the CAREs Act passed in the spring, this year’s RMD “holiday” may present a planning opportunity.

If you have significant qualified retirement accounts (IRAs, 401(k)s, etc.) normally subject to RMDs, then your income for 2020 will be lower if you don’t take any distributions and you might consider converting some portion of these to a Roth IRA this year.

The dollar amount you convert is included as ordinary income for the current year, which may have implications for your 2020 tax bill and Medicare Premiums in 2022, but a Roth conversion of some amount may still be worth considering for a few reasons if you have cash outside or your IRA on hand to cover the taxes. The up-front income tax payment is an important factor to consider, but it’s not the only factor.

Roth IRAs do not require distributions during the lifetime of the owner, allowing assets to accumulate and transfer income tax free to next generations. Conversions of traditional IRAs and 401(k)s to Roth IRAs require a tax payment, but may provide higher after-tax income in the long run.

Under normal circumstances, taxpayers subject to RMDs cannot complete Roth conversions unless they’ve satisfied their RMDs as well, which makes 2020 unique. This year’s RMD holiday provides a better opportunity for Roth conversions than other years simply for this reason.

Potential increases in tax rates in the future are another reason to consider a Roth conversion in 2020. Having some assets in a Roth IRA could provide some tax diversification and the flexibility to withdraw funds from the most tax-effective account at different point in time to aid in managing taxes. Given where income tax rates are today, I think very few us expect that they will be lower in the future.

For those not yet subject to RMDs, but who have accumulated significant IRA or 401(k) accounts, the onset of RMDs (currently when your turn age 72) may suddenly, and significantly increase your taxable income once they begin. This can not only impact the tax bracket you fall in, but your Medicare Part B and D premiums as well and potentially for life. Reducing the amount you hold in traditional IRAs/401(k)s ahead of time may help to limit the potential for increased income/increased taxes in the future.

This is particularly important for “surviving spouses” to consider as well. When one spouse dies, the surviving spouse begins to file taxes “individually” in a more compressed tax bracket. So, similar to folks not anticipating higher income/taxes when RMDs kick in, surviving spouses (and their families) are often not anticipating the change in brackets from joint to individual.

Another reason to consider Roth IRA conversions is for legacy purposes as a result of the way inherited IRAs are to be treated going forward. The Secure Act, which went into effect on Jan 1, 2020, changed the rules for beneficiaries who inherit IRAs (with exception of surviving spouse and certain other beneficiaries).

For typical beneficiaries like your children, the old rules allowed IRA beneficiaries to “stretch” out required minimum distributions over their lifetimes and thereby control the tax obligation of IRA withdrawals. The Secure Act eliminated the “stretch” and now requires that they withdraw the entire account balance and pay taxes within 10 years of inheritance. Some folks may even consider obtaining life insurance to make up for the portion of the assets they intended to go to their heirs, but will now otherwise be lost to taxes.

Passing on a Roth IRA, on the other hand, comes with no adverse income tax implications. Whereas your children will either need to take partial withdrawals during the 10 year time-period, or take it all out and pay all the taxes in the 10th year from a traditional IRA, with a Roth IRA they can take whatever they need when they need it. Or better, yet, they can leave it to grow for 10 years and then take it all out tax-free in the 10th year.

- IRA Qualified Charitable Deductions (QCDs) – For taxpayers 70.5 years old or older, funds transferred directly from your IRA, Inherited IRA, or even an inactive SEP or Simple IRA plan to a qualified charity will not count as taxable income and, in a normal year, will count toward satisfying your required minimum distribution. Ideally, the check should be deposited by the charity by December 31st. Click here for more info or reach out to us if you have questions.

You may be wondering if you can still do a QCD from your IRA in 2020 even though your RMD is waived. The answer is yes. As more of us are taking the standard deduction and not itemizing charitable deductions, a QCD remains beneficial. With a QCD, you get a tax break for your charitable contribution even if you are using the standard deduction in that the QCD is excluded from income. To get a charitable contribution for donating cash or securities, you have to itemize deductions (except for a $300 2020 provision noted below under Charitable Contributions).

With a QCD, just make sure that the funds are paid directly from your IRA to a qualified charity. If you take a distribution from your IRA and then contribute it to a charity, then it’s not a QCD, but rather a taxable distribution. QCDs are also not available from company plans or active SEP or Simple IRAs.

As a result of the SECURE Act, you can still make QCDs starting at age 70.5 even through RMDs don’t kick in until age 72.

Lastly, the SECURE Act also repealed the age cap for make contributions to a traditional IRA. Keep in mind that if you make a “deductible” contribution to your IRA in the same year that you make a QCD, the tax-free portion of your QCD is limited. If you make a QCD for $10,000 for 2020 and also make a deductible contribution of $7,000 to your IRA, then the $7,000 portion of your QCD is taxable and the tax-free portion is only $3,000.

- Charitable deductions remain valuable in the current income tax rate environment, depending on your overall level of itemized deductions.

If you are itemizing deductions in 2020, the CAREs Act increased the limit for cash contributions this year. You can now elect to deduct up to 100% of your AGI (increased from 60%).

The CAREs Act allows for an additional “above-the-line” deductions made in cash up to $300. Even if you are not itemizing deductions, you can claim this new deduction.

There have been no changes to existing deductions for contributions made into donor-advised funds. You can deduct up to 60% of AGI for cash contributions and 30% of AGI for appreciated securities contributed to a donor-advised fund.

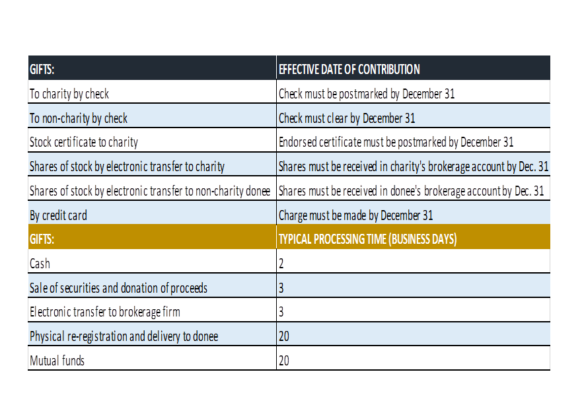

Regardless of the particular tax implications, you can always still donate by check, or by transferring securities (particularly those that have appreciated) or other assets. If you are unsure of the differences between these options, then click here for a review. It is advisable to review how much and to whom you are planning to give and to time your gifts properly. The three critical areas that may make the greatest difference in this pandemic include frontline health staff, safety net organizations like food banks and other non-profits that rely on in-person volunteerism, fundraising events and public performances to survive. We encourage anyone to continue your support for the organizations you always have.

- Contribute to tax qualified accounts, such as your 401(k). Pre-tax contributions to your company sponsored retirement plan reduce your current taxable income. Contributions limits for 2020 are capped at $19,500 if you are under 50 years old and $26,000 if you are 50 or older. We will follow up with more information on this topic next week.

- Use your Flexible Spending Account (FSA) balance before you lose it. Not to be confused with Healthcare Spending Accounts (HSAs), FSAs can help you spend less money on health care while you are working, but only if you use all of the money you’ve contributed by year end. In other words, FSA funds are “use it or lose it” and any unused portion after the end of the year is no longer yours. If you have any FSA funds remaining , then check the IRS list of approved medical expenses and check with your employer to see if your employer offers either a rollover option (which allows you to move up to $500 to next year’s balance) or a grace period (which provides up to 2 ½ months past the end of the year to use your funds). Your FSA likely has one of these options, but cannot have both under IRS rules. For 2020, the CAREs Act eliminated the prohibition for over-the-counter medicines (non-prescribed) being excluded as a “qualified medical expense. Owner of FSAs and HSAs can use funds to cover the cost of over-the-counter medical products, including those needed for quarantine or for social distancing, without a prescription.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth