by Kevin Kern

Founding Partner

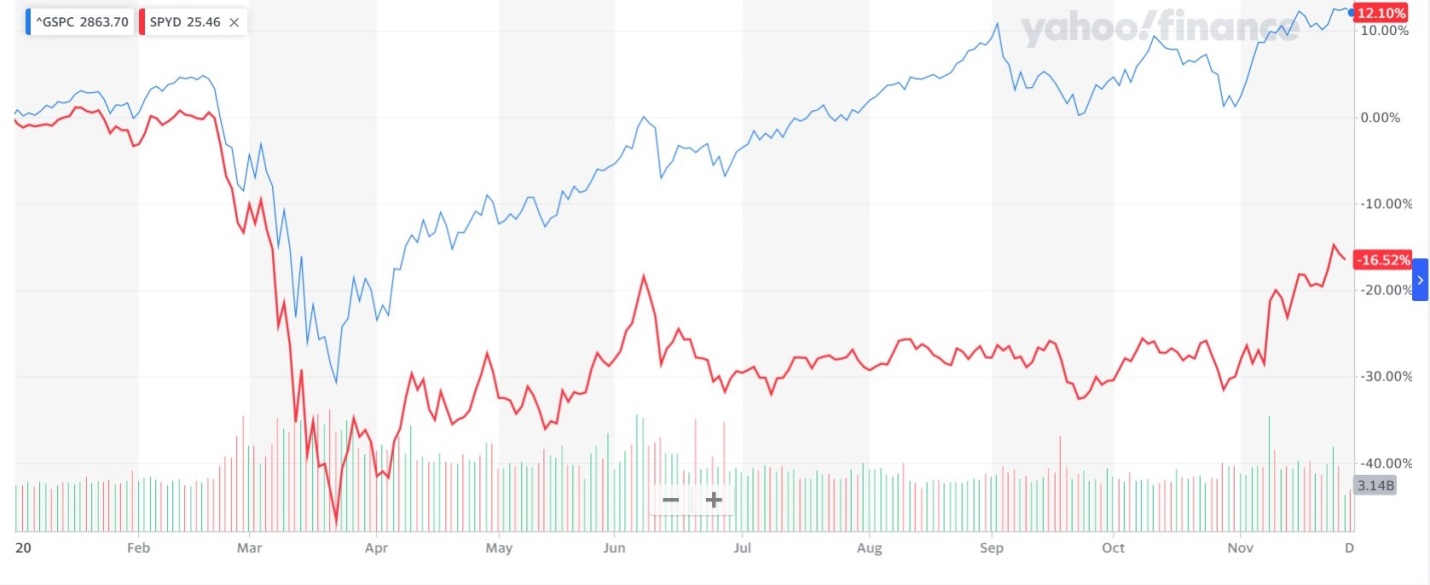

When COVID forced the government shut down of the economy, established dividend paying companies curtailed distributions to husband cash and income focused investors moved to cash in panic. Other investors hopped on the momentum rockets of large cap technology. For those higher yielding dividend investors who stayed invested, they watched their portfolios decline into bear market territory, while technology surged, as the central bank intervened aggressively to support a recovery. For much of the year, the higher yielding dividend stocks as represented by SPYD (SPDR Portfolio S&P 500® High Dividend ETF RED) fell way behind the broader market as represented by GSPC (S&P 500 BLUE) below.

Year to Date comparison S&P 500® Index vs. SPYD through November 30, 2020

Chart Source: Yahoo Finance

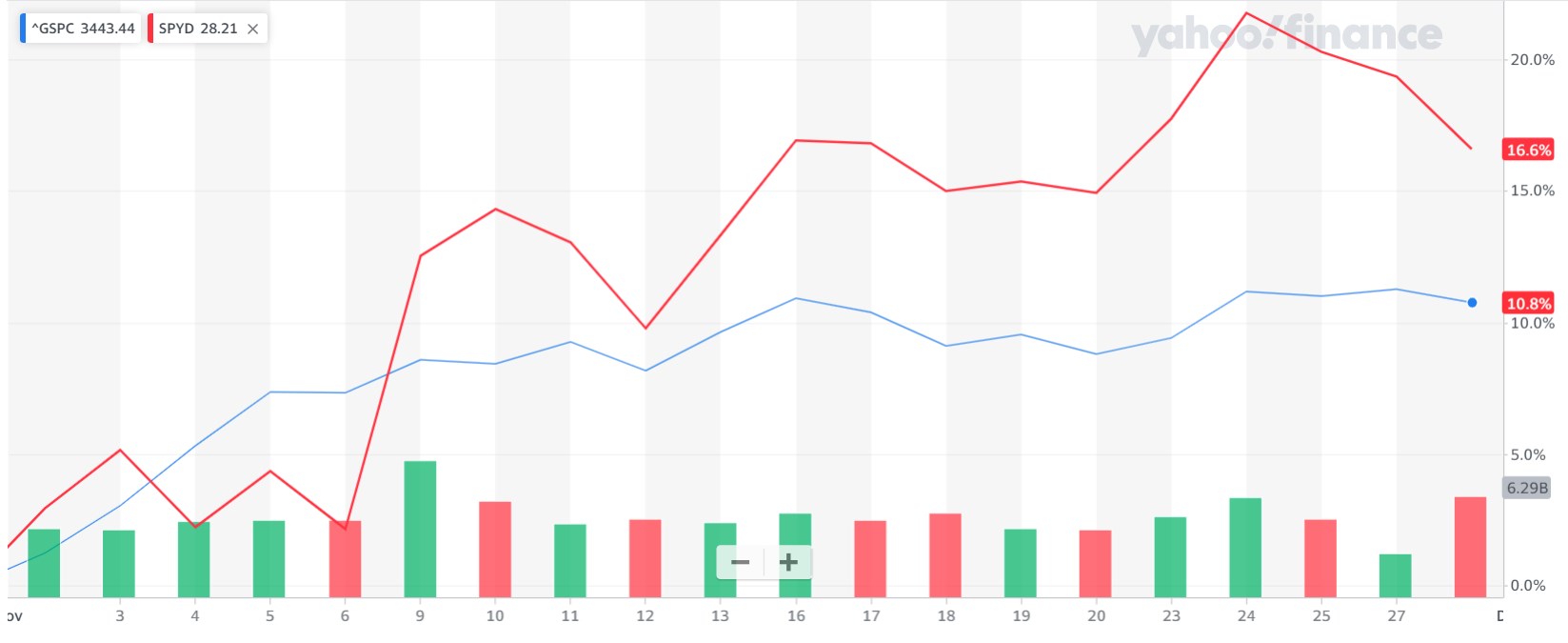

The extreme under-performance of these dividend paying stocks began to change for the better as early as October and has accelerated since the early November announcements from Pfizer and Moderna regarding their vaccine successes. An evident rotation has begun back into all dividend stocks. Now with an end game for COVID 19 visible for 2021, dividend investors are buying back into what makes them happiest…growing cash flow. For the one-month trailing period, high yield dividend stocks as represented by SPYD, have once again begun to outperform the S&P 500®. See chart below.

What do high yielding dividend investors hate more than their current year to date performance? Being in cash or riding growth stocks as an income substitute solution. Dividend investors understand and enjoy the idea of living off growing dividends. Using their cash for income for the past 8 months has caused a lot of pain. Worse, I have never known an income investor forced into momentum stocks who enjoyed that ride either. The constant worry of “when will the momentum party end?” is comparable to the indigestion of eating your cash reserves for income.

As the economy recovers; battered higher dividend stocks have the most to gain.

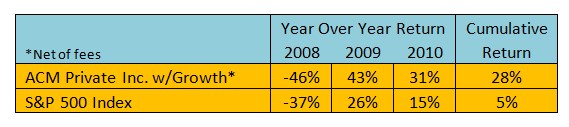

We saw a similar rotation back in 2009-2010 with the recovery after the financial crisis. The 2008 crisis resulted in ACM’s highest yielding strategy (Private Income with Growth) netting a return of -46% to the S&P’s return of -37% for the year. Following and including the crisis, our Private Income with Growth composite outperformed the S&P 500 by 23% (28% versus 5%).

Source: Advisors Capital Management

Back in 2008 our Private Income with Growth had a target gross yield of over 6%, as it still does. So it is not surprising to learn that one month trailing through November 30, 2020 the Private Income with Growth composite is up 15.3% while the S&P 500® is up 10.8%.

History has shown that those investors who stay invested will be successful. History may also be hinting that high yield dividend stocks are setting up for another once in a decade out-performance of the growthy S&P 500®.

Disclosure: The ACM Private Income with growth performance represented in this commentary is net of fees. GIPS® audited performance reporting is available upon request. The S&P 500® Index does not have fees. As a higher yielding dividend strategy the ACM Private Income with Growth composite’s appropriate benchmark is 80% S&P 500® High Dividend (SPYD) & 20% Markit iBoxx USD Liquid High Yield Index. The S&P® 500 High Dividend Index is designed to measure the performance of the top 80 high dividend-yielding companies within the S&P 500® Index, based on dividend yield. To determine dividend yield: (i) an indicated dividend is measured by taking the latest dividend paid (excluding special payments) multiplied by the annual frequency of the payment; and (ii) the indicated dividend is then divided by the company’s share price at the date of re-balancing. The Markit iBoxx USD Liquid High Yield Index is designed to reflect the performance of USD denominated high yield corporate debt, offering broad coverage of the USD high yield liquid bond universe. Dividends and/or interest payments are reinvested in the above benchmarks. Dividends and interest are reinvested in the above benchmarks. Investing in stocks can result in a loss of principal. Dividend income is not guaranteed. Consult with your advisor. Past performance is not an indication of future gains

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth