by Kevin Kelly

Portfolio Manager

While fixed-income investors have enjoyed relatively strong returns in the first half of 2019 after a tough 4Q18, most are likely trying now to handle lower interest rates and very tight credit spreads. As a reminder, the credit spread is the incremental yield an investor demands on a corporate bond versus a Treasury bond of the same maturity. My three suggestions are as follows:

1. Cherry-pick.

2. Don’t limit yourself, but remember pigs get fat, hogs get slaughtered.

3. Preferreds are not always the answer.

Cherry Pick.

When yields are low because both interest rates and credit spreads have declined dramatically, investors must do their very best to cherry-pick their investments. Even the best investors can only have so many “Top Ideas,” so choosing to own 25-35 fixed income securities versus a pool of 50-100+ securities has important advantages. While a portfolio of 25-35 securities still provides reasonable diversification, it also means investors will not be forced to ‘settle’ for their 49th best investment idea which would have a less attractive risk/reward. Arguably, the bigger benefit is the future ability to quickly re-position the portfolio as markets dictate. Selling 5-10 securities can dramatically change the composition of a 30-security portfolio while having to sell 20 to 30+ bonds in a larger portfolio would be needed to have the same overall effect. Selling 5 out of 30 bonds is not only easier and faster but also allows you to be far more opportunistic with your sales.

Pigs get fat, hogs get slaughtered.

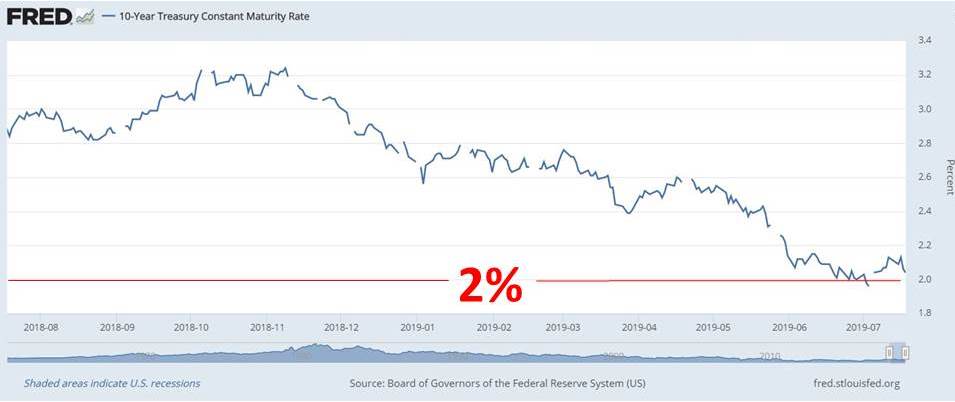

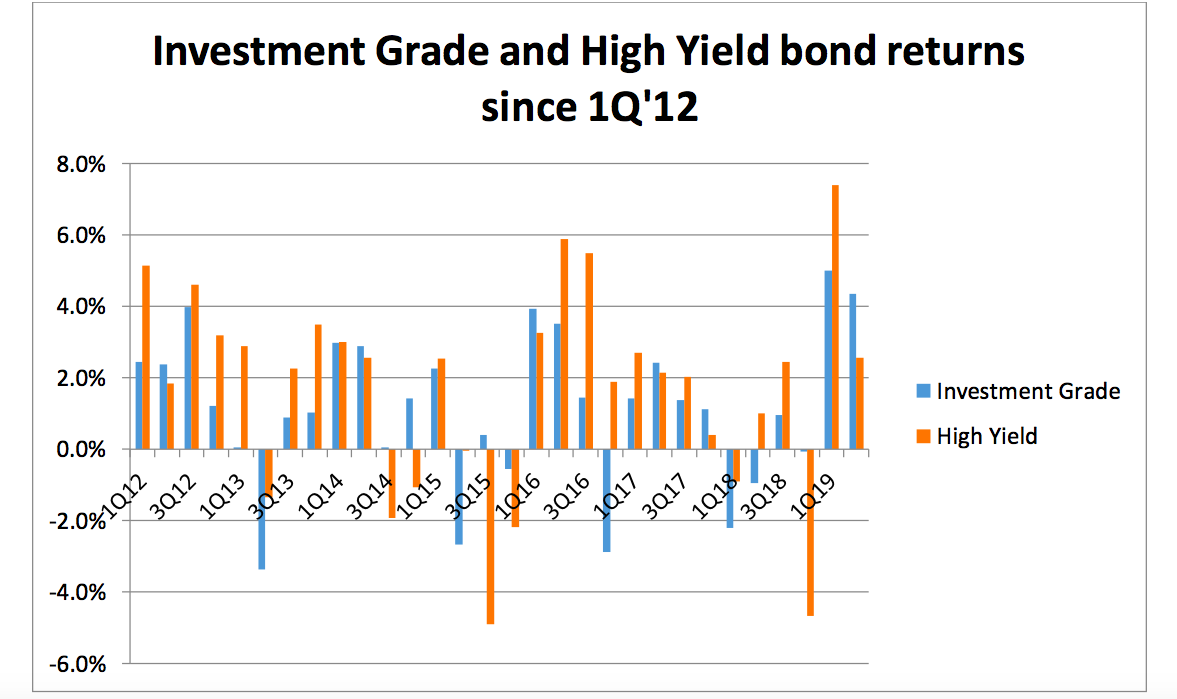

Just because you always did something, doesn’t mean it is always right. There are advantages depending upon market circumstances to owning higher quality versus lower quality, fixed versus floating, and short maturities versus long maturities. While high yield outperformed in 1Q19, investment-grade outperformed in 4Q18, 2Q19, and for the nine months ended 2Q19.In times of extreme ‘risk-on’ and ‘risk-off’ attitudes, the returns across investment grade and high yield vary dramatically. The difference in returns also varies across short-dated and long-dated bonds since a significant widening in credit spreads (holding interest rates constant) will result in dramatic outperformance of short-dated bonds and vice versa when credit spreads tighten significantly. Currently, credit spreads are quite narrow and hence our general favoring of short-dated bonds and preferreds that we expect to be called or that offer relatively high yields for the corresponding risk.

Source: ICE Benchmark Administration Limited (IBA), retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2, May 30, 2019.

Preferreds are not always the answer.

Some investors take a simple approach to earning a higher yield in fixed income in a low-yield environment by buying preferreds. Based on the current offer price, approximately 150 preferreds are trading at a negative yield to the next potential call. That previous sentence is not a typo. While there is an issuance cost to a new preferred and perhaps some companies can’t refinance at a sufficiently low rate to offset these costs, many of these securities can likely be refinanced at a lower rate. Those preferreds are at risk of being called. Also, some securities sustainably trade at prices that would imply a small, 1-2% principal loss upon a call, but investors should be keenly aware of this risk. Unfortunately, many investors are simply looking at the coupon or dividend rate the security pays and ignoring, consciously or not, the potential of an immediate loss upon a call. Additionally, preferreds have significant credit spread and interest rate risk given they typically have no maturity date. For example, if the credit spread on a perpetual 6% preferred widens 1%, all else equal, the preferred could trade down 16.7%. Notably, preferreds may or may not trade in-line with the value implied by the math above, depending upon the long-term interest rate and credit spread investors are comfortable earning on such security, but the risk is there.

The reasons above underlie our current ‘waiting to pounce’ approach to fixed income investing. Active, thoughtful fixed income security selection allows investors to select their best ideas, avoid unnecessary risk, and maintain the ability to stay nimble as opportunities present themselves.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth