by Dr. JoAnne Feeney

Portfolio Manager

Tax-loss harvesting, holiday shopping trends, and 2020 market outlooks take center stage for investors this time of the year. Don’t neglect the first, keep track of the second, and ignore the third. This year, the tax-loss harvesting is a bit more challenging, given the S&P 500’s 25% rise year-to-date. The strength of the consumer is partly responsible for the rise in the market, so this year’s holiday shopping season will be closely watched to see whether retail spending will stay strong. Despite the uncertainty surrounding trade, the broader U.S. economy, and the presidential election, pundits are coming out with projections for the S&P’s rise in 2020. They missed 2019 pretty badly. Not surprisingly, they’re projecting less appreciation next year than this! So, should those outlooks play a major role in shaping investor portfolios today? No.

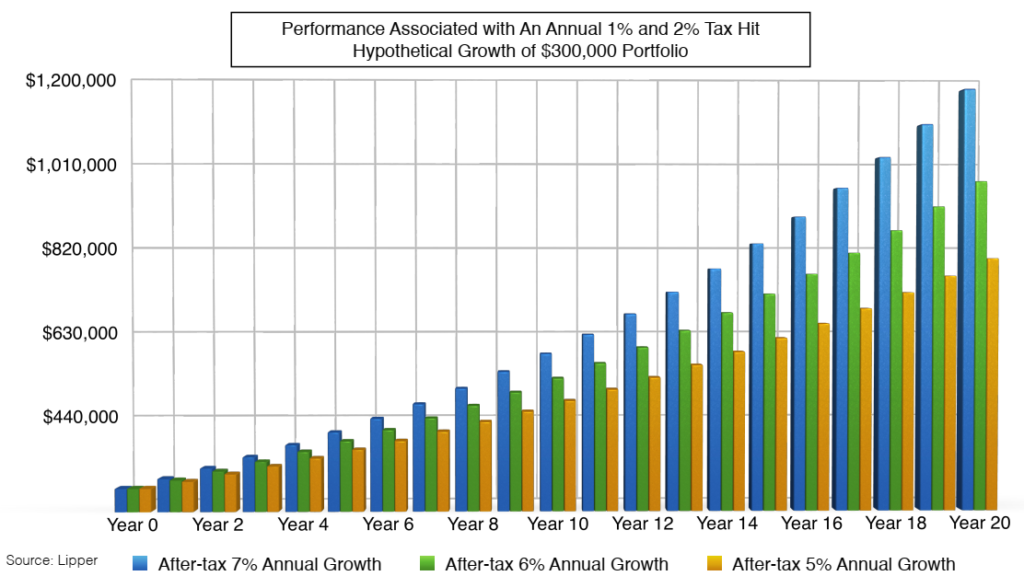

Yes, it’s the season for tax-loss harvesting, but this year our task is particularly challenging since the S&P 500 has climbed 25.3% since the start of the year. Tax-loss harvesting remains an important source of additional return in portfolios. According to Lipper, over the last ten years, tax-loss harvesting would have added 0.98% to 2.08% to a mutual fund portfolio’s average annual return. This can add up:

This year provided more gains than usual, and because those returns have been unevenly spread across stocks and sectors, there are some opportunities to take offsetting losses. Recall, though, that much of this year’s gains have simply reflected recovery from the steep decline the S&P took in the fourth quarter of 2018. Since the beginning of September 2018, the market is up by a much more modest 8.7%. But for shares purchased late last year, and trimmed or sold since, the realized gains can be substantial. We’ve been selling some down positions over the last few weeks, so you will likely see some positions have disappeared from your accounts. Among these, are stocks of energy companies, an area out of favor with investors this year (despite oil’s 19% price rise), select technology companies that suffered from a pushout in spending, and companies adversely affected by the trade war. You can expect most of those positions to be returned to your portfolios since fundamental drivers have improved in each of these areas.

The consumer has been behind much of this year’s economic strength as spending has remained robust even as companies have taken a more cautious approach to capital expenditures in the face of uncertainty in trade policy. Retail sales this holiday season are being closely watched to see whether that strength will carry through to year end. Preliminary figures for spending around Black Friday (which has become many days) are positive: Black Friday’s on-line sales reached $7.4 billion (a new record) and even brick-and-mortar foot traffic rose 6% over 2018 levels. Cyber Monday sales are expected to climb 19% over 2018 levels.

Consumer strength may well continue through 2020, if current trends hold, but the stock market’s potential appreciation next year is more likely to reflect forecasts for corporate earnings in 2021. For the last few years, stock prices have been moving in advance of expected future earnings – and this is as it should be since owning shares in a company only makes sense for the profits the company delivers in the future, not for those it has delivered in the past. For 2019, S&P 500 earnings are expected to come in flat with 2018 levels. As growth expectations for this year’s earnings started to deteriorate in late 2018, valuations pulled back. That was one reason (Federal Reserve comments being another) for the market’s sharp decline in 4Q 2018. But investors quickly realized their fears over possible Fed missteps were misplaced and that earnings in 2020 would likely show a return to growth. Indeed, investors are expecting nearly 10% earnings growth next year and so we saw a strong market rebound through 2019 and net appreciation (excluding that fourth quarter decline) just about in line with 2020 expected earnings growth.

So for this year, we are likely to see stocks reflect evolving expectations for 2021 earnings growth. It’s a bit early to formulate an accurate forecast of profits, however, so we look to the health of the economy and long-term trends in each sector and for specific companies. Recent labor market data, retail spending, corporate capital goods orders, and the move toward normalizing U.S.-China trade relations form a solid foundation for further earnings growth. But there are also several sources of risk. Will Europe continue to improve? Will the election raise the risk of inefficient fiscal policies? Will the trade war persist in China and extend to Europe?

Rather than counting on growth to continue in any one year, we prefer to position portfolios to be able to absorb those risks through diversification across asset classes, sectors and companies, and to find holdings that bring long-term appreciation potential.

Advisors Capital Management, LLC is an Investment Adviser registered with the Securities and Exchange Commission. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developmentsmentioned. As a precautionary measure, we cannot rely on e-mail requests to authorize, direct or effect the purchase or sale of any security, wire transfer, or to affect any other transactions. Such requests, orders, or other instructions sent by email should be confirmed verbally, or by written instructions faxed to 201-857-4099 prior to their anticipated execution. We are unable to ensure email sent to you from us, or sent from you to us will be received. Please contact us at 845-652-3449 if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Additionally, we recommend you compare any account reports from Advisors Capital Management, LLC with the account statements from your Custodian. Please notify us if you do not receive statements from your Custodian on at least a quarterly basis. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.