by Randall Coleman, CFA

Portfolio Manager, CFA

Hi. My name is Randall and I am an addict: I ride my bicycle long distances. I’m not one to brag, but most people that I know agree that riding a bike 200 miles in a single day qualifies as a “long-distance endurance event.” I completed my 64th 200-mile ride last Saturday. These are all-day events, starting in the wee, dark hours of the morning and almost always ending well past nightfall: you have plenty of time to think during the day. With the market (as measured by the S&P 500 Index) within a whisker (68 basis points, actually) of its all-time high, it is instructive and useful to examine many of the parallels between endurance events and long-term investing. To me, the key underlying traits are discipline and stamina. A $10,000 investment in Amazon stock the day it IPO’d in May 1987 would be worth over $12 million today. The path to that $12 million mark has been a topsy-turvy, gut-wrenching run. Would many investors have had the stamina to ride it out? What investment discipline would have allowed such an investment for that length of time?

Before we take a careful look at how $10,000 made it to $12 million, let’s examine the similarities between investing and long-distance cycling.

Similarities

Investing and long-distance bike rides are endurance events. Both require discipline and stamina. The challenges that arise are plentiful and always seem to grow. Cyclists must combat physical as well as mental obstacles. The physical ones are pretty obvious: cramps, flat tires, crashes, broken chains, road hazards, and the like. The weather has an enormous impact on a given ride. Heat, rain, hail, fog, and wind can individually or, in combination, conspire to foil an attempt at a 200-mile ride. A rider cannot control the weather. What the rider CAN control can be broken down into mental and physical. Self-doubt is the biggest internal impediment to finishing a long ride. If a rider thinks he can’t do it, he won’t. The investing parallel is fear. Every investor has bought a security that subsequently dropped in price, sometimes precipitously. The essential element to an investor with stamina is the ability to learn from the experience, put it behind, and continue his process. Setbacks are inevitable. Long-term investing requires the stamina to overcome them.

Each course is different, each day is different: weather, heat, physical preparedness all differ. A course one year can seem easy, while the next year it feels nearly impossible. The investing climate is similarly in a perpetual state of change. Interest rates, the Fed policy cycle, political environment, geopolitical environment, natural disasters: every day presents a new and unique set of investing variables to deal with.

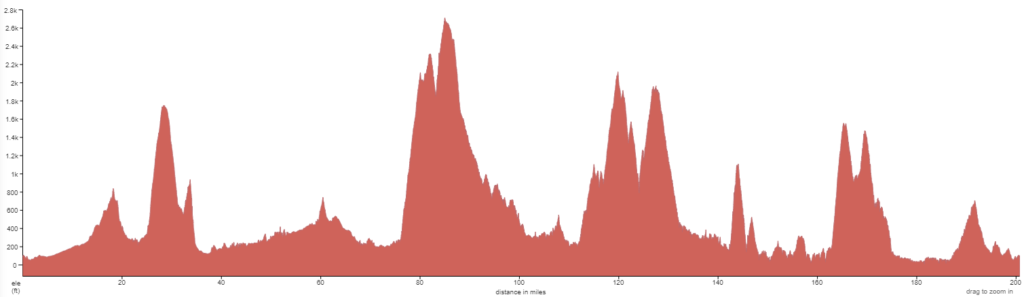

Even the ride profiles and stock charts look similar! (Of course, the fun factor on the ride profiles is inverted: downhills are fun. On stock charts, uphills are fun.)

My Ride Portfolio:

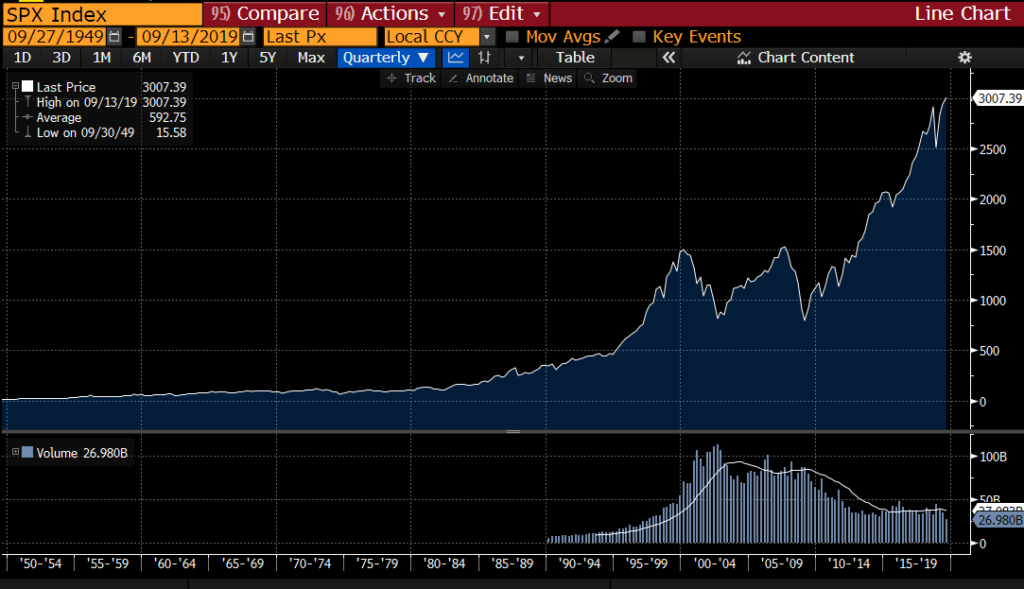

Source: Bloomberg

I love the downhills: effortless speed is exhilarating! Speed is dangerous. The adage goes “There are two types of cyclists. Those who have crashed and those who haven’t yet.” I transitioned from the latter to the former group in 2014. Suffice it to say, I make descents much more cautiously now. In investing, strong performance in a stock can lead to a misalignment in risk. The manager has to make the decision whether the weighting in an individual stock is appropriate or not. If not, the position is trimmed or sold. This is identical to “putting on the brakes.” Putting on the brakes is prudent and exemplifies discipline.

Differences

Of course, there are differences, too. In one sense, long rides are easier: you have the option of quitting. Investors do not have that luxury: financial markets do not rest. Cyclists can take the easy way out the SAG wagon. SAG is an acronym for Support And Gear. This is the vehicle that will scoop you up, cramped, crashed, or otherwise debilitated and transport you to the finish line. The cyclist will receive a “DNF” (Did Not Finish) notation in the official record but will have participated. Investors have no SAG wagon. They can’t quit and they don’t have the ability to DNF: you have to have your money SOMEwhere.

The SAG wagon analogy can also be viewed as moving all investments to cash, the presumed ultimate “safe haven.” When an investor chooses this alternative, he misses out on the ride: no uphills, no downhills. This can be very costly over time, as the market in the past 50 years has trended up.

Source: Bloomberg

In this regard, the 200-mile rides I do are exactly split between ups and downs: they always end up where they start. Investors, by contrast, have an opportunity over the long term to enjoy a ride with more stock price ups than downs, so they would do better to stay out of the SAG wagon.

The Ride

Our giddy, hypothetical Amazon IPO investor felt good, very good at the end of 1998. His $10,000 tripled by the end of 1997, and then exploded almost another 10 times by the end of 1998 to a value of $356,944.

But then what happened?

Our exuberant IPO investor saw his fortune peak at just over $710,000 in December 1999 before collapsing to $39,800 in September 2001, a stunning -94.4% decline in value. Did any owner of Amazon have the fortitude to continue that ride? Where was the SAG wagon when he needed it?

The absolute magnitude of gains and losses becomes more impressive with time. The 200-mile rides I participate in have total elevation gains from 8,400 feet to 20,300 feet. This gives a measure of the ride’s difficulty in “how much uphill is there?” One measure of how fun a ride can be is how much downhill riding there is. In this regard, the more climbing you do, the more fun you get to have on the downhill side. The inverse to this in investing is stock price downdrafts. Recently our hypothetical Amazon investor experience a $4.6 million downdraft in his investment, going from $13.6 million on September 4, 2018 down to $9.0 million on December 24, 2018. As the rides get longer, the magnitudes get bigger.

Just like investors, not all cyclists are the same. Investors have the entire spectrum of time horizons and risk tolerances. What could be appropriate for one investor may definitely not be appropriate for another. Cyclists are the same: time, distance, and conditioning all combine to make a ride appropriate for one and not the other. Preparation for a long ride includes physical conditioning (training) as well as taking care of equipment (bike, lights, helmet, clothing, etc.). The investing parallels are research and portfolio management. Research is the building block of investing, whether it is top-down, or bottom-up. Research drives the investment process and instills discipline.

I contend that only an investor who shared Jeff Bezos’s vision in 1997 would have had the wherewithal to maintain an investment in Amazon from the beginning. The stock’s volatility and severe price declines would have knocked any other type of investor out. A disciplined approach is sometimes at odds with reality.

In a 200-mile ride, you know when you’re done. There’s a finish line. In investing, you set the goal. In both cases, stamina and discipline enable participants to achieve their objectives. We’re in this for the long haul. One final caution: keep your mouth closed. You don’t want to catch any bugs…and enjoy the ride.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth