by Randall Coleman

Even as China has locked down Wuhan, the city of 11 million where Novel Coronavirus (2019 nCoV) originated, cases continue to multiply and spread. Infections have already been reported in 14 other countries as health officials strive to contain the outbreak. These statistics are virtually certain to be outdated by the time this hits your inbox. Is it serious? Yes. Will it get worse? Certainly. Will it be disruptive? It already has been. To investors, the most important questions are: What are the investment implications of 2019 nCoV? Should I react?

Arguably, you shouldn’t react. Knee-jerk reactions in times of crisis are a symptom of “short termism” and are often driven by strong emotions, notably fear. Fear is seldom a source of sage investment advice. Our contention is that you should already be positioned for events like this. What we’re talking about here is diversification.

Fundamental to portfolio management is the concept of diversification. By owning shares in several different companies, the risk to any individual security is mitigated. All your eggs aren’t in the same basket. Diversification takes on many forms: sector, industry, market capitalization, country, etc. ACM’s portfolios are all well diversified, but in particular, let’s focus on our International ADR strategy. Broad regional exposure spreads out geographic risk. Nearly half the portfolio is represented by companies domiciled in Western and Eastern Europe. Canada and Mexico make up about 8%, with the balance domiciled in the Asia/Pacific region. China directly accounts for under 2% of the portfolio and Hong Kong represents about 10%. Even these holdings are quite diverse. Natural gas transmission, water utilities, shipping companies, real estate developers and toll road operators are our investments in the region.

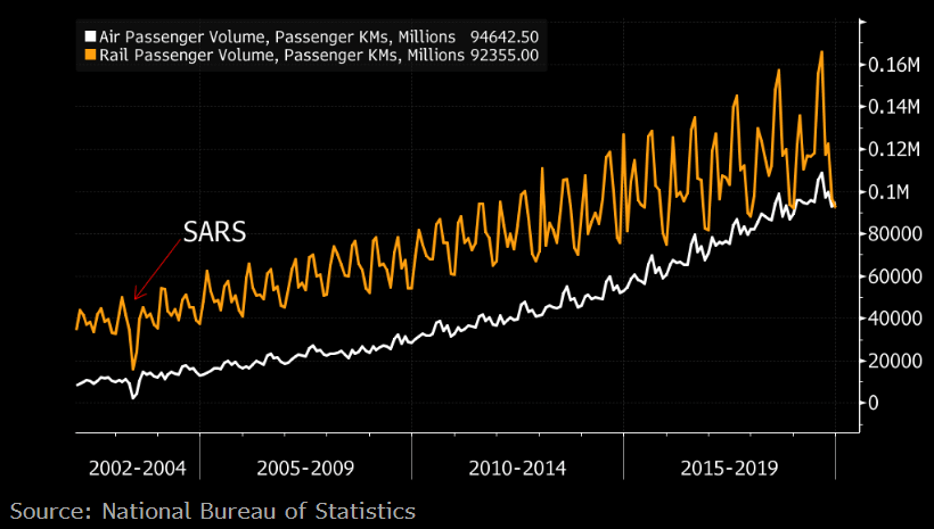

History doesn’t repeat itself, but it does rhyme. The following graph shows China’s air and rail passenger volumes for the past 18 years, including the SARS outbreak in 2002-03. This outbreak is probably our best guide to estimating the ultimate impact of the current 2019-nCoV event. While the SARS impact was severe and dramatic, passenger volumes recovered within a year.

Timing in 2020 is particularly unfortunate, with the outbreak coinciding with the Lunar New Year. Traditionally, this is China’s biggest annual holiday period when tens of millions of workers travel home for family festivities. Travel bans in effect will undoubtedly put a crimp in China’s GDP growth for the year. Regional tourism will also suffer. However, we expect the impact to be transitory.

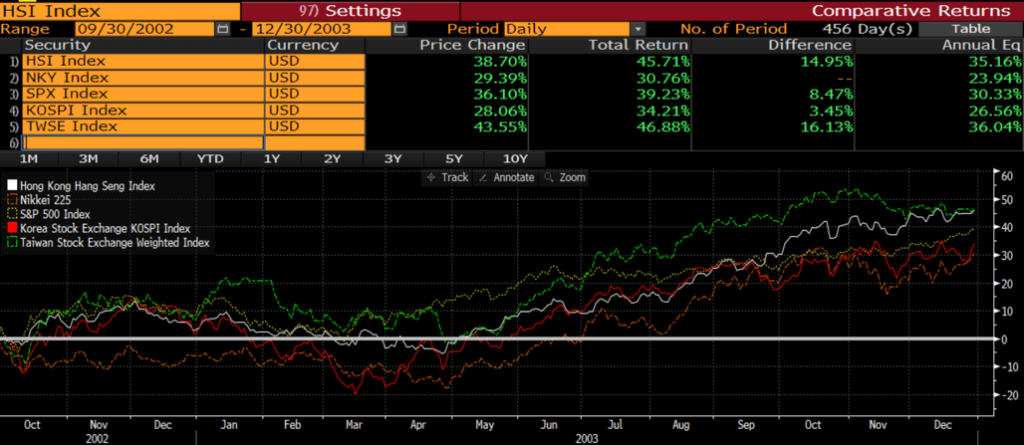

Regional stock markets following the SARS outbreak in 2002-03 also recovered quickly. The peak of the crisis came in early 2003, with schools reopening by the end of April that year. The major regional markets shown below all recovered to pre-crisis levels no more than two months later. The S&P 500 is shown for comparative purposes and illustrates the lack of SARS impact on the U.S. market.

Meanwhile, life goes on in the rest of the world. I’ve just returned from a trip to London where I attended two investment conferences and had meetings with half a dozen UK-based companies. The conferences were very well attended and consisted of French and Italian companies from the health care, industrial, technology, consumer and telecommunications sectors. Far from the epicenter of the 2019 nCoV outbreak, none of the companies mentioned any imminent threat from the disease. While we never say never, we estimate the crisis will have limited impact on Western European companies.

Nobody knows at this point how bad the 2019 nCoV crisis will get. It’s still very early. However, with history as a guide, concerted efforts by governments, medical staff and researchers will ultimately contain and cure this outbreak. In the meantime, some of our portfolio holdings will be buffeted by the news flow, emotion and business disruption. We have seen many crises over the years, and so far, we’ve outlived all of them. We’re remaining calm and rational and will outlive this one, too.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth