by Jeff Deiss

As the Coronavirus outbreak and additional cases occur around the globe, the markets are reflecting this growing worry. Thus far, the markets have responded in a fashion consistent with past epidemics.

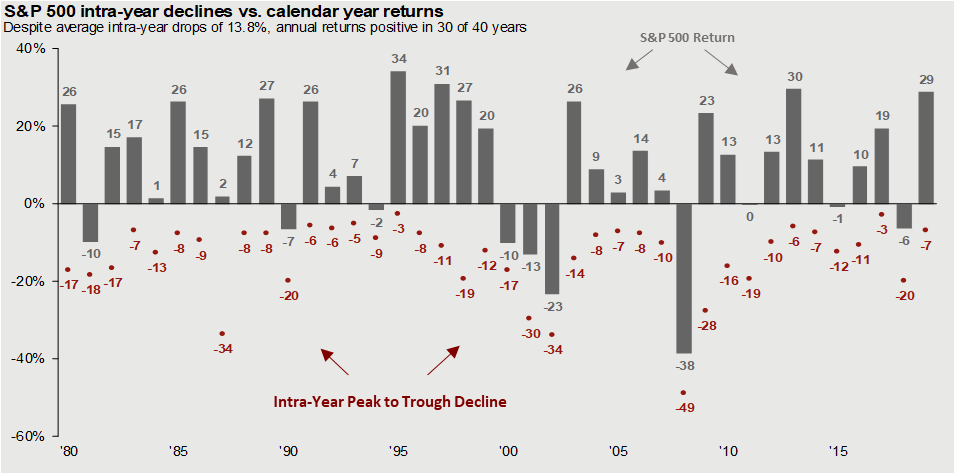

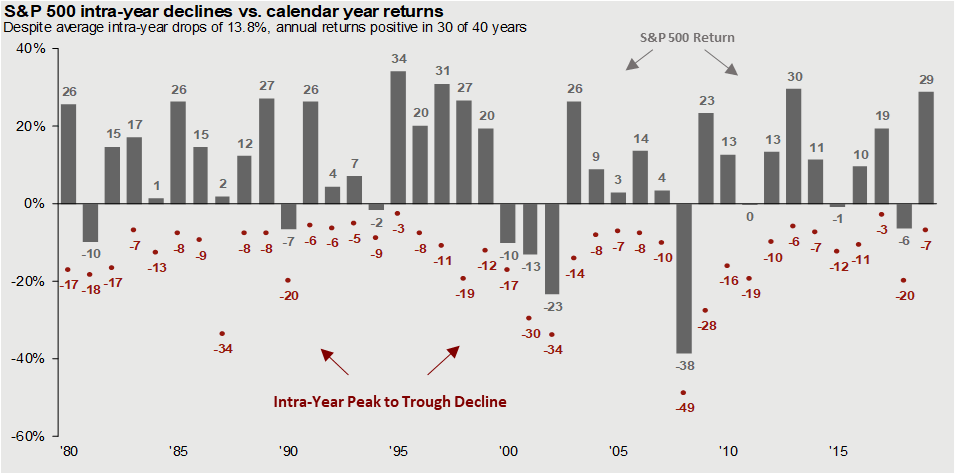

Equity market corrections of 5% to 10% are common, occurring on average about once or twice per year. History has shown that the most recent drawdown is not significant relative to prior events and, in this context; the market often experiences similar corrections and moves on to positive returns for full-year periods.

The SARS epidemic, for example, drove the S&P 500 down about 14% for the first four months of 2003 and it ended the year up 26%. There is no assurance that history will repeat, but there is no immediate action to be taken relative to investment portfolios as a result of the virus. Pandemic-related fear typically drives short-term volatility and these events often prove transitory, eventually reversing associated market weakness.

A current market correction is expected and normal. We will continue to monitor the virus and its impact on global markets and we remain prepared to take action if necessary. In the meantime, equity market volatility is normal and should not be a reason to derail you from your long term goals.

Should you have any questions, please do not hesitate to contact your Wealth Advisor.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth