May 2, 2022

Forefront‘s Monday Market Update

What the Heck is Going On?

That is the question I am being asked a few times each day. Many people have their theories, but at the end of the day, all of us just want clarity and to know what we should do next. If only it were that easy!

It’s OK to Be Confused

Back in 2021, which seems like a lifetime ago, Charlie Munger was asked about the economy and its lack of clarity. He said “If you’re not a little confused by what’s going on you don’t understand it. We’re in uncharted territory.”

Interest rates have risen at a steady clip over the past few months, but that’s bad because the government has trillions in debt, and when it rolls over, a larger portion of the government budget will be going towards debt servicing. Inflation is also high, which means some of the debt is being inflated away, after all, that is how the USA paid off the bill from World War II. A combination of inflation and economic growth.

Higher rates are bad for bonds in the short term because bond rates and prices are inversely related. Higher rates are a good thing in the long run for bonds because investors will earn a higher yield on their fixed income. 2% isn’t going to let you retire on a beach, but it’s certainly better than .04% on the 1-year treasury like we saw during the pandemic.

So, are higher interest rates good or bad? Is inflation actually helping out government and consumer debt? It is okay to be confused right now!

Strip Away the Commentary

We manage investment strategies based on technicals and fundamentals, because that is the easiest way to strip away all of the commentary that isn’t helpful, and serves as a distraction when the trend has changed.

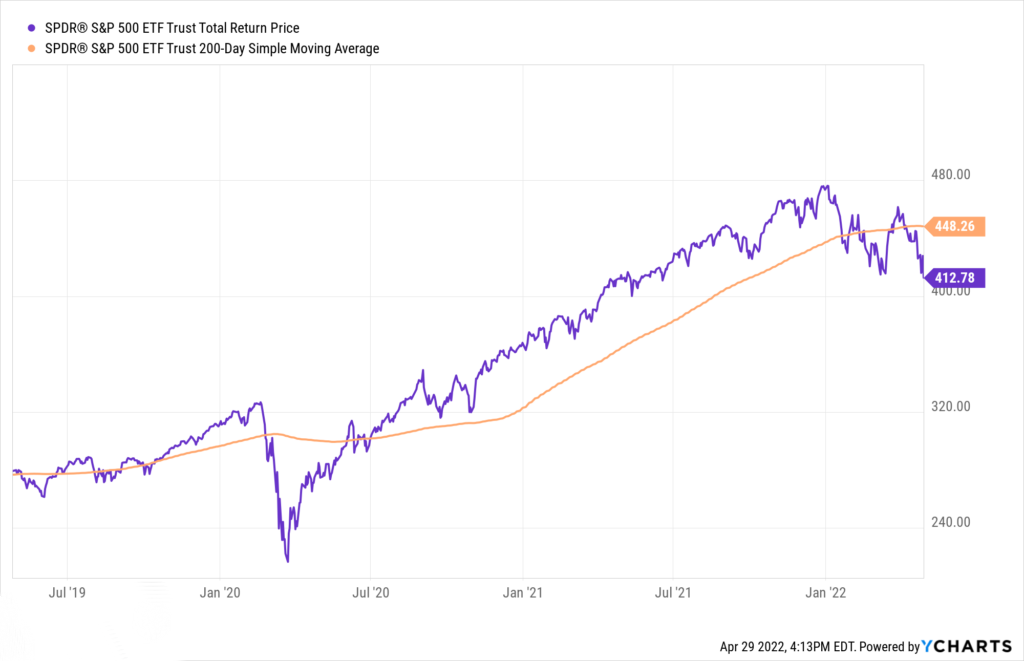

Take a look at the chart above, and notice that the S&P 500 closes a month below its 200-day simple moving average for the first time in two years. What is the 200-day simple moving average?

The 200-day simple moving average compares stock prices relative to its average price over the past 200 days. The chart shows that we actually broke the 200-day in early March but spent the entire month fighting our way back. We got back above it, and it cracked again, and here we are. What does that tell us moving forward?

Break Out the Crystal Ball

Higher volatility will almost certainly become the norm for the foreseeable future. Out of the 50 best and worst days in the S&P 500, 47 of those days occurred while the S&P 500 was below its 200-day moving average.

Human nature doesn’t change much, so looking at history as a guide in the market tells us that we are going to see days that look like St. Patrick’s Day. Green as far as the eye can see, and it will almost be good enough where we start to think that the worst is behind us. Sellers are nowhere to be found.

This will promptly be followed by days that feel like a hundred punches to the stomach. You can barely catch your breath at the force and magnitude of the sell off. We went through it on Friday with broad markets being down 4+%. This will continue for a while, and then the down days won’t be so intense, and the days we are up won’t be so extreme and we will find ourselves on the other side of this.

Winners and Losers

Who comes out on top after all of this? The person who didn’t pay any attention to any of it. When looking at portfolio management, the person who does the least, is generally the one who comes out on top.

The person doing the most is the one who is euphoric and bullish on Tuesday, but by Thursday is bearish again. When you feverishly buy on the green and sell on the red and your attitude and mood for the day will ebb and flow along with the ticker running on the bottom of the CNBC screen. Want to turn a bad situation into something 100 times worse? This is the way.

Over the past decade broad markets have returned nearly 15% a year. That doesn’t just happen for free though because there is a price long-term investors have to pay for returns like that. You are looking at that price right now. So, if you are willing to pay that price right now, in the short term, the long history of the stock market tells us you will be rewarded generously. Are you one of the people who can do it?

So What?

So how does this impact all of you?

- Is short term volatility a price you will pay for long term prosperity?

- The winner will be the people who do the least.

Stock market calendar this week:

| MONDAY, MAY 2 | |

| 9:45 AM | S&P Global U.S. manufacturing PMI (final) |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Construction spending |

| TUESDAY, MAY 3 | |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital goods orders (revision) |

| Varies | Motor vehicle sales (SAAR) |

| WEDNESDAY, MAY 4 | |

| 8:15 AM | ADP employment report |

| 8:30 AM | International trade balance |

| 9:45 AM | S&P Global U.S. services PMI (final) |

| 10:00 AM | ISM services index |

| 2:00 PM | FOMC statement |

| 2:30 PM | Fed Chair Jerome Powell news conference |

| THURSDAY, MAY 5 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Productivity (SAAR) |

| 8:30 AM | Unit labor costs (SAAR) |

| FRIDAY, MAY 6 | |

| 8:30 AM | Nonfarm payrolls |

| 8:30 AM | Unemployment rates |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor force participation rate, 25-54 |

| 9:15 AM | New York Fed President John Williams speaks |

| 3:00 PM | Consumer credit |

| 7:15 PM | St. Louis Fed President James Bullard and Fed Gov. Chris Waller speak |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.