April 25, 2022

Forefront’s Monday Market Update

A Housing Crash is Unlikely

I passed an open house near me this weekend, and you would have thought it was the line to get into Yankee Stadium. People stretched around the block waiting to get in, and inevitably that home owner will have a few offers to consider over the weekend.

As home prices rise, it had little effect on the consumer, until interest rates started to rise. Just 4 weeks ago a typical 30 yr. mortgage had an interest rate below 4%. Today those rates top 5%, which is one of the most remarkable moves in rates in recent history. This provides a perfect opportunity for people to get on TV and declare “a crash in housing is imminent.”

Housing prices might come down, and the rate of purchases might slow down a bit, but a housing crash is unlikely, and let me tell you why.

Demographics

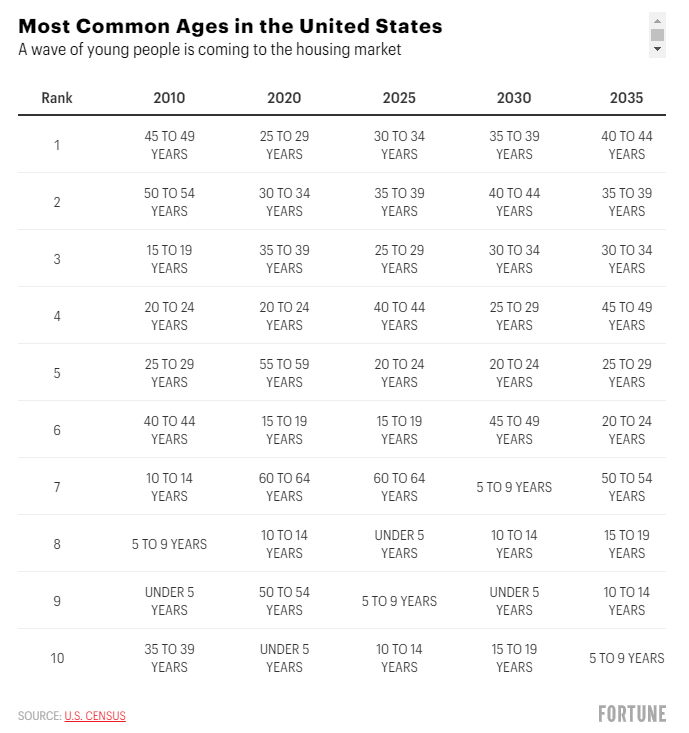

The chart above shows the most common age of Americans, and projects out what that will be every 5 years. For the next fifteen years, the most common age of Americans will be in their 30s and 40s. Baby Boomers were the dominant generation in the US for decades, but Millennials have ousted them from that distinction.

This demographic information matters because it shows the age group with the most people in it is the age group when people buy their starter homes in their early 30s or upgrade their homes in their late 30s and early 40s.

After the housing market collapse in 2008, every wall street analyst and talking head on TV declared that Millennials would never buy houses. The job market was abysmal and the assumption is that Millennials would just live in cities forever. For a bit, the pundits thought they were spot on, and they were. Millennials delayed purchasing homes and getting married, but eventually, people have children and realize their 900 sq. ft. studio in Soho, just wasn’t going to cut it. Millennials accounted for more than half of all mortgage loan applications in 2021. Demand for housing isn’t going anywhere, but what about the supply?

There just isn’t enough housing

We all remember the years 2008 and 2009 and the devastation we saw in housing, but the actual housing market crash started in 2006. Home owners were already recognizing they had overextended themselves, and been sold on a variable interest rate that was about to reset. This didn’t only have an impact on home owners, but it decimated home builders.

In January of 2006, housing starts in the U.S totaled 2.3mil, but fast forward three years later and in January of 2009 it was only 490,000. Very simply put, builders, stopped building homes following the housing crisis.

The 1970s saw a population in the USA of around 210 million people, and we were completing the building of more than 2 million homes a year to sustain housing for our population. We are not at 330 million people, and last year less than 1.3mil homes were completed.

Although the number of homes being completed is moving up, Altos Research Analyst, Mike Simonsen notes that as recently as 2015 we had as many as 1.2mil homes for sale, and that number is closer to 300,000 homes today.

Demand is there, but supply is still catching up.

Do you want to sell your house?

Yes, building more homes in the U.S. would help, but there are other factors to our housing supply issue. Between 1987 and 2007, people lived in their homes for an average of five years. Since 2008 we have seen that average double, where people are staying in their home an average of ten years. What changed?

If you look at the make up of new houses being built in the 70’s the median new home was about 1,500 sq. ft. and only a quarter of them had four bedrooms or more. 40% of homes built at that time had 1.5 bathrooms or less, and half of all homes did not have air conditioning.

Today, the average home being built has close to 2,500 sq ft of space, half of them have 4 bedrooms or more, and less than 5% come with 1.5 bathrooms or less. Houses today are larger, built with more amenities, and overall provide more space for living. No wonder people are staying in their homes for longer. This doesn’t even touch on the generationally low mortgage rates that many of us have, which we would be giving up if we sold our homes and moved.

So What?

So how does this impact all of you?

- We have an abundance of housing demand, and limited supply, which shows a housing collapse is unlikely.

- Low rates, and better homes make moving less enticing to many people.

Stock market calendar this week:

| MONDAY, APRIL 25 | |

| None scheduled | |

| TUESDAY, APRIL 26 | |

| 8:30 AM | Durable goods orders |

| 8:30 AM | Core capital equipment orders |

| 9:00 AM |

S&P Case-Shiller U.S. home price index

(year-over-year)

|

| 9:00 AM | FHFA U.S. home price index (year-over-year) |

| 10:00 AM | Consumer confidence index |

| 10:00 AM | New home sales (SAAR) |

| WEDNESDAY, APRIL 27 | |

| 8:30 AM | Advance report on international trade in goods |

| 10:00 AM | Pending home sales index |

| 10:00 AM | Home ownership rate (NSA) |

| THURSDAY, APRIL 28 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Real gross domestic product (SAAR) (first estimate) |

| 8:30 AM |

Real final sales of domestic product (SAAR)

(first estimate)

|

| FRIDAY, APRIL 29 | |

| 8:30 AM | Employment cost index |

| 8:30 AM | PCE price index |

| 8:30 AM | Core PCE price index |

| 8:30 AM | PCE price index (year-over-year) |

| 8:30 AM | Core PCE price index (year-over-year) |

| 8:30 AM | Nominal personal income |

| 8:30 AM | Nominal consumer spending |

| 8:30 AM | Real disposable incomes |

| 8:30 AM | Real consumer spending |

| 9:45 AM | Chicago PMI |

| 10:00 AM | UMich consumer sentiment index (final) |

| 10:00 AM | UMich 5-year inflation expectations

|

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.