June 13, 2022

Forefront‘s Monday Market Update

Does Owning Bonds Even Work?

Bonds are supposed to be the safety net, the portion of your portfolio that weathers the storm so that you can sleep at night. If bonds aren’t working, what other options do you have?

Have you been thinking this lately? Maybe you are hearing it from your parents as they watch their IRA’s and brokerage accounts fall in value. This way of thinking is completely normal, especially when we are in the midst of the unnerving market drops that we have seen over the past six months.

As the market correction slowly parallels the growing possibilities of a recession, we are losing perspective as investors. Fear and panic are turning to despondency and continuing to push us closer to making emotional and rash decisions.

The Data

The best way to calm those emotions and find some comfort during a time of uncertainty, is data.

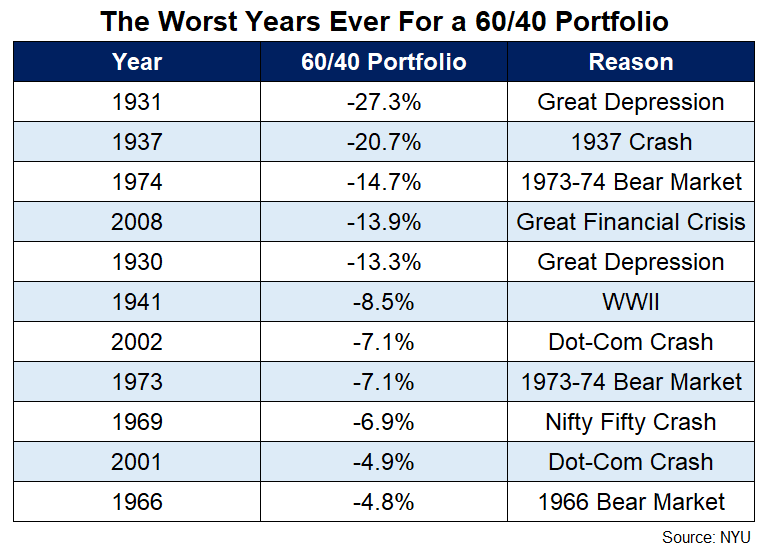

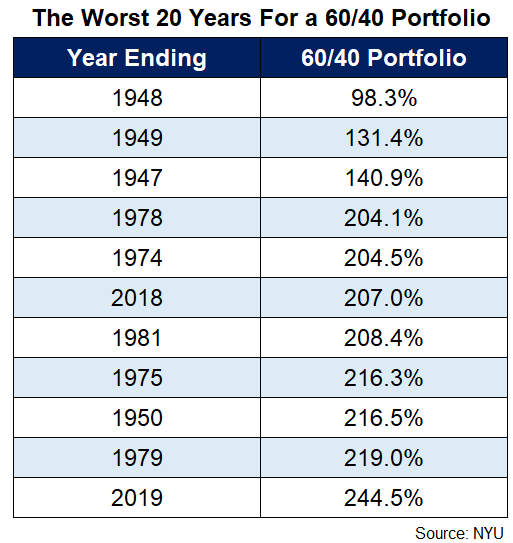

The chart above shows us the worst years ever for the 60/40 portfolio going back to 1928. A 60/40 portfolio is an allocation of 60% equities, and 40% bonds. I understand some people may have 50% in bonds, or 30% etc. and for my clients, I tend to create a custom percentage that goes into bonds to tailor the plan to the client’s unique life circumstances. For the sake of looking at data across a broad spectrum, using the 60/40 portfolio encompasses the greatest number of households.

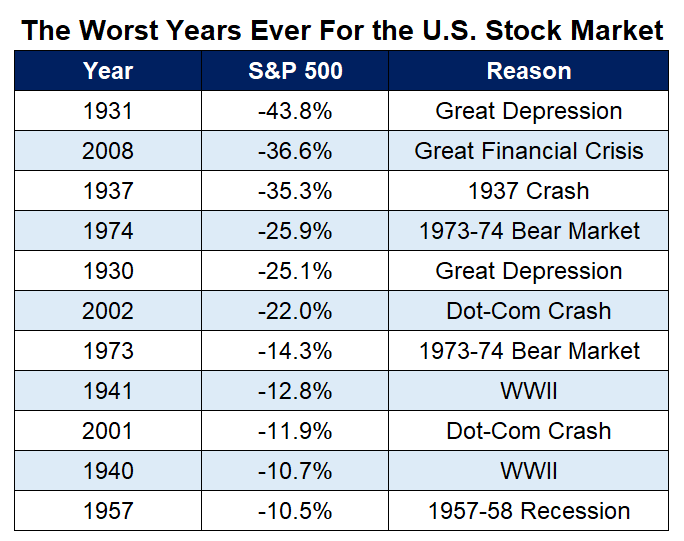

The worst years for the 60/40 portfolio tend to also be the worst years for the US stock market. Bonds can’t stop your portfolio from going down, they just help buffer the storm a bit. Take a look at the chart below, which is the worst years ever for the US Stock market. The dot com crash of 2002 saw the markets fall 22%, but the 60/40 portfolio was only down a touch over 7%. In the midst of 2002, I can remember my father talking to me about how there was no where to put his money because bonds were collapsing also. He was wrong, but in the moment, he couldn’t see that.

Time Frame Dictates Risk

If you know me, and are considering using my services, or are a client of mine, you will inevitably hear me utter those words to you. Time frame dictates risk. Do you need a new roof? The money you have saved for it should be in the bank with absolutely zero risk associated with it. Are you 39 and just left your job? Your old 401k/new IRA can take on the maximum amount of risk. You can’t take from that account for another 20.5 years without a hefty government penalty.

When the market is falling it is natural to start thinking about worst case scenarios, which leads to the idea that we are going to need all of our money, right away! We start to ask ourselves “what if this time is different?” It isn’t. Anything you need money for that might be coming up should already be put away in cash. If there is an emergency that comes up, you have an emergency fund for that too. Start reminding yourself that time frame dictates risk, and the longer the time frame, the less likely you are to lose money.

Zoom Out

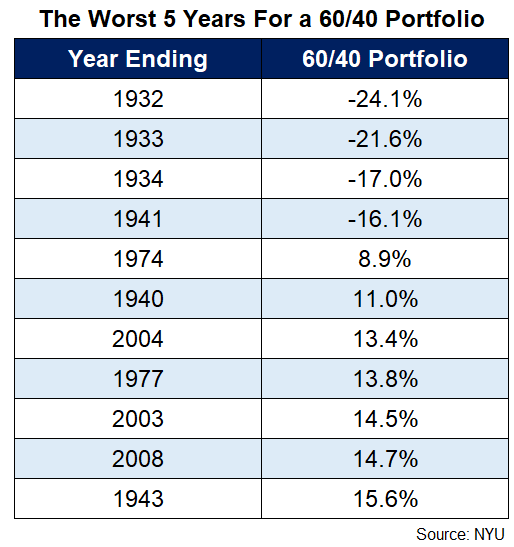

The worst 5-year period of time for a 60/40 portfolio were all times right around the great depression. Since the 1940’s we have yet to have a five-year time frame where the 60/40 portfolio is negative.

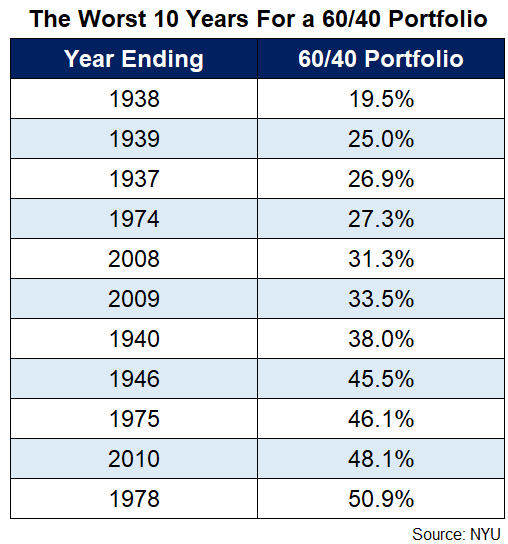

There has never been a ten-year time frame where a 60/40 portfolio has been negative. Bonds work. They work to minimize risk, and if the above chart tells us anything, it is that time is our friend. Unless you are over the age of 55, our current stock market environment should be nothing more than a chance to buy good companies at last years prices.

Has there ever been a chart that screamed to invest early and often as much as this chart. During every single one of these twenty-year time frames the market fell. In fact, it fell by more than 20% multiple times during each of these time frames.

Elbows Deep

We are elbows deep in a host of political, geopolitical, economic, and societal issues that just seem to compound on themselves. If we hire too many people in America, it means inflation will continue going up, but if hiring slows down that means we might have a recession. There is a war in Eastern Europe that is having some impact on global supply chains and energy prices, but how much of an impact, and when will it end?

These are all great questions, and talking heads on TV are giving you their best guesses at the click of button. They are mostly wrong, or lucky, but that won’t stop them from spouting theories and lies, because that is their job. Your job as an investor, and my job as an advisor has nothing to do with performance or even having an answer for what Vladimir Putin is thinking. Our job is to create a plan together, that is specific to you and your family, and make sure you stay the course. The plan is the product, not the portfolio.

So What?

So how does this impact all of you?

- The plan is the product, not the portfolio

- Timeframe dictates Risk.

Stock market calendar this week:

| MONDAY, JUNE 13 | |

| 11:00 AM | NY Fed 1-year inflation expectations |

| 11:00 AM | NY Fed 3-year inflation expectations |

| TUESDAY, JUNE 14 | |

| 6:00 AM | NFIB small-business index |

| 8:30 AM | Producer price index final demand |

| WEDNESDAY, JUNE 15 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding vehicles |

| 8:30 AM | Import price index |

| 8:30 AM | Empire state manufacturing index |

| 10:00 AM | NAHB home builders index |

| 10:00 AM | Business inventories |

| 2:00 PM | FOMC statement |

| 2:00 PM | FOMC projections |

| 2:00 PM | Fed Chair Jerome Powell news conference |

| THURSDAY, JUNE 16 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 8:30 AM | Philadelphia Fed manufacturing index |

| FRIDAY, JUNE 17 | |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Leading economic indicators |

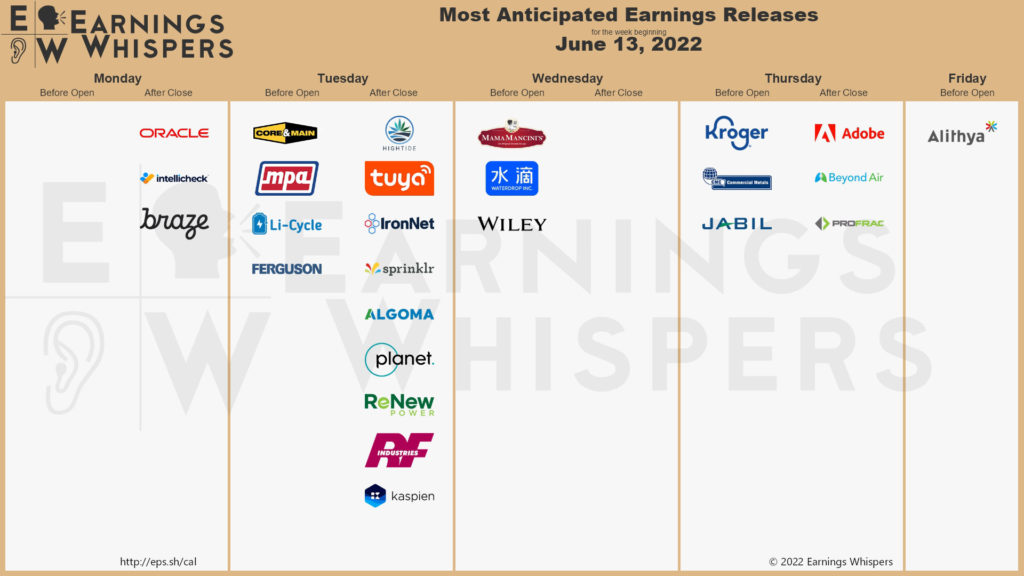

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.