June 20, 2022

Forefront’s Monday Market Update

What’s Next

Does anyone else receive a ton of emails about subscribing to someone’s newsletter, where they tell us that the world is ending, the dollar is worthless, and the only thing we can do now is to buy gold? I have always gotten a handful of these spam emails, but since the market has corrected and slipped into bear market territory, the number of emails has quadrupled.

I inquired about a well-known doomsday newsletter this weekend, and to my surprise, when they asked me to pay for the subscription, they wanted payment in dollars. When I asked why they wanted payment in dollars, the representative did not have an answer when they predicted the dollar would be worthless in the next 18 months.

These times of spam emails and broader-based scams become more prevalent when emotions and fear elevate. The same goes for articles and blog posts like “How to Predict a Market Bottom” or “The three things that must happen for the market to bottom.” If only it were that easy.

Instead of making pure speculation predictions, let’s look at the data available to us and understand it better.

CPI

CPI, or, to give you its full name, the Consumer Price Index for All Urban Consumers (CPI-U), is the most widely cited inflation metric that we will all hear. CPI-U is not the only way the government gauges inflation but is the most commonly used metric.

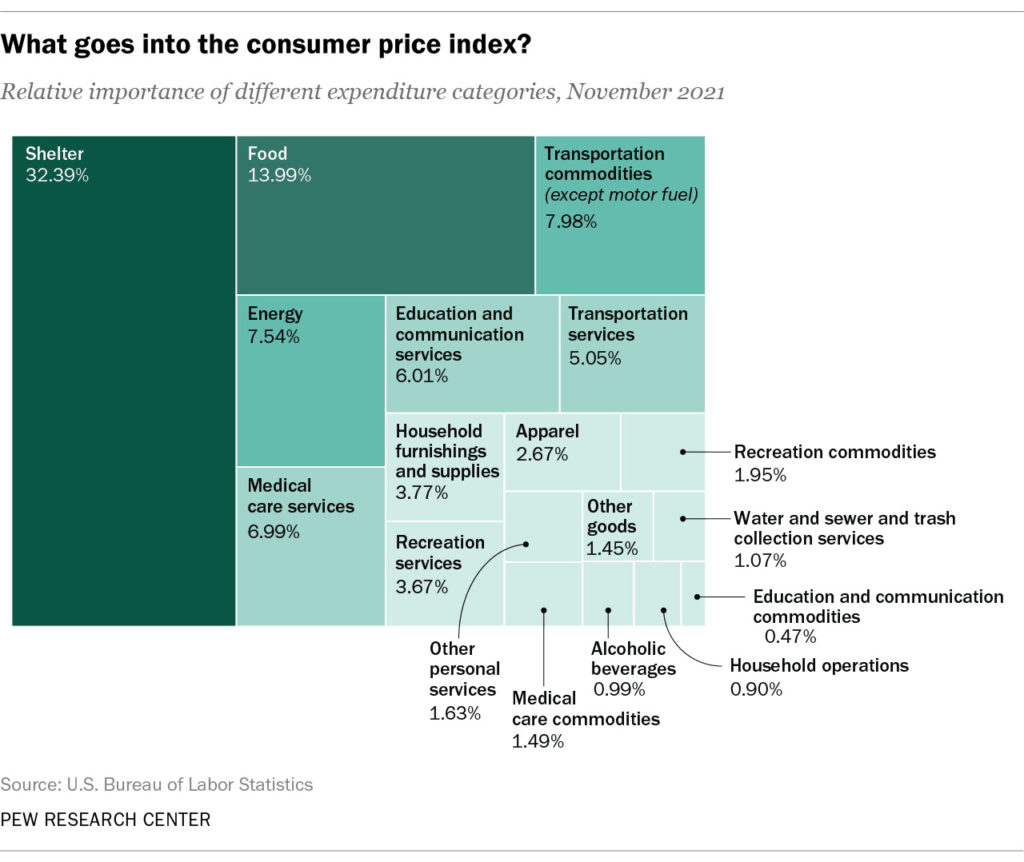

The chart above will show you what goes into the CPI number, and as you can see, shelter, food, energy, and transportation costs except motor fuel make up a significant chunk of the inflation gauge.

What gets omitted when hearing the CPI number parroted is that the Consumer Price Index is essentially backward-looking. The CPI number we received earlier in June looks at April’s housing and used car markets. With the 30-year mortgage jumping from just over 4% in April to just over 6% now, it is fair to say that the housing market of April does not reflect the current housing market. The same goes for the price of used cars. As financing has become more expensive, the demand for used vehicles has softened, and prices have begun returning to earth.

We are already seeing embedded data showing inflation is moderating and will begin to fall as the year progresses, but we won’t hear that when just the CPI numbers get reported. Diving into the data provided and understanding its context is the only way to make financial decisions.

The Stock Market is Not the Economy

Everyone has heard me say this, and I will repeat it. The stock market is not the economy!

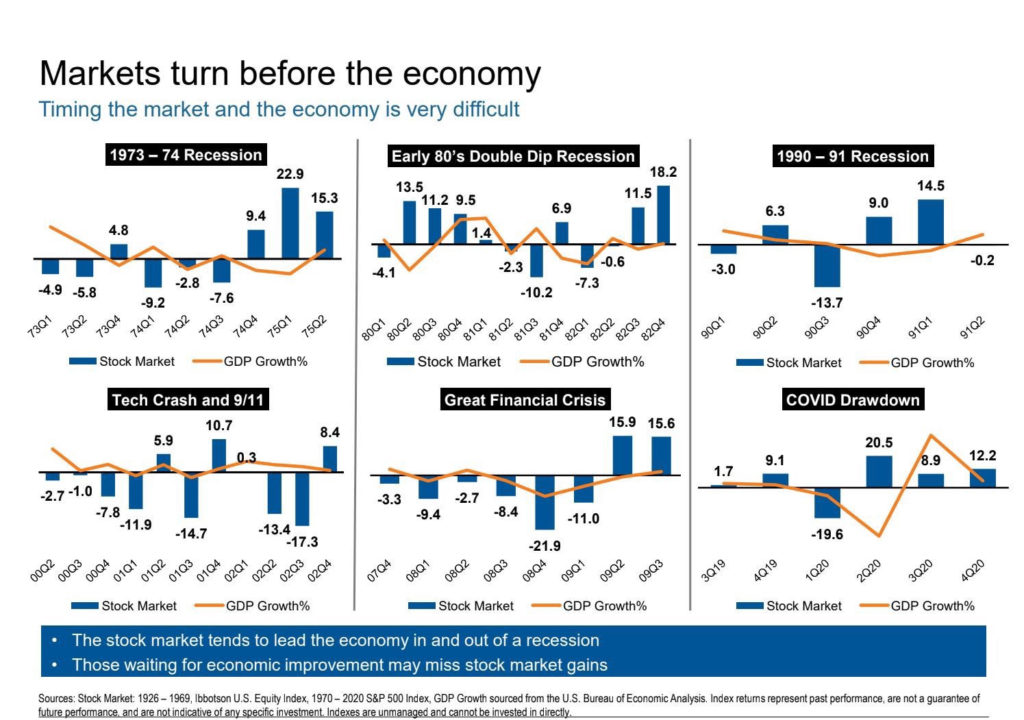

If this chart tells you anything, timing the market is nearly impossible. The market will turn even while we get less than stellar economic news.

The stock market and the economy do not work in lockstep. In fact, during most economic corrections and recessions, the stock market will begin to turn before the economy.

If you are fearful now, imagine your advisor telling you to put your money back into the market when things look even worse! That is what timing the market means. Selling now when you are scared and panicked, but reinvesting that money into the market when things worsen. That doesn’t seem likely.

What it All Means

Earlier in June, we received the May jobs number, which indicated a higher-than-expected number of new jobs. This data is a good thing, and the market promptly sold off. Wages continue to increase for hourly employees across retail and food services, which is good. The market still sold off. Even when we get good news, it’s bad news, indicating where we stand.

Markets don’t know what they want, making for the most volatile of markets. Clarity and direction are what market participants seek; indecisiveness and a murky outlook are what we have at the moment.

We all know inflation is too high, so we need inflation to come down. For this to happen, we need spending to slow down; thus, the Fed has raised rates to make spending on things like houses much more expensive. Housing is a massive driver of overall economic activity, and affording a place has become much more costly. The fewer people buying homes, the fewer people buy new dishwashers, paint the walls, change the carpet, and install an alarm system.

Suppose people stop buying houses though the economy will begin to slow down, which will lead to a recession. So as interest rates go up and fewer people buy homes, the market goes down. We want inflation to regulate, so we want Americans to spend less, but when Americans spend less, we are scared of a recession. Do you think any of this makes sense?

Forefront’s Opinion

Although inflation is eating into buying power, it has not stopped the US consumer from continuing to spend. The US consumer is continuing to spend because the bottom 20% of America’s wages are rising for the first time in a long time, and those people are gaining the ability to become more significant consumers in our economy. Although this has resulted in highly elevated inflation, as I pointed out earlier, we are starting to see inflation curtailing if we dive into the data.

This additional spending should keep whatever recession our economy goes into reasonably shallow. We may even see the markets turning as the data says the US economy is in a recession. The reality is that we are already in a recession and will be working our way out of it before the backward-looking data can put a title to it.

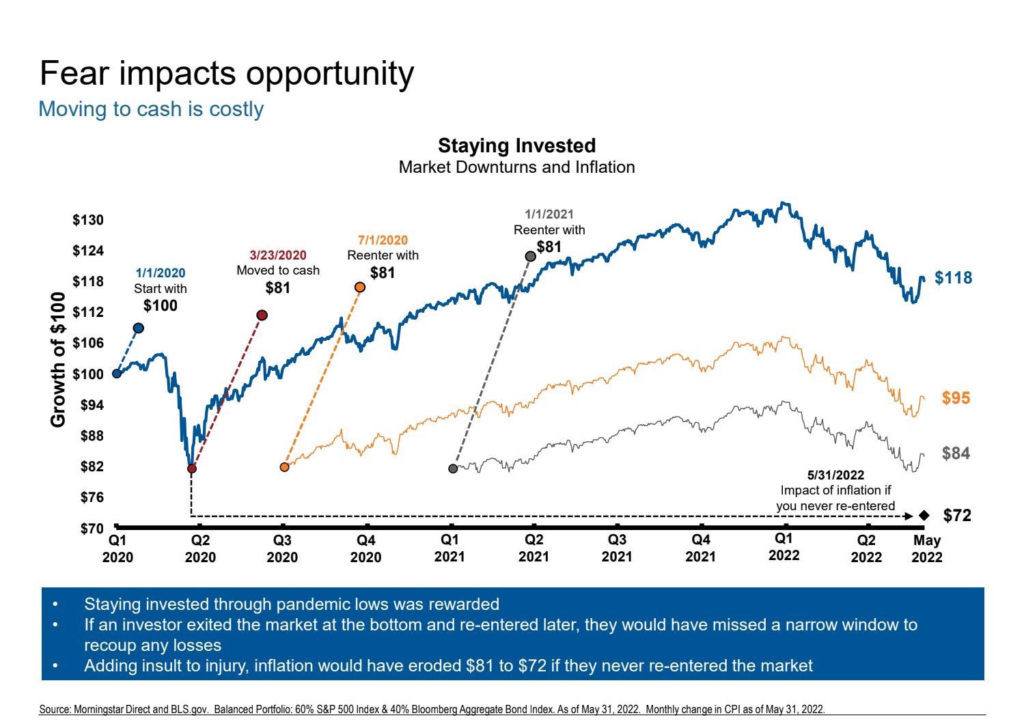

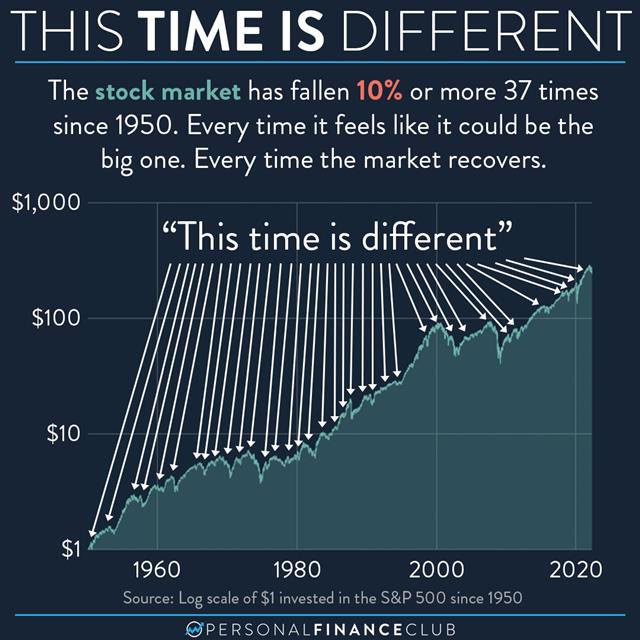

Going to cash or deviating from your plan is foolish. This time isn’t different. The market will recover.

So What?

- Wages are rising for hourly employees, which will lead to more spending, resulting in whatever recession we see being shallow.

- Deviating from your plan or going to cash is foolish, the market will recover, but this time isn’t different.

Stock market calendar for this week:

| MONDAY, JUNE 20 | |

| Juneteenth holiday. No indicators scheduled | |

| 12:45 PM | St. Louis Fed President James Bullard speaks |

| TUESDAY, JUNE 21 | |

| 8:30 AM | Chicago Fed national activity index |

| 10:00 AM | Existing home sales (SAAR) |

| 12 noon | Cleveland Fed President Loretta Mester speaks |

| 3:30 PM | Richmond Fed President Tom Barkin speaks |

| WEDNESDAY, JUNE 22 | |

| 9:30 AM | Fed Chair Jerome Powell testifies on monetary policy at Senate Banking Committee |

| 12:50 PM | Chicago Fed President James Bullard speaks |

| THURSDAY, JUNE 23 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Current account deficit |

| 9:45 AM | S&P Global U.S. manufacturing PMI (flash) |

| 9:45 AM | S&P Global U.S. services PMI (flash) |

| 10:00 AM | Fed Chair Jerome Powell testifies on monetary policy at House Financial Services Committee |

| FRIDAY, JUNE 24 | |

| 7:30 AM | St. Louis Fed President James Bullard speaks |

| 10:00 AM | UMich consumer sentiment index (final) |

| 10:00 AM | 5-year inflation expectations (final) |

| 10:00 AM | New home sales (SAAR) |

| 4:00 PM | San Francisco Fed President Mary Daly speaks |

There will be no Forefront Market Notes on Monday, June 27th, 2022. I will be in Disney World with my family, and although I am always available for my clients, I will take a one-week break from the Forefront Market Notes.