June 6, 2022

Forefront‘s Monday Market Update

What If There Is a Recession?

A recession means 2 consecutive quarters with negative GDP. Q1 of 2022 already came in with negative GDP, and maybe Q2 will do the same. It does feel odd to think that our economy might be in a recession while unemployment is at rock bottom, hiring continues, wages are up, and spending continues to be robust. Yet, supply chain issues, and rising interest rates have thrown our economy into a bit of chaos. We have to remember; the stock market is not the economy!

The word recession scares most people, but let’s take a look at the data, and try and calm some of those emotions.

The stock market can go up in a recession

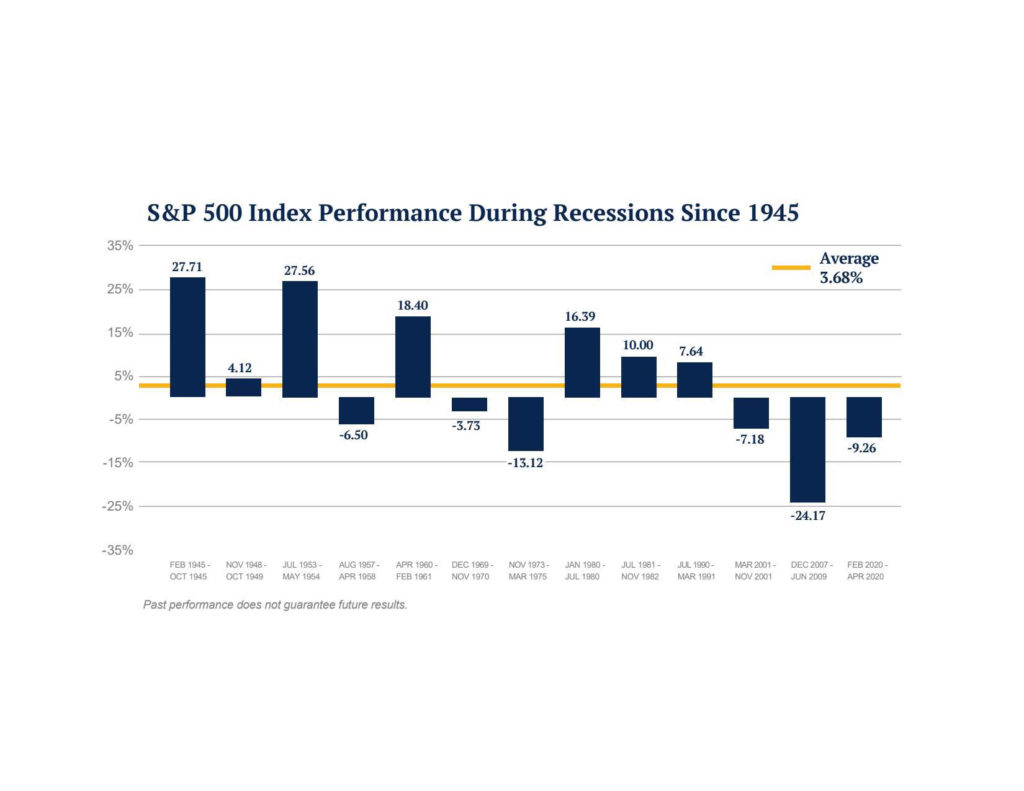

Take a look at the chart below, and you will notice that the stock market doesn’t always go down when the U.S economy is in a recession. Remember when I said the stock market is not the economy? The S&P500 has actually gone up in more than half of all U.S recessions since 1945. Seven out of the past thirteen to be exact.

Markets look ahead

As markets are generally more forward looking, the market tends to reprice with a six-to-twelve-month outlook during a recession. So, it would make sense that periods leading up to actual recessions were typically negative, while markets were well into recovery during the actual event. According to Forbes, since 1953, in the six months prior to recession, the S&P 500 averaged a return of -2%, while in the six months after a recession had started, the S&P averaged a return of 7%. Looking 12 months after the start, the average return is 16%.

All recessions are scary

All recessions are scary regardless if you are just entering the workforce, saving to buy a new house, or preparing an income distribution plan in retirement. Everyone’s journey through life is at a different point, and the emotional impact of a recession is far more damaging most times than the financial impact. Investors have lived through countless recessions, and survived. You will survive too. Reading those words aren’t going to be the reason you sleep at night, but reviewing your financial plan, and talking to your advisor will prove to be paramount in your success through the remaining months of uncertainty.

So What?

So how does this impact all of you?

- The stock market can go up during a recession.

- Regardless of the data, recessions are still scary. Talk to your advisor to help keep emotions from giving you anxiety.

Stock market calendar this week:

| MONDAY, JUNE 6 | |

| None scheduled | |

| TUESDAY, JUNE 7 | |

| 8:30 AM | Foreign trade balance |

| 3:00 PM | Consumer credit |

| WEDNESDAY, JUNE 8 | |

| 10:00 AM | Wholesale inventories revision |

| THURSDAY, JUNE 9 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 12 noon | Real household net worth (SAAR) |

| 12 noon | Real domestic nonfinancial debt (SAAR) |

| FRIDAY, JUNE 10 | |

| 8:30 AM | Consumer price index (monthly) |

| 8:30 AM | Core CPI (monthly) |

| 8:30 AM | CPI (year-over-year) |

| 8:30 AM | Core CPI (year-over-year) |

| 10:00 AM | UMich consumer sentiment index (preliminary) |

| 10:00 AM | 5-year inflation expectations (preliminary) |

| 2:00 PM | Federal budget balance |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.