Forefront’s Monday Market Update

Being rich

In 2018 my wife and I brought my son and daughter, then 5 and 4 yrs. old, to India with my brother and his family, as well as my parents. It brought back a wave of memories of my own trips to India as a child, and I wondered how my children would react to an entirely new culture, people, food, sights, and sounds.

As the trip progressed, I watched my daughter, Priya, disappear each morning during breakfast, and reappear about 2 minutes later. She would grab a stack of bread slices, and some fruit, and run out of the same doors I ran out of as a child. Instead of my grandmother yelling after me to be careful, Priya had her own grandmother (my mother) yelling at her to be careful.

I followed her on one of her jaunts outside, and she was bringing bread to the stray dogs, and as much fruit as the biggest bowl she could find would hold to the poor, and homeless children that litter the streets of India.

Priya, was and is rich. She has more than she requires to live a happy life, and when her belly is full, she makes sure those who don’t have enough, can have some of hers, whether they have 2 legs or 4.

I wish I had come up with this, but alas a far better content creator than me, named Scott Galloway, came up with the algebra of wealth.

Focus

Most people are going to read this and think focus means you should concentrate on your goals. Head down and keep moving forward. Or one of the 100 other sayings on inspirational calendars under the bolded letters FOCUS. What this actually means in the algebra of wealth is to focus on yourself. Not just yourself, but putting yourself in the best position to succeed and be financially successful. Focus on your education and certifications in your field of work. Focus on the relationships in your life that will bring you long term happiness. Focus on your spouse, and invest in your relationship every day. After all the algebra of wealth is for the both of you.

Stoicism

Understanding what you can, and can not control is paramount to wealth building. You can’t control the stock market, but you can control your savings rate is something I probably say 25 times a week. What we don’t discuss much when talking about control is our reactions. We control how we react to temptation and to fear. Not being able to stay stoic and disciplined in a society of overindulgence and abundance can make building wealth nearly impossible. It doesn’t matter what kind of car your neighbor drives, what matters is what you can control. Remain calm, and stay disciplined.

Time

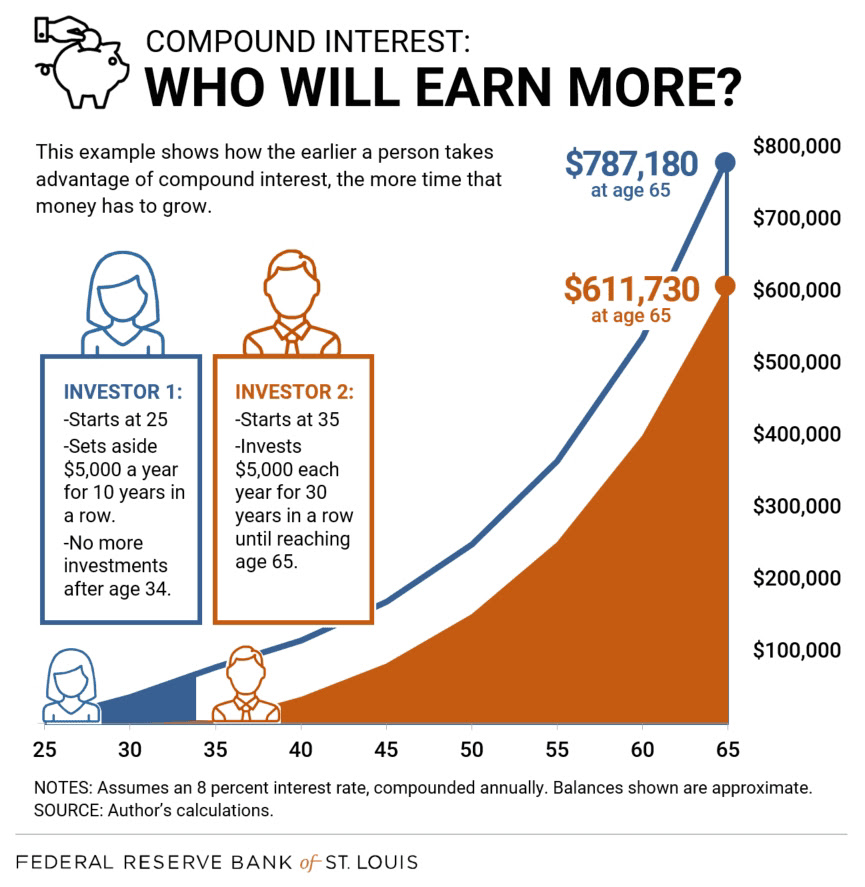

Squander money, and you can earn it back. Squander time, and it’s lost forever. It is our most valuable commodity, and also our greatest asset in building wealth.

When I tell people thinking about hiring me and my firm as their financial planner that I have very little to do with performance they look at me a little funny. I have to explain that advisors who talk about performance are taking credit for something we have no control over.

The stock market on a day-to-day basis is about as rational as Priya is when she wants to wear her dress up shoes to school, in the winter, with snow on the ground, and no socks. I can’t make the market go up or down, but what I can control is getting you exposed to the market for the longest time frame possible.

Although day to day the market might be irrational, over a long period if time there is a pretty consistent upward trend. You don’t need to get in at the bottom and out at the top, you just need to ride the trend upwards, for as long a time as possible.

Compounding is the most powerful force in the world, and this isn’t just about the investments we make with our money. Think about the investments you have made with your time and effort, and how the results in your career, relationships, and life have compounded over time.

Diversification

Diversification means always having to say you’re sorry. This one is pretty straight forward. Don’t blow yourself up. This doesn’t just mean when investing, it means in life. Don’t count on one skill to propel your career, or one stock to propel your portfolio. Diversify in investments, in knowledge, and in life skills.

Following this formula of building wealth is what also lets you focus on what “being rich” is to you.

So What?

So how does this impact all of you?

- Wealth = focus + (stoicism x time x diversification)

Stock market calendar this week:

| MONDAY, FEB. 7 | |

| 3:00 PM | Consumer credit |

| TUESDAY, FEB. 8 | |

| 6:00 AM | NFIB small-business index |

| 8:30 AM | International trade |

| 11:00 AM | Real household debt (year-over-year) |

| WEDNESDAY, FEB. 9 | |

| 10:00 AM | Wholesale inventories (revision) |

| 10:30 AM | Fed. Gov. Michelle Bowman speaks |

| 12 noon | Cleveland Fed President Loretta Mester speaks |

| THURSDAY, FEB. 10 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Consumer price index (month-to-month) |

| 8:30 AM | Core CPI (month-to-month) |

| 8:30 AM | Consumer price index (year-to-year) |

| 8:30 AM | Core CPI (year-to-year) |

| 2:00 PM | Federal budget |

| 7:00 PM | Richmond Fed President Tom Barkin speaks |

| FRIDAY, FEB. 11 | |

| 10:00 AM | UMich consumer sentiment index (preliminary) |

| 10:00 AM | UMich 5-year inflation expectations (preliminary) |

Most anticipated earnings for this week: