Forefront‘s Monday Market Update

Inflation, the economy, and recession. Simplified.

The month of January comes to an end today, and for investors, January has been down right scary!

We ended on a high note last week, but that doesn’t change the fact that major indexes are 10-15% lower than their November highs.

Like I try and do each week, my goal is to help educate and guide all of you, and I do that using facts, data, and visuals such as charts. No amount of data or charts are going to be enough to completely assuage your feelings of concern, and fear. That isn’t the goal though, the true goal is to give you just enough so that those concerns and fear, don’t turn into panic and emotional decision making.

Sometimes, no amount of data helps you sleep at night, so instead let’s try to understand what is going on right now, and give ourselves some perspective.

Formula 1 and Inflation

I love Formula One Racing. I never thought I would be a fan of auto racing, and I don’t particularly care for Nascar, but something about F1 cars intrigue me.

The economy and an F1 engine have a lot in common, mainly that they are both very particular, and can lose power or overheat very quickly.

Drivers of F1 cars have to maintain a balance of acceleration, and coming off the throttle, to prevent overheating and the engine stalling or exploding, sending them into a wall at 180 MPH.

The economy is the same way, and instead of our engine stalling and us crashing into a wall, one of the ways the economy shows signs of overheating is through inflation. We can come off the throttle by raising interest rates, which the Fed has given a clear indication they will be doing, perhaps as early as March, but we have to make sure we don’t overheat.

If an engine gets too overheated though, there isn’t much you can do to pull it back, much like the economy. Those who lived through the hyper inflation of the 1980s, remember an economy so overheated that no amount of Fed intervention could bring inflation back to earth.

Thankfully we have seen a willingness by the Fed to fully prevent the economy from overheating, even if in the short term it causes volatility.

Always a reason to sell

Every single year, the economy, markets, politics, geopolitical risk, and 100 other things can give traders, and individual investors a reason to sell.

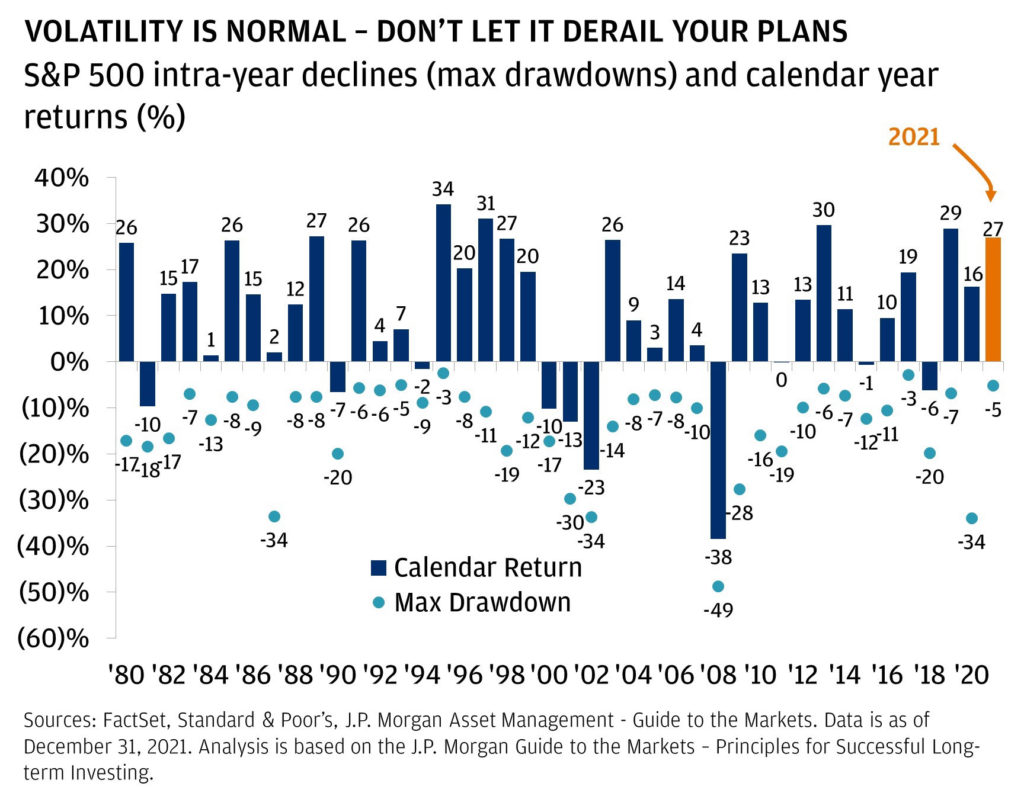

Almost every single year since 1980 have we been in negative territory at some point throughout the year, but in a vast majority of those years, we finish the year positive. This isn’t a prediction for what may happen in 2022, but it is meant to give us perspective.

Volatility is completely normal. I won’t let it derail your plan!

The End

I am being asked the same question these days. “Where is the bottom?” “When will the drop be over?”

I wish I knew, but what I do know is that consistency and time are the way to make money in the markets overall.

Many will say they don’t have as much time due to their age, but even you need to allow for market volatility, and buffer it through a plan of cash and fixed income.

Carl Richards has a great illustration that helps put investing into perspective. Take a look below, but don’t hesitate to call me when those day time swings have your stomach feeling like you just took a ride in the F1 car from earlier.

So What?

So how does this impact all of you?

- Volatility is completely normal, do not let it derail your plan

- What are you focused on in your investing plan? Today, or the future

Stock market calendar this week:

| MONDAY, JAN. 31 | |

| 9:45 AM | Chicago PMI |

| 11:30 AM | San Francisco Fed President Mary Daly speaks |

| 12:40 PM | Kansas City Fed President Esther George speaks |

| TUESDAY, FEB. 1 | |

| 9:45 AM | Markit manufacturing PMI (final) |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Job openings |

| 10:00 AM | Job quits |

| 10:00 AM | Construction spending |

| WEDNESDAY, FEB. 2 | |

| 8:15 AM | ADP employment report |

| 10:00 AM | Home ownership rate |

| THURSDAY, FEB. 3 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Productivity (preliminary) |

| 8:30 AM | Unit labor costs (preliminary) |

| 9:45 AM | Markit services PMI (final) |

| 10:00 AM | ISM services index |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital equipment orders (revision) |

| FRIDAY, FEB. 4 | |

| 8:30 AM | Nonfarm payrolls (month to month) |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings (month-to-month) |

| 8:30 AM | Labor-force participation rate 25-54 |

Most anticipated earnings for this week: