May 15, 2023

Mother’s Day and Debt Ceilings

Happy Mother’s Day to all the incredible moms who give the best hugs have magical booboo-fixing kisses, and bring order to the chaos of life. I wouldn’t have been able to achieve half of what I have accomplished without my mother’s support and my wife, Christina. One of my mother’s best lessons will serve us all well in the coming weeks, “don’t believe everything you hear.”

Debt Ceiling

The debt ceiling is a cap on how much debt the federal government can accumulate. Before 1917, for every treasury auction, Congress would have to pass a new law just for that one auction. During World War I, the government was borrowing so much, we changed to our current debt ceiling structure. The debt limit has been raised 78 times in the past 63 years. This is not a Democrat or Republican issue, nearly every president has raised the debt limit while in office since 1960, regardless of political affiliation. The political theatre only started in 2011 when Republican Speaker John Boehner was in a standoff with the Obama administration about paying for debts accrued under the Bush administration. At one point in 2011, the stock market was down intraday by 20% because of how close the USA came to a historic default.

What if it isn’t Raised?

The stock market will be impacted, but to what degree is yet to be seen. In addition, the US would not be able to make payments to its legal obligations such as Social Security, Medicare benefits, and military salaries, to name a few.

The US has never failed to make a debt payment, which makes it so easy for the US Government to sell Treasury bonds to investors across the globe, and why the US dollar is one of the most trusted currencies. A default would destroy that confidence and damage the US’s stature within the global structure for years to come.

Although I don’t believe our politicians are dumb enough to allow a default, I have been wrong before, and our politicians are all terrible. Just remember that the talking heads on TV will do everything in their power to drum up fear and anxiety because those emotions will keep you watching. Everyone from Jim Cramer to Sean Hannity will be all about the doom and gloom of a default.

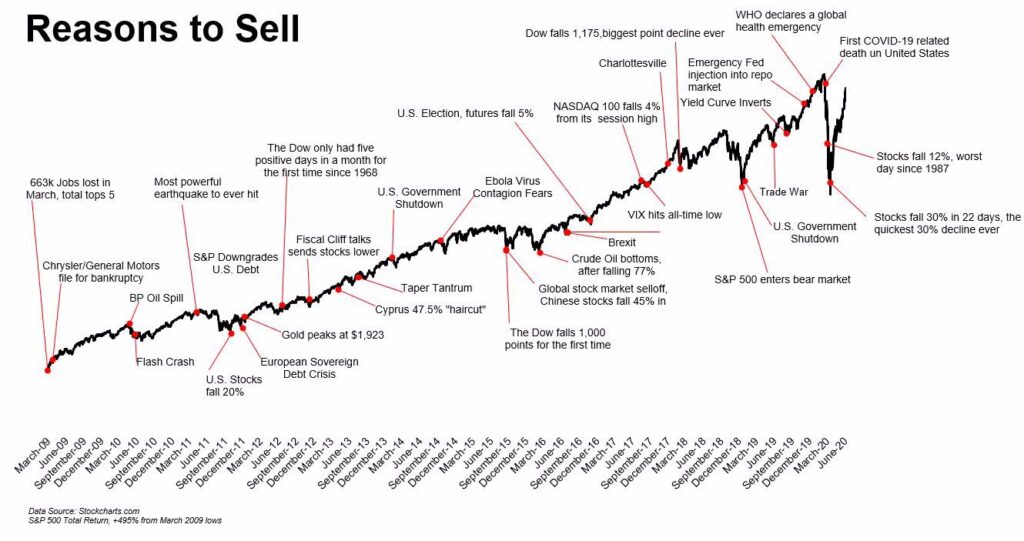

I wish I had a crystal ball to see how this will all play out, but I do know that over the past decades, there have been countless reasons to sell or not invest at all, and you would have been wrong to do either of those things at any of those times.

Stock market calendar this week:

| MONDAY, MAY 15 | |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | Chicago Fed President Goolsbee on TV |

| 9:15 AM | Minneapolis Fed President Kashkari speaks |

| TUESDAY, MAY 16 | |

| 8:15 AM | Cleveland Fed President Mester speaks |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| 10:00 AM | Fed Vice Chair Barr testifies |

| 10:30 AM | Richmond Fed President Barkin speaks |

| 12:15 PM | New York Fed President Williams speaks |

| 2:30 PM | Chicago Fed President Goolsbee on TV |

| 7:00 PM | Atlanta Fed President Bostic and Chicago Fed President Goolsbee on panel |

| WEDNESDAY, MAY 17 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| THURSDAY, MAY 18 | |

| 8:30 AM | Philadelphia Fed factory survey |

| 8:30 AM | Initial jobless claims |

| 9:15 AM | Fed Gov. Philip Jefferson speaks |

| 9:30 AM | Fed Vice Chair for Supervision Barr testifies |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, MAY 19 | |

| 8:45 AM | New York Fed President Williams speaks |

| 11:00 AM | Fed Chairman Powell and former Fed Chairman Bernanke on panel |

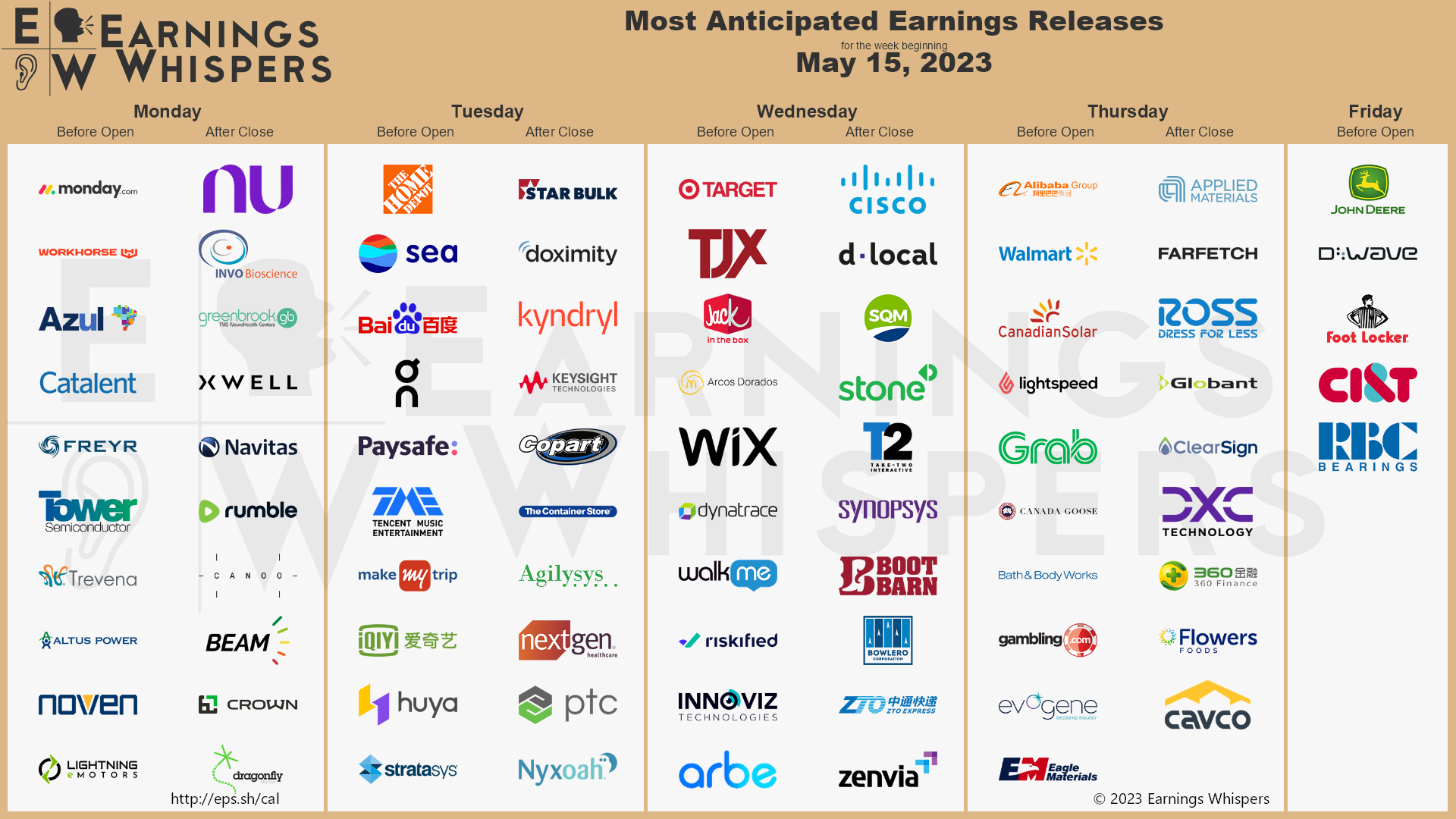

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.