Getting Back to Normal

Schools are opening in NJ next year with no remote option being provided to parents. The mask mandate is going to be over on Friday, May 28th, and Covid case numbers should be below a 10K average within the week. Things are slowly but surely getting back to normal. One of the incredible shifts that has taken place during Covid has been the gambling mentality that has taken over stock investing.

The Gambler

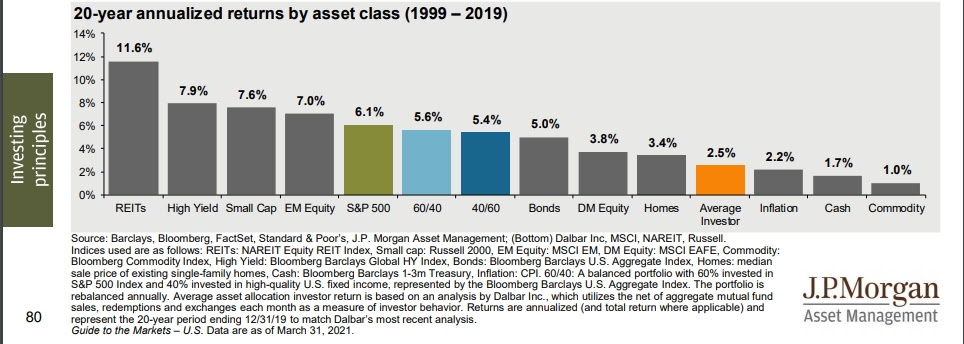

The chart above analyzes data for over 20 years and shows that the average investor did just .8% better than if they had just had that money in cash in the bank. .8%, that’s it!

I am sure throughout all of this you have heard your neighbors, friends, or even your children tell you about how much money they have made trading XYZ stock, or cryptocurrency, or whatever the flavor of the week is at the time. As the world returns back to normal, so does human nature and the belief that we can beat the market. I hate to be the bearer of bad news, but we can’t beat the market, not consistently at least.

Talk is cheap

Just like many of you on social media, you see posts from friends about their Cryptocurrency holdings, or diamond hands etc. They are all playing the short game, they are trying to win each individual day without stepping back and looking at investing as an overall, long-term plan. That doesn’t mean you can’t have a fun trading account, on the contrary I encourage all of my clients to have one. It should only be between 5-10% of your total investible assets, and YOLOing all of your money into the next hot stock is not going to work out long term.

Investing and Saving = freedom

The pandemic has made it abundantly clear that many people invest so that they can brag about investing. They aren’t savers, they are traders and over time that never works. There is another side to this story though.

While the gamblers have come out in droves, I have also watched more people find ways to save voraciously and put themselves on a path to freedom years earlier than they thought. Gambling and trading buy you short term bragging rights and a euphoric feeling. Long-term saving and investing, buys you freedom. The freedom to do what you want, when you want, with whom you want, and for however long you want.

Think about that for a second? Would you love to go to the beach right now with your spouse, or children and spend 2 weeks doing nothing? Me to, and that’s what we all save and invest for, to get to the point where we can do whatever we want, whenever we want. Don’t let a return to normalcy let you lose sight of what planning and saving is really for.

Disciplined saving/investing = freedom

So What?

So how does this impact all of you?

- Disciplined investing and saving = Freedom

- Don’t let peoples braggin make you think you missed the boat

Stock market calendar this week:

Tuesday May 25th:

Case-Shiller National Home Price Index (12 month change) @ 9:00AM

Thursday May 27th:

Initial and continuing Jobless Claims @ 8:30AM

Friday May 28th:

Core Inflation @ 8:30AM