Panic selling will ruin years of good investing decisions

Yes, even once, panic selling will ruin years of good investing decisions. That is a really factual statement and easy to write. It is much harder to put into practice when the market is plummeting and you need to maintain your investing discipline. A classic case of easier said than done!

Conviction enables patience

Having conviction in what you own is paramount to allowing yourself to have patience. Patience builds wealth! Research builds conviction, but for most of you who don’t have an extra six hours a day to research the holdings in your portfolio, that conviction will come from understanding the process that was used to create not just your portfolio, but your overall plan.

Trust the process

I don’t like this phrase. It seems like a way to just say “this isn’t working right now, but it will……eventually.” That’s a normal brain talking there, but what you need to do is push that voice out and remind yourself that everything has a process. We have a friend who is due with her 3rd child very soon, and she is ready for her to come out. Regardless of how fed up with the process she might be, the baby will be introduced to the world when she is ready. Trust the process.

Know what you own

When it comes to financial plans, and portfolios the most important thing for my clients, is understanding WHAT you own, and WHY you own it. Buying something because it pays a high dividend is not knowing why you own something. My wife and I love using products, or frequenting stores of companies that we own. It lets us feel like we are a part of something, and that helps us remember WHY we own that particular company, even during the tough times.

What drives growth?

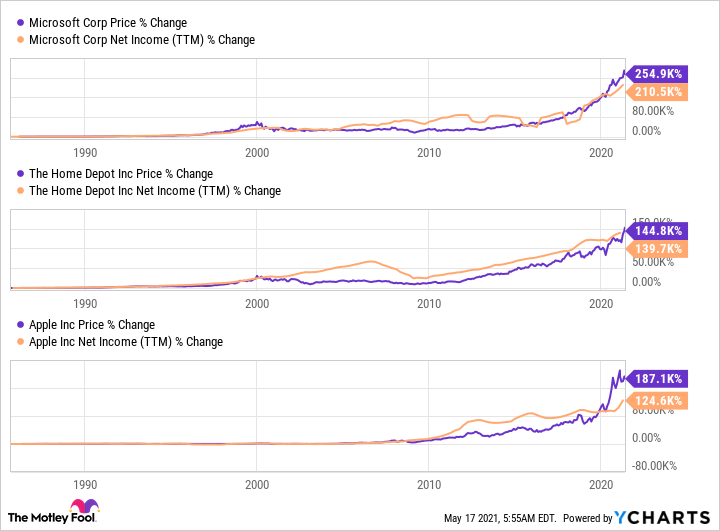

This is a fundamental question that all of us need to remember the answer to. In the short term, your emotions, and computer algorithms determine stock prices. If you are a gambler or day trader this is the world you live in. This is not the world a majority of us live in, but it is the world reported to us via the media every single day. Profit growth is what drives long term stock prices. Take a look at the charts below, you will notice net income growth and stock price are tied pretty closely together.

Last Example

So, before I get too boring and technical let’s talk about Amazon for a second. Let’s consider the history of their stock price.

It has declined:

10% – 30 times

20% – 14 times

30% – 8 times

40% – 5 times

50% – 4 times

90% – 1 time

Returns since IPO: 164,400%

Having conviction, knowing what and why you own something and understanding what drives long-term growth all enables patience, and patience builds wealth!

So What?

So how does this impact all of you?

- Understand the process to build conviction

- Conviction enables patience, and patience builds wealth

Stock market calendar this week:

Wednesday May 19th:

FOMC Minutes @ 2:00PM

Thursday May 20th:

Initial and Continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week