HELP MY TAXES ARE GOING UP!!!

President-elect Biden has been inaugurated and gets a name change. Now he is simply President Biden, and with that comes with it more questions than answers. The major question I keep hearing is more of a statement……” help my taxes are going up!!!”

Two weeks ago, I broke down the entire Biden/Harris Tax plan. You can read about it here, or listen to the podcast breaking it down even further here.

So, lets address the elephant in the room. What do we do if our taxes go up?

Efficiency, like Tom Brady

Is anyone else amazed that Tom Brady is going to his 10th Superbowl, and that when he went to his first Superbowl, Patrick Maholmes the Chiefs QB was in kindergarten. Tom Brady is efficient with everything that he does, both on the field and off the field. Taxes are the same way, there isn’t just one thing you can do but a lot of small things you can do to make sure you are being tax efficient. Let’s go through a few to implement for 2021 and beyond.

Low hanging fruit first

- First things first, make sure you are maxing out your company 401K/403B plans.

- In 2021 if you are under the age of 50 you can contribute $19,500

- Over the age of 50 can contribute $26,000.

- These limits haven’t changed in 2021 from the 2020 limits.

That immediately comes off your income, reducing your taxable income and accomplishing a goal of saving for retirement.

After you have built up an emergency fund, building to the point where you are maxing out your retirement plan contribution is step number 2.

- The second thing you should do is find out your eligibility for a Health Savings account and put in the maximum contribution.

- Eligibility for an HSA depends on your health insurance plan.

- If you have an annual deductible of $1,400 or more as an individual and an out-of-pocket maximum of $7,000 or less, you’ll qualify for an HSA.

- If you’re saving on behalf of a family, you’ll need a deductible of $2,800 or more with an out-of-pocket maximum of $14,000.

Assuming you qualify, the 2021 HSA limits are:

- $3,600 for individuals under 50

- $7,200 for families when the plan participant is under 50

- $4,600 for individuals 55 and older

- $8,200 for families when the plan participant is 55 and older

An unpopular opinion

I know I might be biased, but use a professional. The $400 savings you get from using your local H&R Block or AARP location is not worth the headache if you get audited. Creating a relationship with a tax professional will allow them and your financial planner to communicate and work as a team on your behalf. I know we all try and be as cost effective as possible but giving up safety for cost savings is a recipe for disaster. Cars would be a lot cheaper if our cars were built with less steel and no airbags but on the off chance, we get T boned, we are all grateful we paid extra for the safety measures. Not only does using a professional protect you, over time they will provide more savings in the form of tax efficiency.

So What?

So how does this impact all of you?

- The time to be tax-efficient is now, not the end of the year

- Taxes might go up, but being prepared regardless will save you money

The stock market calendar this week:

Wednesday Janurary 27th

Jerome Powell Press Conference @2:00PM

Thursday January 28th

Initial and continuing Jobless Claims @ 8:30AM

Most Anticipated Earnings for the Week

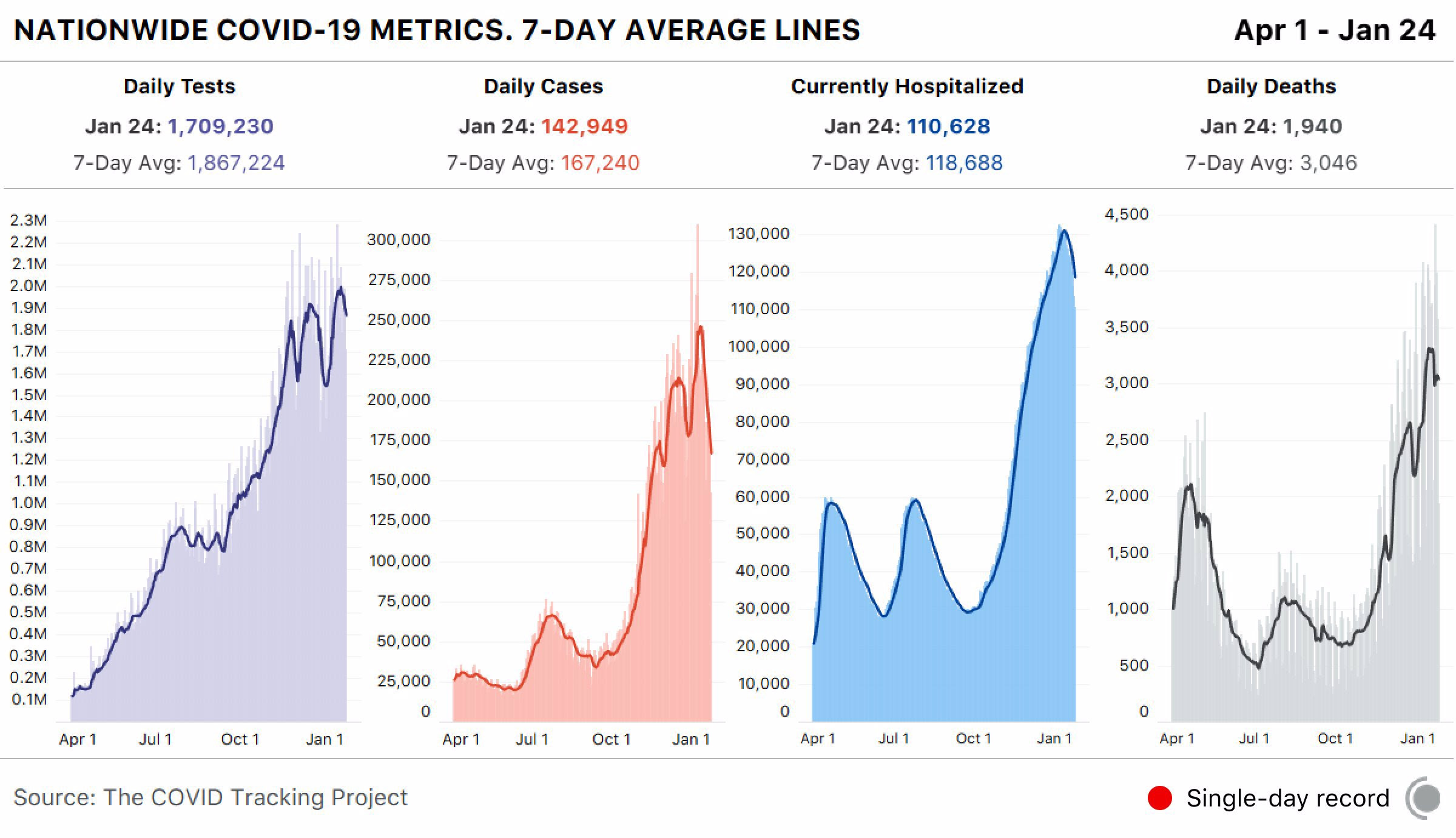

Latest Covid-19 Data