The catalyst to the correction

When Christina (my wife) and I first met I told her that one of the things she will have to deal with over time is how I watch sports. I yell at the TV, and although she thinks I am nuts, I let her know that the coaches and players can’t hear me, but they know what I’m saying. She accepted it and has lovingly mocked me for the past 15 years for it. The last straw was this weekend though…… I was yelling at a news reporter on TV.

First, if your head is spinning about what the heck a short squeeze even is, or any of the other jargon you are hearing on TV, I did an emergency podcast episode explaining everything in simple terms. Check it out here.

The “news” reporter was saying that the WallStreetBets short squeeze of GME and AMC was going to cause a market correction. He didn’t provide any data or insight, just kept repeating that retail investors have beaten hedge funds at their own game and this was the end!

He failed to mention a few things though.

- Since 1920 the S&P500 has on average recorded a 5% correction 3 times a year

- It has recorded a 10% correction every 16 months.

- It has recorded a 20% correction every 7 years

The 5% and 10% corrections are what help to shake the trees and wash out some of the novice investors who have gotten out ahead of their skis. These blips on the map help for people to realize that slow and steady wins the race, and trying to hit it big is not a likely strategy for success when it comes to investing.

To the moon!

Someone once asked me why we hold cash and bonds when the market is ripping higher. I always have to explain that my goal is to win the long-term game by surviving the short term. Think about how fast our cars would go without steel or airbags, but man do you appreciate those things in an accident.

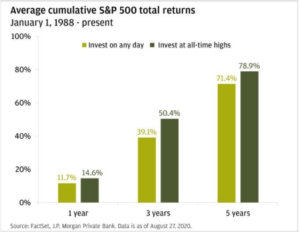

It is easy for us to lose sight of the risks in front of us, but once we see them. instead of acting accordingly, our emotions push us immediately into fear and panic. This leads us to inevitably try and zig and zag while trying to time the market. Take a look at the chart below and you will see that timing the market doesn’t work, and doesn’t matter.

Corrections happen, by why?

The market might correct, or it might not. If I had a definitive answer all of us would have our feet up on a beach somewhere instead of looking at snow piling up for many of us. Markets will correct because just like individual investors, sometimes it gets out ahead of its skis.

If this market were to correct it is because in the near term it has grown beyond the prospect of future earnings. Stock prices will adjust to reflect the correct earnings expectations and based on ongoing Covid progress, and setbacks. This is a good thing, its time to shake the trees and let some companies that shouldn’t be valued where they are come back to reality.

Corrections are good

We took my children to India in December of 2018 and one of the pieces of advice their pediatrician gave us over and over again was not to use anything like Imodium or Pepto. Her explanation is you want their body to flush out whatever is causing them discomfort, whether its food or germs.

Market corrections are the same, and are actually viewed as a healthy part of overall market growth. You need the market to flush out some companies and investors who have gotten ahead of themselves. Remember, right now in the market you have participants who think they are brilliant and CAN’T be wrong! This can result in a correction that is hard and fast, but shakes these people out.

What do I do?

Nothing! This isn’t the answer many want to hear because no action seems like you’re just letting something happen, but there isn’t anything you can do. The chart earlier shows that whether you invest at the high orsome other time, it doesn’t make a material difference. It’s best to build a plan, and then construct portfolios based on that plan that will allow you to stay invested. Remember, fundamentals are still in place, Covid vaccinations are going into people’s arms, and the Fed remains very supportive. If a correction does happen, markets will find a new starting point and good, high quality companies will be on sale. Everyone loves a sale!

So What?

So how does this impact all of you?

- Corrections happen, it’s healthy, but don’t let emotions take hold

- You lose money in a correction because of emotions.

Stock market calendar this week:

Wednesday February 3rd

ADP employment report @ 8:15AM

Thursday February 4th

Initial and continuing Jobless Claims @ 8:30AM

Friday February 5th

Non-Farm Payrolls and unemplyment rate @ 8:30AM

Most anticipated earnings for this week

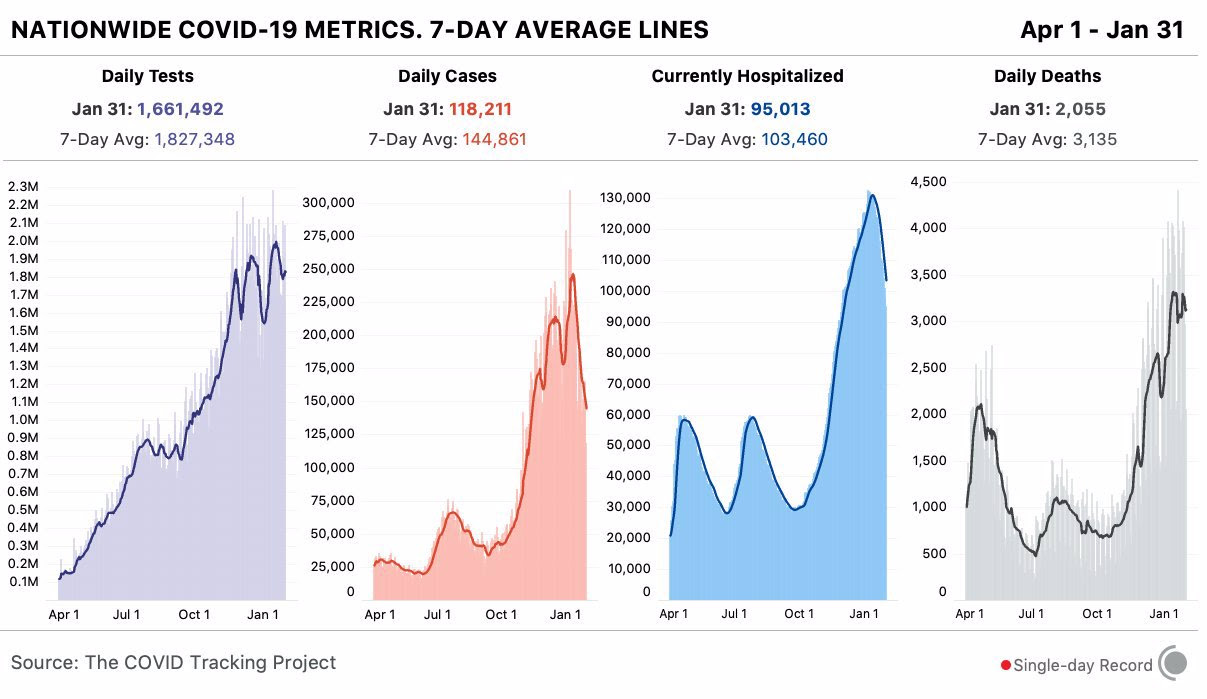

Latest Covid-19 Data