Are my taxes going up?

In a little over a week this nightmare of an election season will be over. A new president will be inaugurated, with new policies and different views on what is right for America than our last president. You may agree or disagree but there is no changing the inevitable and fighting against it is a sure-fire path to failure.

One of the major changes President-Elect Biden will attempt to implement is a change in the income tax structure which undoubtably is of major concern to all of you reading. If you listen to the media The Biden/Harris tax proposal is either going to make all of us pay 60+% in taxes like rapper 50 cent said on CNBC in November, or is the savior to our nation’s debt. Both of these couldn’t be further from the truth, and hopefully no one is taking financial or any sort of advice from rapper 50 Cent. The only thing that could be worse than that is taking advice from Kanye West.

The assumption many make is since Democrats have taken control of the Senate that all 50 senators will just rubber stamp whatever President Elect Biden proposes. Democrats will all want something of theirs done or included in exchange for voting yes. Because of this dynamic let’s take the proposed tax plan of Joe Biden with a slight grain of salt, understanding that it most certainly will change.

The Dilemma

Before the Donald Trump tax cuts business leaders had been discussing and lobbying for the corporate tax rate to drop from 35% to 25%. The final bill ended up lowering that tax rate to 21%. Now, hear me out for a second, no matter who won the election, corporate taxes were going to go up. They had to. We just added 7 trillion dollars to our nation’s debt! Raising government revenue was going to be a priority for whomever won the presidency.

The Tax Proposal

Below is a breakdown of the major points in the Biden Tax Proposal. Remember all of this can change, and most likely will change. To get a more in-depth analysis of each of these points, check out Episode 6 of my podcast Understanding the Power of Money. You will get a full breakdown of the proposal in under 15 minutes.

- Raising the marginal income tax rate from 37% to 39.6% for those making more than $400,000

- raising corporate taxes from 21% to 28%, and a 15% minimum book tax

- taxing long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6 percent on income above $1 million

- those making over $400,000 should be subject to an additional 12.4% Social Security payroll tax, split evenly between employers and employees.

Major changes are not expected in 2021 as President-Elect Biden will have to step in and deal with the Corona Virus pandemic and the inevitable fallout from the Duck Dynasty guys and a man dressed like Chewbacca being able to breach the Capitol building.

What can we do?

What we have control over is our savings rate. That’s the percentage that actually matters not your tax rate, or your rate of return. Remember the Biden Proposal is just a proposal, as more concrete information becomes available, we can study what impact it might have on all of us.

Being proactive with taxes will always put you in a better position than being reactive. Don’t let your advisor ever tell you “we will cross that bridge when we get there”. I am supposed to be running a mile ahead of you at all times crossing bridges well before you do so I can make sure you avoid obstacles in the road. Change will always bring some unexpected obstacles but we can stay on top of it together

So What?

So how does this impact all of you?

- The Biden/Harris tax proposal, is just a proposal. It will change

- Let’s be proactive instead of reactive

Stock market calendar this week:

Thursday January 14th

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

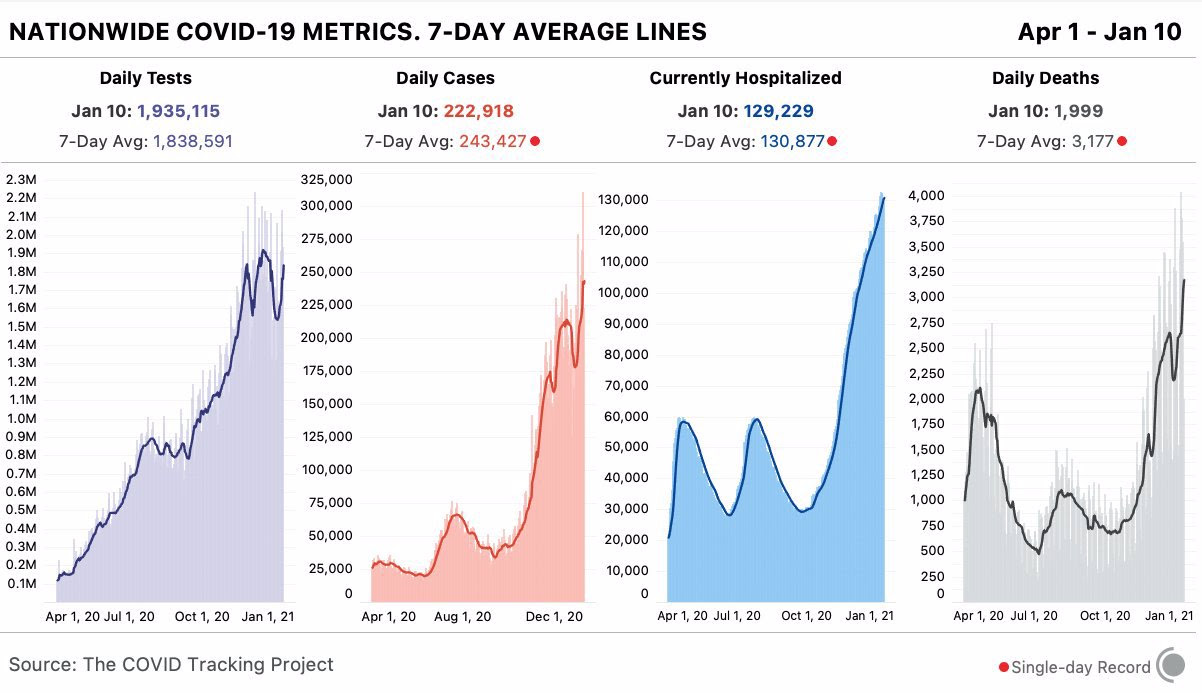

Latest Covid-19 Data

[…] weeks ago, I broke down the entire Biden/Harris Tax plan. You can read about it here, or listen to the podcast breaking it down even further […]