Inflation and the Tooth Fairy

My 6-year-old daughter (Priya) lost her first tooth yesterday, and couldn’t have been more excited. She proudly held it up for all of us to see, and promptly asked her brother (AJ) how much money the tooth fairy gave him for his last lost tooth. The tooth fairy had left $5 for AJ, and when he told Priya she immediately said to herself “that means I will get $6 dollars!”

The financial planner in me was excited for her to explain that since AJ lost his tooth in the middle of last year there must have been inflation so she has to get $6. Nope. Not even close. When I asked her why she would get an extra dollar over her brother she said “AJ only brushes his teeth for 6 seconds, I brush way better.”

Cheap Tooth Fairy

The tooth fairy is cheap in the Chopra household, and Priya was given $5, just like AJ. She did get a sticker book with a note telling her what a great job she does brushing. It did make me think about when I was a child so I called my mother and asked her what I received for my first tooth. Again, the financial planner in me got excited to tell my kids how daddy only got a quarter for his first tooth, and I was even going to tell them that I had to walk to school both ways up hill. Surprisingly my mother told me that for my first tooth, I was given……$5!

How could this be, how could there not be any inflation. She quickly pointed out that losing teeth doesn’t happen on a schedule, and sometimes they only had $5 in the house to give. If my father had to play tooth fairy now, I assure you whatever monetary value we would be given, would come in the form of coins. That’s what happens when you own a laundromat.

Is there a point?

I promise this whole email isn’t just about the ridiculous conversations in my house there is actually a point. For many of you reading, you remember getting money from the tooth fairy in the form of coins. Dimes and Quarters, and inevitably you are my older readers. The inflation you have witnessed over the course of your lifetime shapes who you are and how you purchase goods and spend money.

For those reading this who, like myself, aren’t young but remember the tooth fairy leaving paper money for us. We have not seen inflation in any meaningful way for our entire lives, and this has shaped an entire generation’s purchasing and money habits.

In the first episode of Understanding the Power of Money I tell my own money story and show how everyone is walking their own financial journey. Often times we look at other people’s crazy financial idiosyncrasies and think they are nuts, when in reality we have our own crazy financial quarks. My father still pays his mortgage via check, that he hands to the bank teller. This is crazy to me, but when I pay my plumber via Venmo he thinks I am absolutely nuts.

A world divided

In a world that is already so divided, one thing that causes a rift between older and younger generations is our view of the others money habits. Everyone is shaped by their own financial experiences, and when we recognize we ourselves have some quirky habits, it makes it easier to understand why others do what they do.

So What?

So how does this impact all of you?

- Everyone is a little nuts when it comes to money, embrace it!

- There is no right or wrong answer, financial decisions are based on you

Stock market calendar this week:

Wednesday Janurary 20th

Joe Biden Inaugeration @12:00PM

Thursday January 21st

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

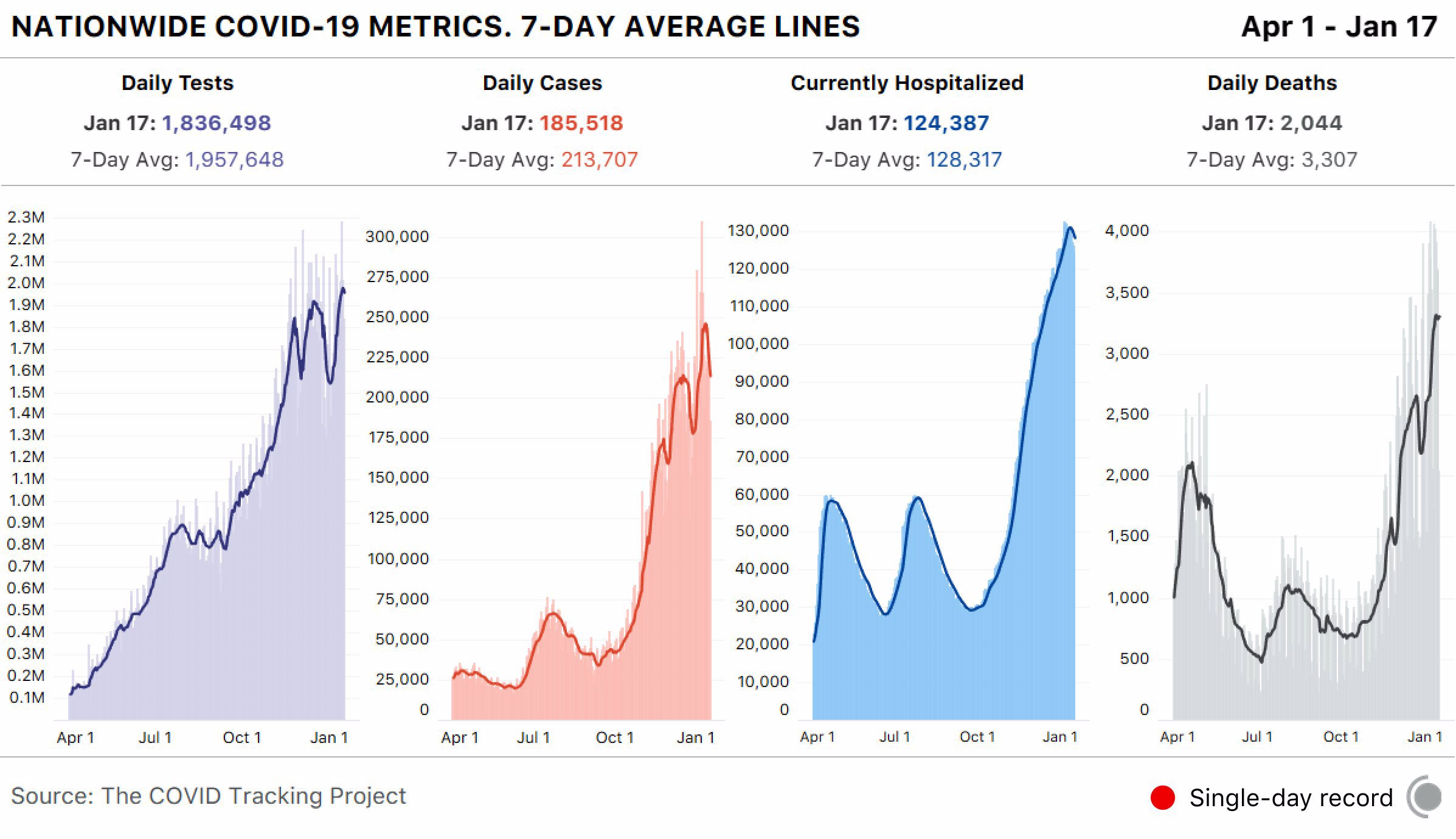

Latest Covid-19 Data