Forefront’s Market Notes:

November 25th, 2024

Stocks advanced last week, powering ahead with pre-holiday optimism despite geopolitical tensions and two disappointing Q3 corporate updates.

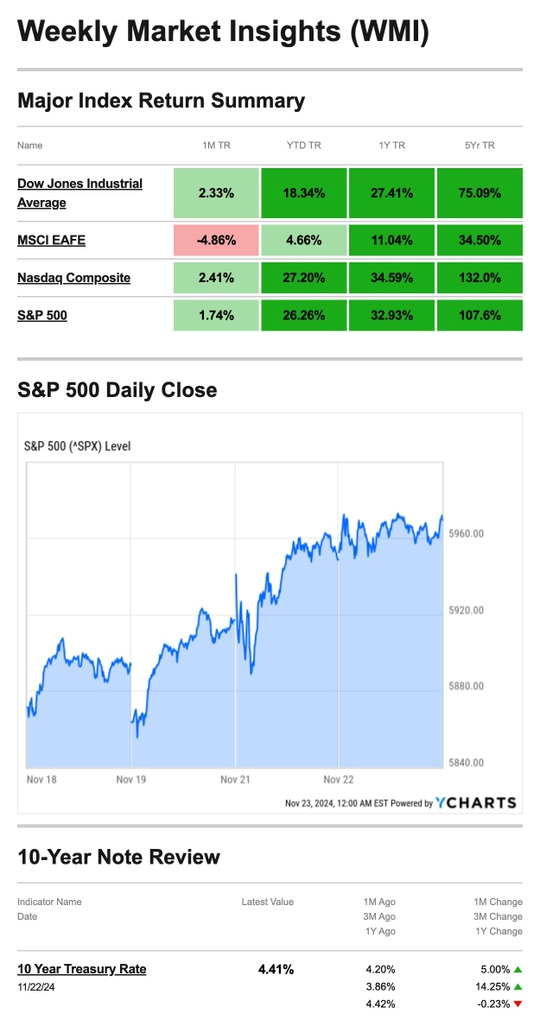

The Standard & Poor’s 500 Index rose 1.68 percent, while the Nasdaq Composite Index gained 1.73 percent. The Dow Jones Industrial Average led, picking up 1.96 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was flat (-0.05 percent).1,2

Stock Push Ahead

Stocks showed mixed results during the first half of the week due to geopolitical tensions that boosted precious metals and put pressure on Treasury yields.3

The Dow Industrials jumped out in front midweek and never looked back. Disappointing earnings on Tuesday from a large box retailer held back some gains in the broader S&P 500. A mixed Q3 update report from the nation’s leading AI chipmaking company also tempered gains a bit.4

Year-end optimism, especially around consumers driving a healthy holiday shopping season, supported the rally for much of the week. Fresh data that weekly jobless claims dropped to a seven-month low also lifted spirits.5,6

Source: YCharts.com, November 23, 2024. Weekly performance is measured from Monday, November 18, to Friday, November 22. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Small-Cap Focus

For several weeks, investors have favored small-cap names over larger-cap issues. This trend was again on display last week.

The Russell 2000, an index of 2,000 small-cap companies widely used as a benchmark for U.S. small-cap stocks, rose 4.50 percent for the five days of trading. In the month-to-date through November 22, the Russell is up nearly 9 percent.7

Did You Know That You Have the Right to Challenge the IRS?

As a taxpayer, you can challenge the IRS’ position; this is part of the Taxpayer Bill of Rights, which outlines your fundamental rights when working with the IRS.

With this right, you can:

- Raise objections to an IRS decision

- Provide additional documentation in response to proposed or formal IRS actions

- Expect the IRS to deliver a timely objection

- Have the IRS consider any supporting documentation promptly and fairly

- Receive a response from the IRS if they disagree with your position

In some circumstances, you may have a hearing before an independent Office of Appeals.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Footnotes and Sources

1. The Wall Street Journal, November 22, 2024

2. Investing.com, November 22, 2024

3. MarketWatch.com, November 19, 2024

4. CNBC.com, November 20, 2024

5. CNBC.com, November 21, 2024

6. MarketWatch.com, November 21, 2024

7. The Wall Street Journal, November 22, 2024

8. IRS.gov, July 5, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, NOV. 25 | |

| None scheduled | |

| TUESDAY, NOV. 26 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 10:00 AM | New home sales |

| 2:00 PM | Minutes of Fed’s November FOMC meeting |

| WEDNESDAY, NOV. 27 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | GDP (first revision) |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:00 AM | Personal income (nominal) |

| 10:00 AM | Personal spending (nominal) |

| 10:00 AM | PCE index |

| 10:00 AM | PCE (year-over-year) |

| 10:00 AM | Core PCE index |

| 10:00 AM | Core PCE (year-over-year) |

| 10:00 AM | Pending home sales |

| THURSDAY, NOV. 28 | |

| None scheduled, Thanksgiving holiday | |

| FRIDAY, NOV. 29 | |

| None scheduled |

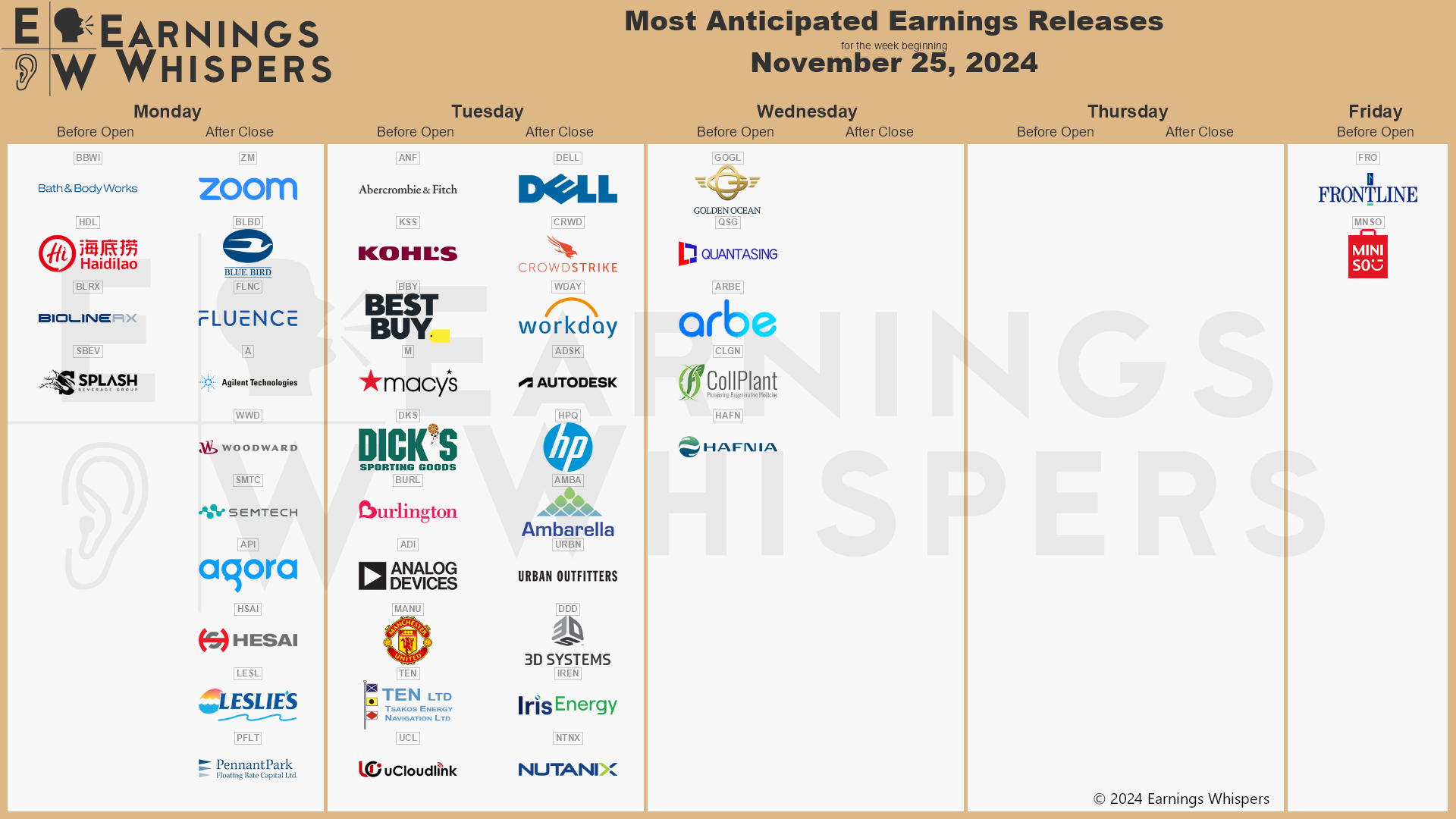

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.