Forefront’s Market Notes:

November 18th, 2024

Stocks fell last week as the postelection rally lost momentum amid an inflation uptick and cautious comments from Fed officials.

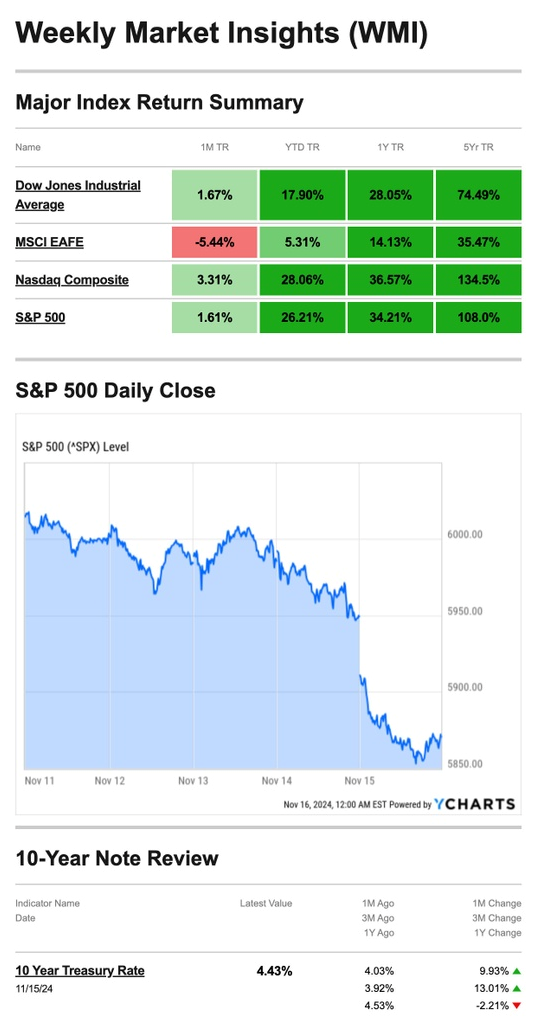

The Standard & Poor’s 500 Index fell 2.08 percent, while the Nasdaq Composite Index declined 3.15 percent. The Dow Jones Industrial Average lost 1.24 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, dropped by 2.38 percent.1,2

Rally Fizzles, Data Rattles

Stocks began the week with modest gains as all three major indexes hit record highs. On Tuesday, stocks took a breather with monthly inflation pending.3

News that the Consumer Price Index (CPI) ticked up slightly in October injected some uncertainty into the markets. The Producer Price Index released the following day showed wholesale inflation ticked up last month. While both the CPI and PPI aligned with expectations, investors hoped for better news.

Comments from Fed Chair Powell that the Fed wasn’t “in a hurry” to cut rates were a bit unexpected, which put stocks under more pressure.4,5

Stocks dropped again on Friday as strong October retail sales seemed to reinforce Powell’s comments about Fed rate adjustments. News that Boston Fed President Susan Collins expressed doubts about what the Fed might do in December, putting further pressure on stocks.6

Source: YCharts.com, November 16, 2024. Weekly performance is measured from Monday, November 11, to Friday, November 15. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Tug-O-War

The inflation data that came in last week—retail and wholesale—show that the path to the Fed’s stated goal of 2 percent inflation may prove bumpy.

For the past couple of years, inflation has been the focus of the Fed’s efforts to manage rising prices by tightening the money supply. Ironically, strong retail sales numbers—while a sign of a strong economy—send a mixed message to investors. Confident consumers tend to spend money, which may take some pressure off the Fed as it looks to manage economic activity.

What To Do If You Get Mail From the IRS

The IRS sends letters and notices for many different reasons. Some letters need a response or action item, while some are to keep you informed.

Here’s what to do if you receive mail from the IRS:

- Don’t throw it away

- Don’t panic

- Don’t reply unless directed to do so

- If a response is needed, respond promptly

- Review the information to make sure it’s correct

- Respond to a disputed notice

- If you need to call the IRS, use the phone number printed on the notice

- Avoid scams through email, social media, or text messages

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

Footnotes and Sources

1. The Wall Street Journal, November 15, 2024

2. Investing.com, November 15, 2024

3. CNBC.com, November 12, 2024

4. The Wall Street Journal, November 13, 2024

5. The Wall Street Journal, November 14, 2024

6. CNBC.com, November 15, 2024

7. IRS.gov, May 6, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, NOV. 18 | |

| 10:00 AM | Home builder confidence index |

| 10:00 AM | Chicago Fed President Austan Goolsbee welcoming remarks |

| TUESDAY, NOV. 19 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 12:25 PM | Chicago Fed President Austan Goolsbee speaks |

| WEDNESDAY, NOV. 20 | |

| 11:00 a.m. | Fed Gov. Lisa Cooks speaks |

| 12:15 PM | Fed Gov. Michelle Bowman speaks |

| 4:00 PM | Boston Fed President Susan Collins speaks |

| THURSDAY, NOV. 21 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:45 AM | Cleveland Fed President Beth Hammack welcoming remarks |

| 10:00 AM | Existing home sales |

| 10:00 AM | Leading economic index |

| 1:10 PM | Kansas City Fed President Jeff Schmid speaks |

| 4:40 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| FRIDAY, NOV. 22 | |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Consumer sentiment (final) |

| 6:15 PM | Fed Gov. Michelle Bowman speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.