Forefront’s Market Notes:

December 2nd, 2024

Stocks posted solid gains over a short and busy holiday week as investors parsed fresh economic data, comments on potential future trade policy, and a few Q3 reports from technology companies.

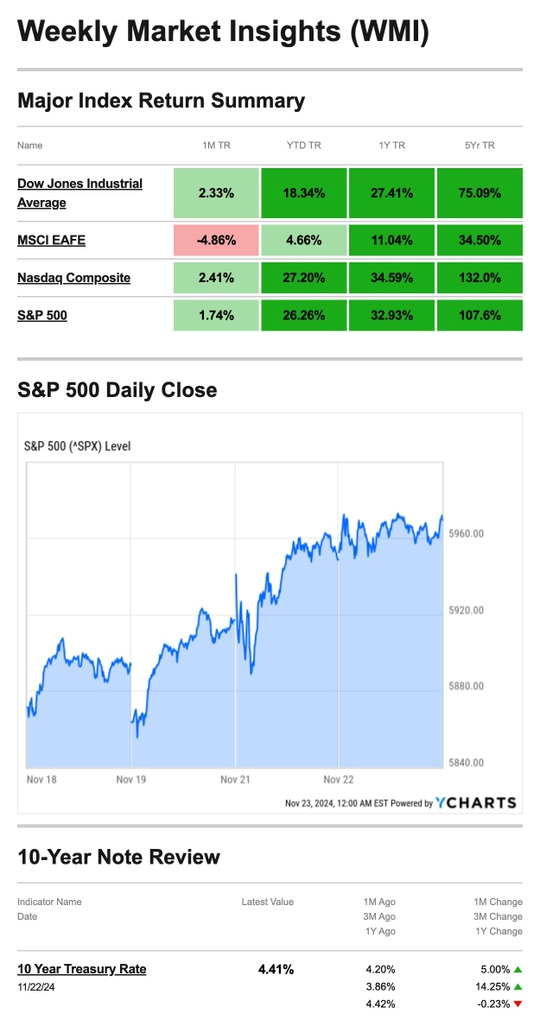

The Standard & Poor’s 500 Index gained 1.06 percent, while the Nasdaq Composite Index advanced 1.13 percent. The Dow Jones Industrial Average rose 1.39 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 2.02 percent.1,2

Rally Extends

Stocks staged a broad-based rally to start the week as investors reacted to the nominee for Secretary of the Treasury. Small-cap stocks continued their month-to-date surge as the Russell 2000 Index rose to an all-time high. News that consumer confidence rose in November appeared to contribute to gains.3,4

Then stocks took a pre-Thanksgiving pause as investors digested economic data. Also, disappointing Q3 updates from two computer hardware manufacturers weighed on the tech sector in pre-Thanksgiving trading.5

Semiconductor stocks rallied on Friday, pushing all three averages higher for a second straight week. The Dow cracked 45,000 for the first time, and the S&P 500 hit a new record high—with each index closing out its best month of 2024.6

Source: YCharts.com, November 30, 2024. Weekly performance is measured from Friday, November 22, to Friday, November 29. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Tariff Talk

Some of the post-election rally has been driven by investor expectations for less regulation and lower corporate taxes proposed by the incoming administration. One area of concern has been the economic impact of proposed tariffs.

Some market observers believe that the markets have already priced in the impact of these tariffs. In contrast, others see a new Treasury Secretary as a potential buffer in the tariff talks.7

How to Verify Your Identity When Calling the IRS

When calling the IRS, you can expect them to verify your identity before delving into personal information. Here’s what you’ll need to verify your identity:

- Social Security number

- Birthdate

- An Individual Taxpayer Identification Number if you have one instead of your SSN

- Your filing status

- Your prior tax return. You may need information from your prior year’s return to answer certain questions.

- A copy of the tax return you’re calling about

- Any letters or notices you’ve received from the IRS

Important note: the IRS will only ask for this in documents or online. Never offer this info to someone who calls you and says they are from the IRS.

Having all this information handy before you call the IRS will make the process faster because IRS phone operators will only speak with the taxpayer or a legally designated representative.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Footnotes and Sources

1. The Wall Street Journal, November 29, 2024

2. Investing.com, November 29, 2024

3. The Wall Street Journal, November 25, 2024

4. CNBC.com, November 26, 2024

5. The Wall Street Journal, November 27, 2024

6. The Wall Street Journal, November 29, 2024

7. CNBC.com, November 26, 2024

8. IRS.gov, October 23, 2023

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, DEC. 2 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| TUESDAY, DEC. 3 | |

| 10:00 AM | Job openings |

| TBA | Auto sales |

| WEDNESDAY, DEC. 4 | |

| 8:15 AM | ADP employment |

| 8:45 AM | St. Louis Fed President Musalem speaks |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 10:00 AM | Factory orders |

| 2:00 PM | Fed Beige Book |

| THURSDAY, DEC. 5 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. trade deficit |

| FRIDAY, DEC. 6 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 10:00 AM | Consumer sentiment (prelim) |

| 10:30 AM | Chicago Fed President Goolsbee speaks |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: November 25th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.