Forefront’s Market Notes:

May 28th, 2024

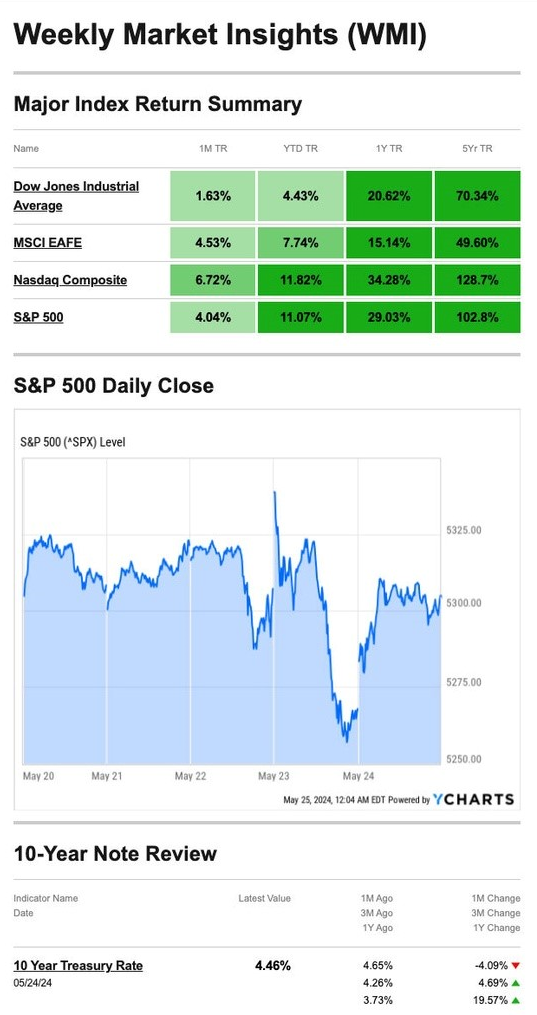

Last week’s stock performance was mixed, following investors’ reaction to the Fed’s May meeting minutes, while a handful of mega-cap tech companies created a buzz with their news.

Market Splits

Stocks began trading in a narrow band last week. Still, mega-cap tech names rallied in anticipation of the Q1 corporate report from a key company that makes semiconductors for artificial intelligence (AI). The enthusiasm lifted the Nasdaq to fresh records.

Federal Reserve news mid-week unsettled investors, who reacted to Federal Open Market Committee meeting notes that stated some Fed officials worried over the lack of progress on inflation.1

Technology was the sole winning group for the whole week, with all other Standard & Poor’s 500 industry sectors ending in the red.2

Source: YCharts.com, May 25, 2024. Weekly performance is measured from Monday, May 20, to Friday, May 24.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Bucking the Trend?

One of the handful of companies bucking the trend last week was Nvidia.

The semiconductor maker – the fifth largest company in the S&P 500 by market capitalization, thanks to their prominent role in AI – reported that its Q1 sales tripled from a year ago. The company also announced a 10-to-1 stock split. The news pushed its market cap to over $2 trillion.3

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities.

To some on Wall Street, Nvidia is the bellwether for the AI industry. By one estimate, the entire AI market is nearly $300 billion for this year – more than 3X the market’s size of $95 billion just three years ago. By 2030, that estimate may reach $1.8 trillion.4

Remember that forecasts rely on assumptions and may undergo revisions over time. Financial, economic, political, and regulatory issues may cause the actual results to differ from the expectations expressed in the forecast.

Employee vs Independent Contractor: Classifying Those Who Work for You Appropriately

Classifying workers as independent contractors or employees is essential for several tax reasons. The basis for this classification has two primary considerations: control and relationship.

Control refers to how much of the person’s work you control; this encompasses the completed work, its execution, and whether you control the financial aspects of the person’s job. In this manner, “control” means both behavioral and financial control.

Another critical factor is the relationship between the employer and the worker. How both parties perceive this relationship can guide you in determining the worker’s status. Some factors that influence relationships include the following:

- Written contracts that describe the relationship the parties intended to create.

- Whether the business provides the worker with employee-type benefits, such as insurance, a pension plan, vacation, or sick pay.

- The permanency of the relationship.

- The extent to which services performed by the worker are a pivotal aspect of the company’s regular business.

- The extent to which the worker has unreimbursed business expenses.

Footnotes and Sources

1. The Wall Street Journal, May 22, 2024

2. Sectorspdrs.com, May 24, 2024

3. The Wall Street Journal, May 22, 2024

4. Statista.com, May 24, 2024

5. IRS.gov, January 24, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MAY 27 | |

| Memorial Day holiday | |

| TUESDAY, MAY 28 | |

| 12:55 AM | Cleveland Fed President Loretta Mester and Fed Gov. Michelle Bowman speak in Japan |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:55 AM | Minneapolis Fed President Neel Kashkari speaks |

| 10:00 AM | Consumer confidence |

| 1:00 PM | Fed Gov. Lisa Cook and San Francisco Fed President Mary Daly speak |

| WEDNESDAY, MAY 29 | |

| 1:45 PM | New York Fed President John Williams speaks |

| 2:00 PM | Fed Beige Book |

| 7:00 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, MAY 30 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | GDP (first revision) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 10:00 AM | Pending home sales |

| 12:05 PM | New York Fed President John Williams speaks |

| 5:00 PM | Dallas Fed President Lorie Logan speaks |

| FRIDAY, MAY 31 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 9:45 AM | Chicago Business Barometer (PMI) |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: May 20th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.