Forefront’s Market Notes:

June 3rd, 2024

Stocks edged lower in the final week of May as fresh news on economic growth and inflation failed to inspire investors.

Stocks Slide

Markets shrugged off news that the Q1 Gross Domestic Product was revised lower to 1.3 percent from the initial estimated 1.6 percent. Despite concerns that the economy was cooling faster than expected, investors didn’t believe the update was enough to influence the Fed’s decision about adjusting short-term rates.1

On Friday, investors were on edge waiting for the update on inflation. The Fed’s preferred inflation indicator, called the personal consumption and expenditures (PCE), rose 0.2 percent in April, which was in line with forecasts.2

Stocks rose slightly in pre-market trading on the news but were under pressure throughout the day as investors digested the inflation update. But in the last hour of trading, stock staged a powerful rally led by the Dow, which had its best day of the year.

Source: YCharts.com, June 1, 2024. Weekly performance is measured from Friday, May 24, to Friday, May 31.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Is Bad News Good News?

On the economic front, last week’s news was generally disappointing. The update on Q1 GDP was a bit discouraging, and several Fed officials gave seemingly more hawkish updates. Also, the Fed’s “Beige Book” revealed modest economic growth nationwide.

Yet despite the drumbeat of bad news, stocks were resilient and closed only slightly lower for the holiday-shortened week.3

Tax Season May be Over, but the Taxpayer Bill of Rights Applies Year-Round

Although filing season might be over for most taxpayers, the IRS is available year-round for any questions. They also have a Taxpayer Bill of Rights, which promises the level of service and information you will receive when working with the IRS.

Here are the ten fundamental rights you have as a taxpayer when interacting with the IRS:

- The right to be informed: As a taxpayer, you must know what is required to comply with tax laws.

- The right to quality service: You will receive prompt, courteous, professional assistance.

- The right to pay no more than the correct amount of tax: You only pay what is legally due, including interest and penalties.

- The right to challenge the IRS’ position and be heard: You can object to IRS actions and provide further justification with documentation.

- The right to appeal an IRS decision in an independent forum: Taxpayers are entitled to a fair and impartial administrative appeal of most IRS decisions, including certain penalties.

- The right to finality: You have the right to know how much time you have to challenge an IRS position and how soon the IRS must audit your taxes.

- The right to privacy: All IRS inquiries, examinations, and enforcement will not be more intrusive than necessary.

- The right to confidentiality: Taxpayers have the right to expect that their tax information will remain confidential.

- The right to retain representation: Taxpayers have the right to retain an authorized representative of their choice to represent them in their interactions with the IRS.

- The right to a fair and just tax system: Taxpayers have the right to expect fairness from the tax system; this includes considering all facts and circumstances that might affect their liabilities and their ability to pay or provide information in a timely fashion.

Footnotes and Sources

1. CNBC.com, May 30, 2024

2. CNBC.com, May 31, 2024

3. Investors Business Daily, May 30, 2024

4. IRS.gov, May 1, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MAY 27 | |

| Memorial Day holiday | |

| TUESDAY, MAY 28 | |

| 12:55 AM | Cleveland Fed President Loretta Mester and Fed Gov. Michelle Bowman speak in Japan |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:55 AM | Minneapolis Fed President Neel Kashkari speaks |

| 10:00 AM | Consumer confidence |

| 1:00 PM | Fed Gov. Lisa Cook and San Francisco Fed President Mary Daly speak |

| WEDNESDAY, MAY 29 | |

| 1:45 PM | New York Fed President John Williams speaks |

| 2:00 PM | Fed Beige Book |

| 7:00 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, MAY 30 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | GDP (first revision) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 10:00 AM | Pending home sales |

| 12:05 PM | New York Fed President John Williams speaks |

| 5:00 PM | Dallas Fed President Lorie Logan speaks |

| FRIDAY, MAY 31 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 9:45 AM | Chicago Business Barometer (PMI) |

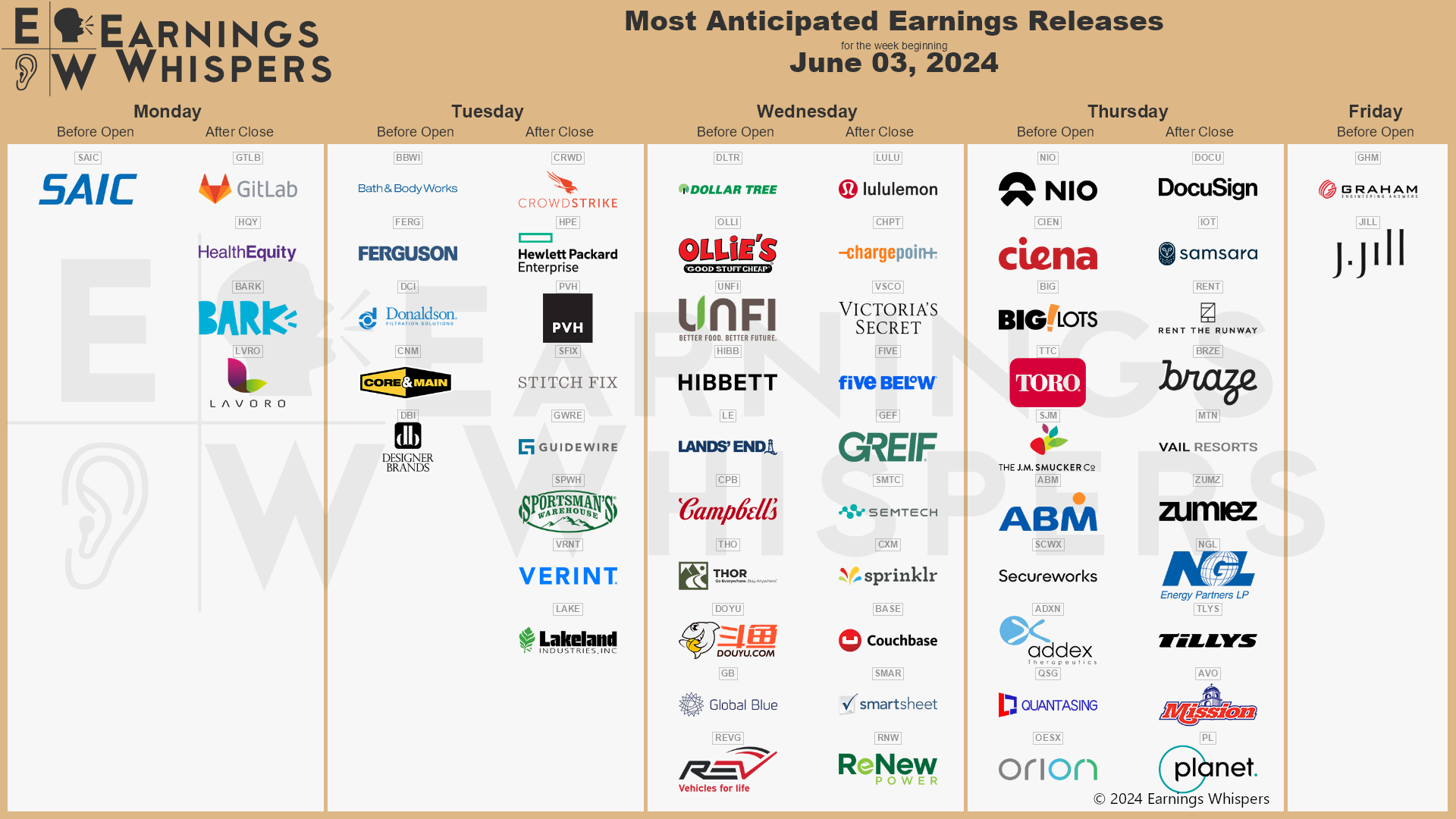

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: May 28th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.