Forefront’s Market Notes:

May 20th, 2024

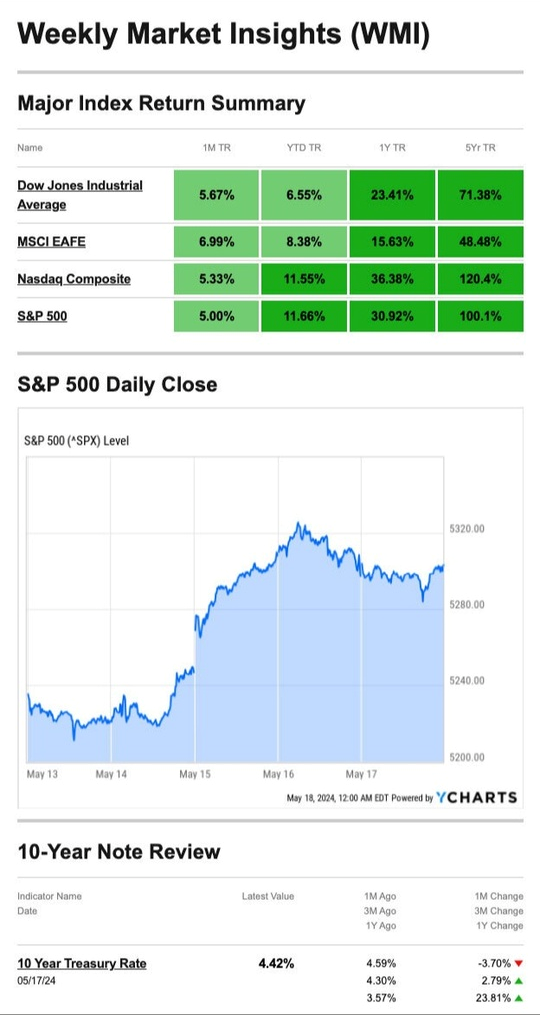

Stocks notched a solid gain last week in a mega-cap, tech-led rally bolstered by positive inflation news.

Dow 40,000

The week began quietly as market averages traded in a tight range, awaiting fresh inflation news.

On Tuesday, markets rose steadily throughout the day after digesting a mixed wholesale inflation report.1

The next day, a cooler-than-expected Consumer Price Index (CPI) report sparked a broad-based rally as the upbeat news raised investors’ hopes for a rate cut. The Nasdaq Composite and Standard & Poor’s 500 (which ended above 5300 for the first time) closed the day up 1.4 percent and 1.2 percent, respectively. Meanwhile, the bellwether 10-year Treasury yield fell to 4.35 percent.2,3

Investors took a break as the week ended, mostly yawning at mixed economic data. Notably, the Dow closed just above 40,000 on Friday.

Source: YCharts.com, May 18, 2024. Weekly performance is measured from Monday, May 13, to Friday, May 17.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Inflated Expectations

With the two critical inflation updates last week, attention shifted to the Federal Reserve’s next steps with interest rates.

The top-level CPI numbers (known as headline inflation) tend to be less important than what’s underneath: core inflation (CPI minus volatile food and energy prices) in the Fed’s eye. Core CPI came in at 0.29 percent for April, just below the 0.30 percent from Wall Street. It was the first time the core CPI was lower than forecasts in three months. The news revived speculation that the Fed might consider a rate adjustment as early as September.4,5

Starting a New Hobby? These Tips Can Help You Understand the Tax Situation

Whether you pick up painting or cook new concoctions in your kitchen, starting a new hobby is always fun and a great avenue to learn something new. However, there are some important tax considerations when starting a new hobby, especially if you are considering turning your newfound passion into a business.

Taxpayers must report any income earned from hobbies, even if it does not involve a licensed business. While businesses should make a profit, hobbies are primarily recreation. The following nine factors can guide you in determining whether a hobby could also be considered a business, according to the IRS:

- Whether you execute the activity in a businesslike manner and maintain complete and accurate books and records.

- Whether you have personal motives in performing the activity.

- Whether the time and effort you expend in the activity indicate that you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you or your financial professional understand how to parlay the activity into a successful business.

- Whether you successfully made a profit through similar activities in the past.

- Whether the activity will make a profit in some years and how much profit it will make.

- Whether you can profit from appreciating the assets used in the activity.

You can also deduct some of the expenses associated with your hobby. Within certain limits, taxpayers can typically deduct ordinary and necessary hobby expenses. An ordinary expense is common and accepted for the activity, while a necessary expense is appropriate.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. CNBC.com, May 14, 2024

2. The Wall Street Journal, May 15, 2024

3. CNBC.com, May 17, 2024

4. CNBC.com, May 14, 2024

5. The Wall Street Journal, May 15, 2024

6. IRS.gov, November 15, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| SUNDAY, May 19 | |

| 3:30 PM | Fed Chair Powell prerecorded commencement remarks |

| MONDAY, May 20 | |

| 9:00 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 9:00 AM | Fed Gov Christopher Waller gives welcoming remarks |

| 10:30 AM | Fed Vice Chair Philip Jefferson speaks |

| TUESDAY, MAY 21 | |

| 9:00 AM | Fed Gov. Christopher Waller speaks |

| 9:05 AM | New York Fed President John Williams opening remarks |

| 11:45 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 7:00 PM | Cleveland Fed President Loretta Mester, Atlanta Fed President Raphael Bostic and Boston Fed President Susan Collins speak together on panel |

| WEDNESDAY, MAY 22 | |

| 10:00 AM | Existing home sales |

| 2:00 PM | Minutes of Fed’s May FOMC meeting |

| THURSDAY, MAY 23 | |

| 8:30 AM | Initial jobless claims |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | New home sales |

| 3:00 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, MAY 24 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 9:35 AM | Fed Gov Christopher Waller speaks |

| 10:00 AM | Consumer sentiment (final) |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: May 13th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.