Forefront’s Market Notes:

March 25th, 2024

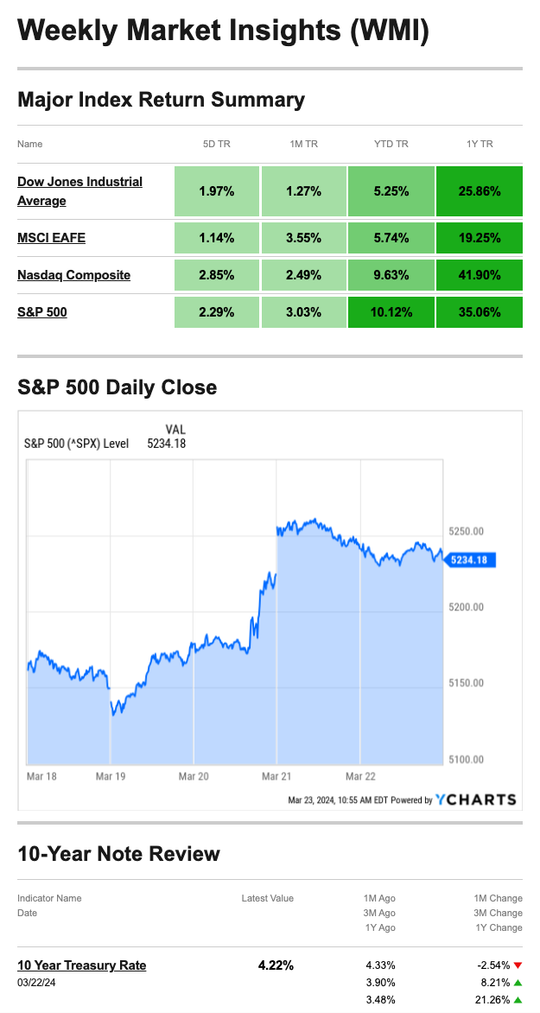

Stocks posted their best week of the year, sparked by news that the dovish Fed decided to keep rates steady and signaled three rate cuts were still possible this year.

Stocks Bounce Back

As widely expected, the Fed left rates unchanged at the conclusion of its two-day meeting. But somewhat less expected, the Fed signaled its inclination to cut interest rates three times this year—each time by a quarter percentage point. That was a positive surprise for some, who worried that recent hot inflation reports would cause the Fed to reconsider its stance.1

Markets pushed higher Wednesday following the news, with all three averages closing at record highs. The rally continued through Thursday, boosted further by news that existing home sales rose 9.5 percent in February.2,3

The week’s rally was broad-based overall, with 10 of the 11 S&P 500 sectors posting gains (health care dropped slightly). At one point late in the week, nearly one in four S&P 500 stocks were trading at 52-week highs. That was the highest proportion in three years, which supports the idea that the rally was broadening out from mega-cap tech stocks.4

Source: YCharts.com, March 23, 2024. Weekly performance is measured from Monday, March 18, to Friday, March 22.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Turning Point

The Federal Open Market Committee’s decision marks a turning point as the Fed signaled that its target range of 5.25 to 5.50 percent has topped out. That target range, in place since late last year, is the highest level in 23 years.

“We believe that our policy rate is likely at its peak for this type of cycle,” said Fed Chair Powell at the post-meeting press conference. He added that if the economy keeps on its current course, that the FOMC would likely “begin dialing back policy restraint at some point this year.” If the FOMC votes to ease it at its June meeting, it would be the first cut in four years.4,5

Rules for Home Office Deductions

If you have a business and work out of your home, the IRS allows you to deduct certain expenses on your return. Here are a few key things to keep in mind:

- The IRS requires you to use your office (or a part of your home) for “regular and exclusive use.” The part of the house should be your principal place of business, a place where you meet customers, or a separate structure dedicated to the business, like a garage or studio.

- To calculate your deduction, you can use one of two methods:

- The simplified option allows you to multiply the allowable square footage of your office by $5, up to a maximum of 300 square feet.

- The regular method allows you to specifically calculate the actual expenses, such as rent, mortgage interest, taxes, repairs, depreciation, and utilities you pay for the portion of your home used for the business. You must determine the percentage devoted to business activities if you use only part of a space for your business.

- The simplified option allows you to multiply the allowable square footage of your office by $5, up to a maximum of 300 square feet.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal, March 22, 2024

2. CNBC.com, March 20, 2024

3. Sectorspdrs.com, March 22, 2024

4. MarketWatch.com, March 22, 2024

5. The Wall Street Journal, March 21, 2024

6. IRS.gov, November 14, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MARCH 25 | |

| 8:25 AM | Atlanta Fed President Raphael Bostic speaks |

| 9:05 AM | Chicago Fed President Austan Goolsbee speaks |

| 10:00 AM | New home sales |

| 10:30 AM | Fed Gov. Lisa Cook speaks |

| TUESDAY, MARCH 26 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, MARCH 27 | |

| 6:00 PM | Fed Gov. Christopher Waller speaks |

| THURSDAY, MARCH 28 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | GDP (2nd revision) |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:00 AM | Pending home sales |

| 10:00 AM | Consumer sentiment (final) |

| FRIDAY, MARCH 29 | |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | Personal income (nominal) |

| 8:30 AM | Personal spending (nominal) |

| 8:30 AM | PCE index] |

| 8:30 AM | Core PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE (year-over-year) |

| 11:30 AM | Fed Chair Jerome Powell speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: March 18th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.